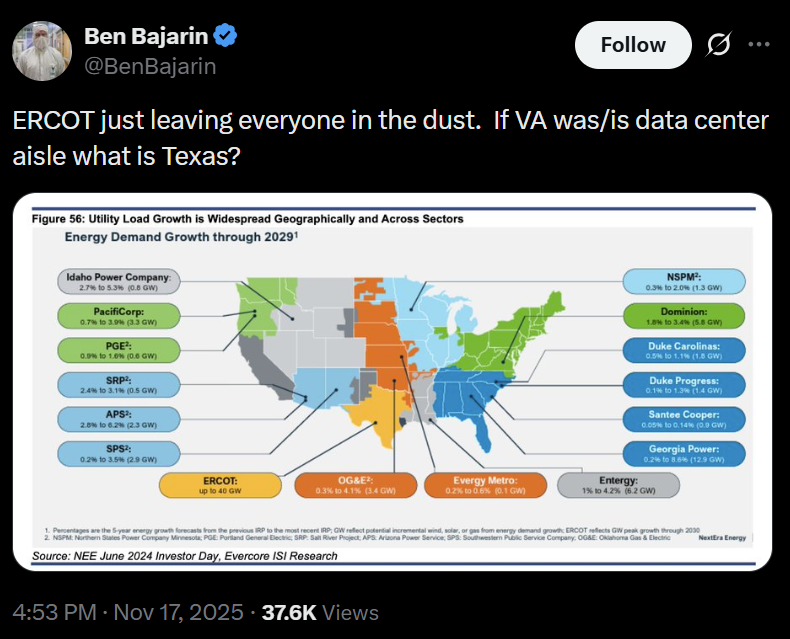

Texas is quickly rising as a hub for synthetic intelligence-driven power demand, with an unprecedented surge in heavy-duty energy calls for that at the moment are being dominated by AI information facilities fairly than Bitcoin miners.

Figures highlighted in The Miner Magazine’s newest e-newsletter and cited from ERCOT’s new system plan and weatherization replace present the grid is going through a essentially totally different sort of development.

ERCOT, the Electrical Reliability Council of Texas, which operates Texas’ unbiased energy grid and oversees dependable energy service to about 90% of Texans, reported that its heavy-load interconnection queue has ballooned to 226 gigawatts of latest requests, about 73% of that are tied to AI gear.

Builders have already submitted 225 large-load requests this yr, and on the availability facet, ERCOT is contemplating 1,999 technology proposals totaling 432GW, in keeping with The Miner Magazine.

Nonetheless, load is growing sooner than provide. Though the technology queue is massive, it’s nonetheless dominated by photo voltaic and battery tasks, and these assets can not present the 24-hour energy wanted for AI information facilities. This mismatch creates future reliability and funding challenges.

sauce: ben bajarin

State regulators are dashing to adapt, Miner Magazine reported. ERCOT is greater than doubling the variety of transmission tasks beneath assessment as new guidelines are developed to categorise clients requesting 75 MW or extra as “particular remedy” circumstances.

Associated: Bitcoin miners wager on AI final yr and it paid off

What about Bitcoin miners?

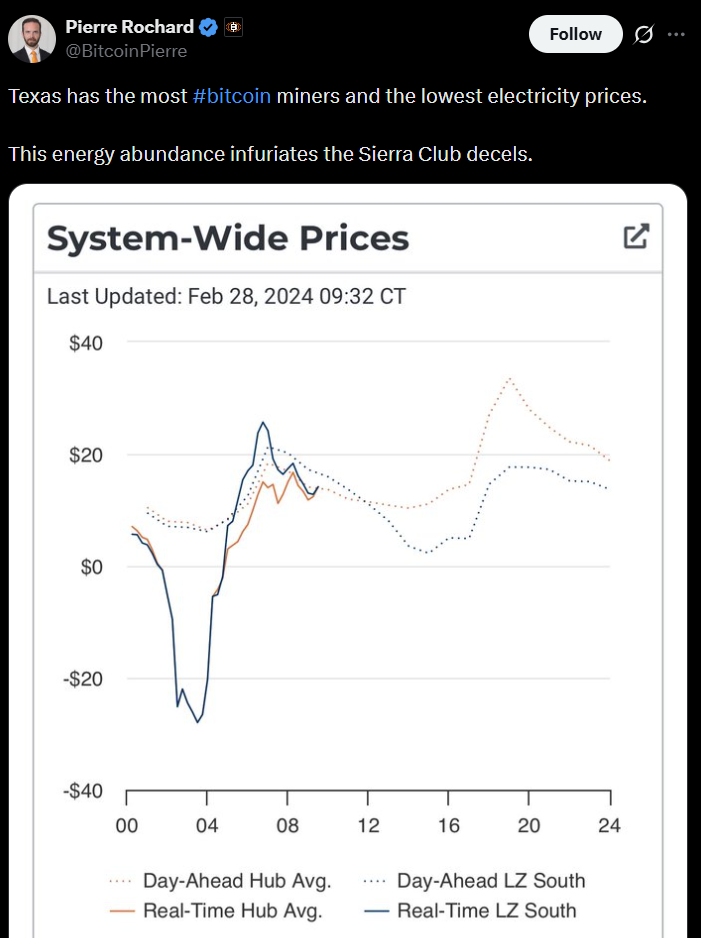

Miner Magazine’s report contrasts right this moment’s AI-driven energy demand surge with the earlier growth pushed by Bitcoin (BTC) miners, noting that Texas’ new energy demand crunch is now being pushed by AI, not cryptocurrencies.

Bitcoin miners have been as soon as among the many state’s largest new energy customers. The affect was positively optimistic. Miners ceaselessly curtailed operations during times of peak demand, which helped shore up grid stability and save states an estimated $18 billion, in keeping with a January research by the Digital Asset Institute.

sauce: Pierre Roshard

However the panorama is altering. Many miners and digital asset managers are reallocating their infrastructure to AI computing to make the most of the burgeoning demand for GPU capability.

A current instance is Mike Novogratz’s Galaxy, which secured $460 million to transform a former Bitcoin mine in Texas into a large AI information middle.

Associated: Bitcoin miners enter the “hardest margin atmosphere in historical past”