After a protracted interval of disappearance, final seen in November 2024, the elusive 2010-era large whale has resurfaced, lastly awakening 2,000 long-dormant Bitcoins mined throughout Bitcoin’s early days. The vault, at the moment valued at $181 million, moved in a single clear sweep and was absolutely handled with a block peak of 931668.

Early Bitcoin miner breaks silence and transfers 2,000 BTC held since 2010

Bitcoin.com Information has repeatedly documented this specific whale since 2020, with the view that its massive holder is probably going a single entity or particular person moderately than a unfastened cluster of wallets. Additional examination of the Bitcoin blockchain means that this entity was secretly unloading the 2010 Coinbase rewards string effectively earlier than figuring out the spender six years in the past.

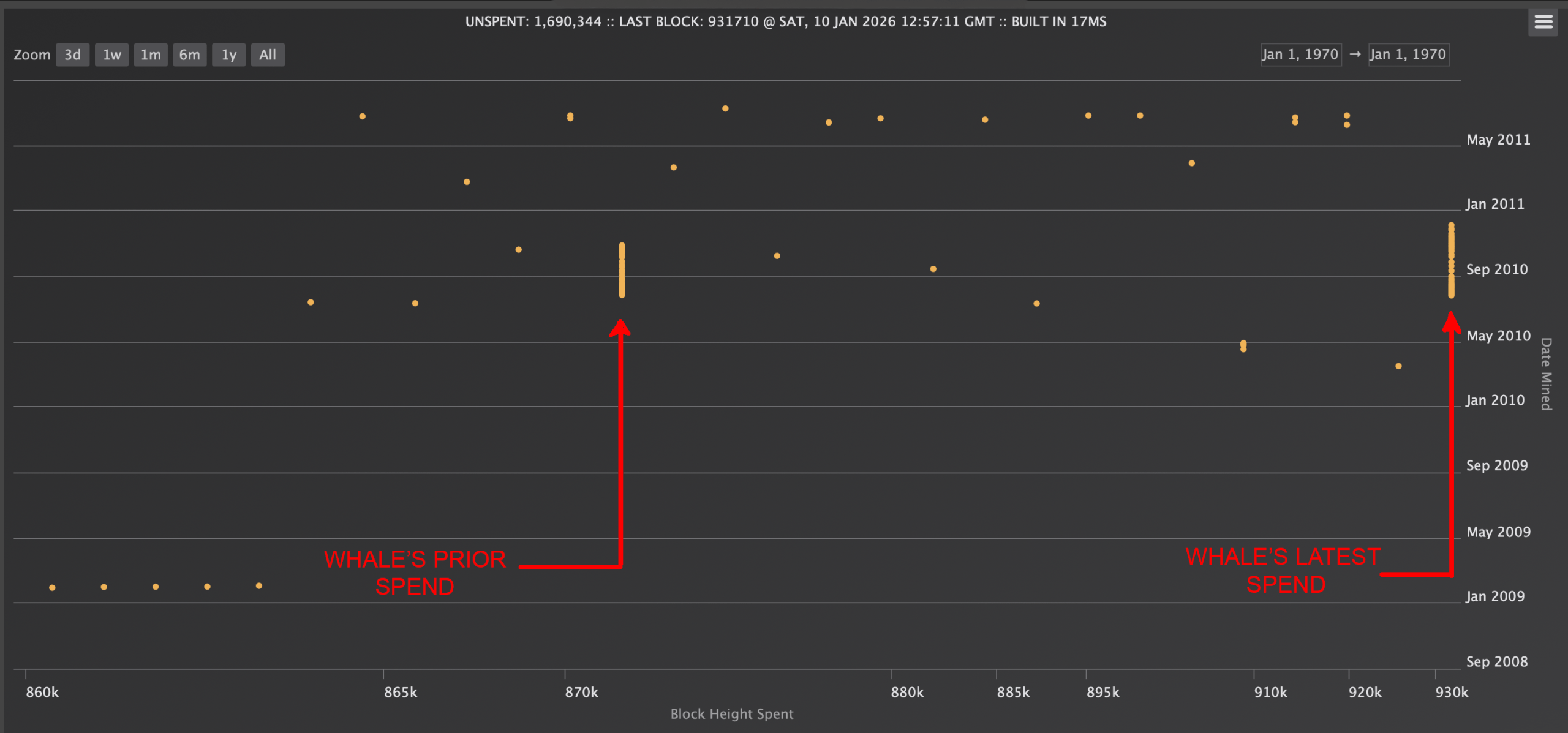

Remarkably, the final sighting of the whale occurred on November 14, 2024, after which it disappeared all through 2025. The sample for that day mirrors January 10, 2026, when the entity spent 40 Coinbase rewards mined in 2010, utterly clearing the settlement of block 870,329. The newest 40-block subsidy switch was cleared at block 931,668, flagged by btcparser.com, and different on-chain sleuths shortly caught the identical path.

“A miner bought 2,000 BTC from block rewards that had been dormant since 2010 and moved the funds to Coinbase Change,” Sani, founding father of timechainindex.com, wrote on X. “Funds had been held in 40 P2PK addresses,” the analyst added.

The P2PK pockets funneled 2,000 BTC into an built-in P2SH (Pay-to-Script-Hash) tackle that ended up on cryptocurrency change Coinbase. This wasn’t a one-off both, as Whale’s earlier spending strings found by Bitcoin.com Information repeatedly present a connection to wallets linked to Coinbase.

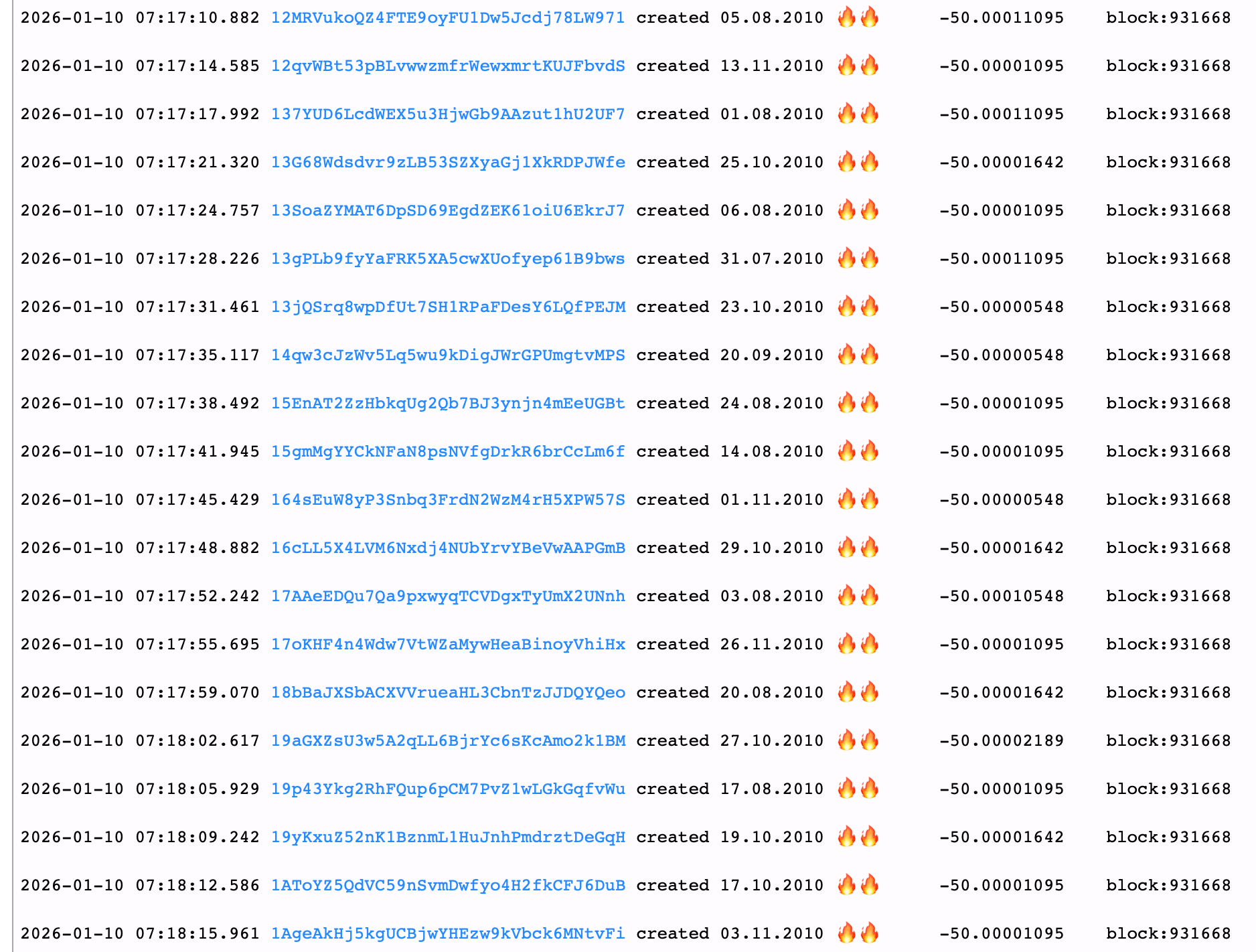

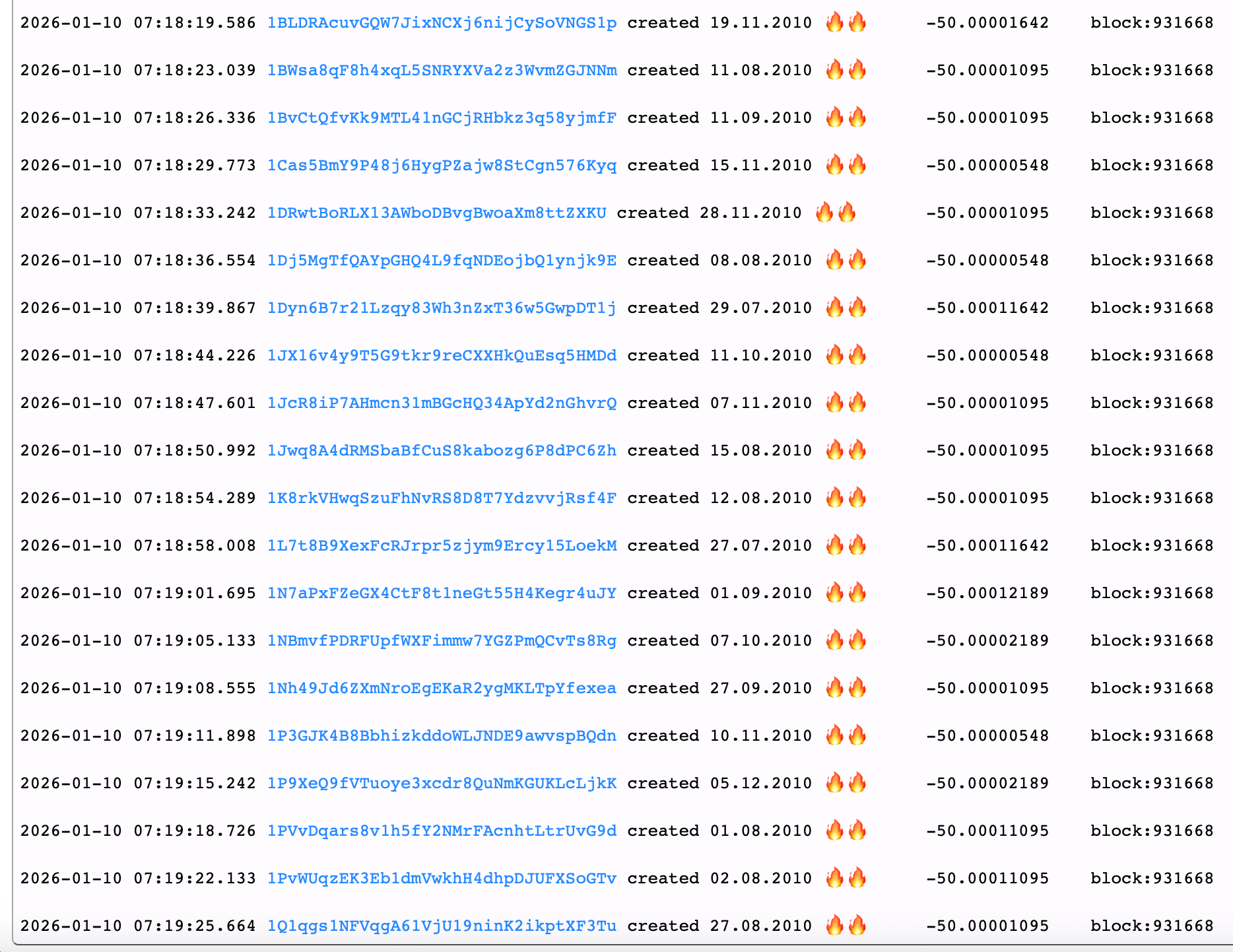

20 out of 40 P2PK addresses that moved 50 BTC every on January 10, 2026.

Including to additional points, the matching Bitcoin Money (BCH) related to these identical block rewards was shuffled round 5 years in the past. The whale had beforehand been caught unloading tens of 1000’s of cash, however appeared largely detached to Bitcoin worth fluctuations.

The remaining 20 of the 40 P2PK addresses moved 50 BTC every on January 10, 2026.

For instance, you will have unloaded this batch when BTC crossed the 6-digit degree. On October sixth, the quantity acquired could be roughly $126,000 per coin. As an alternative, the coin moved in the present day, with BTC sitting simply north of $90,000. This indifference to cost has turn into a defining function of this whale’s on-chain habits, reinforcing the view that timing market tops was by no means its major goal.

Additionally learn: Stablecoin buying and selling quantity reaches report excessive of $33 trillion attributable to coverage tailwinds

Whether or not costs stay at report highs or quiet down, the corporate’s actions counsel a scientific, long-term unwinding moderately than a reactive commerce in pursuit of an optimum exit. Moreover, I doubt that such a deep and small worth distinction would have a big affect on a Bitcoin stash. When Bitcoin as soon as traded between $0.01 and $0.40, even a $90,000 price ticket nonetheless represents a formidable return.

For now, the whale is again within the shadows, leaving analysts to attend for the following transfer by certainly one of Bitcoin’s early miners. If historical past is any information, the silence might final for months and even years till a collection of neatly packaged 2010-era rewards quietly roll up the chain.

Continuously requested questions 🐋

- Who moved 2,000 BTC? An extended-dormant Bitcoin whale related to 2010-era mining rewards has transferred funds after over a 12 months of inactivity.

- The place did Bitcoin go? In accordance with on-chain knowledge, 2,000 BTC was consolidated and in the end despatched to a pockets linked to Coinbase.

- When was Bitcoin first mined? This coin was born from block rewards mined in 2010 throughout Bitcoin’s early days.

- Why is that this whale exercise vital? Massive-scale actions by early Bitcoin miners usually entice consideration attributable to their measurement, age, and potential market affect.