2025 noticed each a rise and a pointy decline. Nevertheless, the previous three months have seen a pointy decline, opposite to expectations of a rise.

Bitcoin and altcoins have been maintaining traders out of the market in latest months as a result of poor efficiency, however 2026 has began with new threat urge for food and an upward pattern.

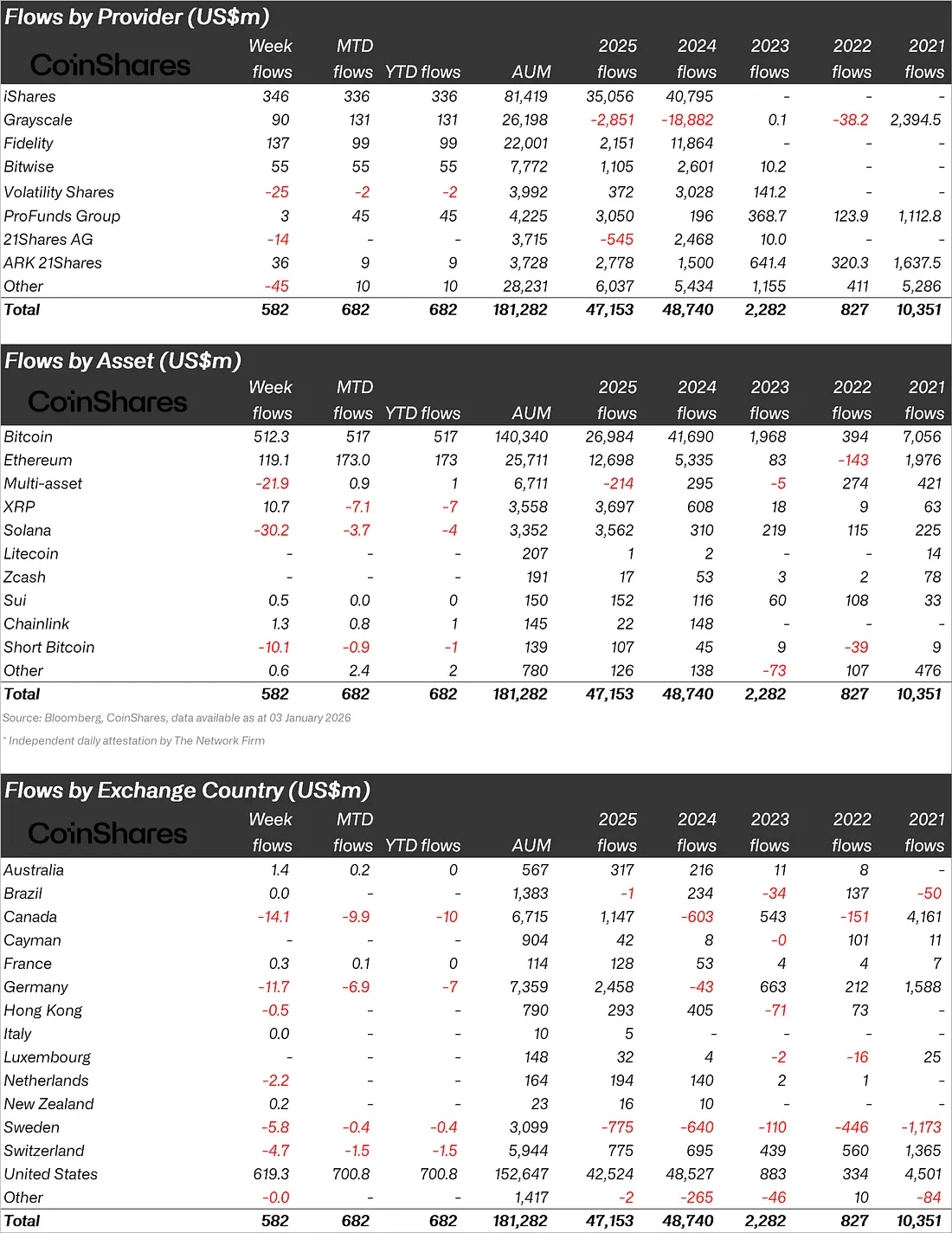

Though predictions for 2026 range, CoinShares launched its crypto report and mentioned it had $582 million in inflows final week.

In response to the information, complete inflows in 2025 reached $47.2 billion, and curiosity in some altcoins additionally elevated.

“International crypto inflows are projected to achieve $47.2 billion in 2025, very near the 2024 document.”

Regardless of some mid-week swings, 2026 is off to a powerful begin.

Cryptocurrency merchandise recorded $47.2 billion in inflows globally by the tip of 2025. This determine was barely decrease than the $48.7 billion recorded in 2024.

Bitcoin maintains the lead!

When taking a look at cryptocurrency funds individually, we noticed that almost all of inflows have been in Bitcoin.

On a weekly foundation, Bitcoin noticed inflows value $512.3 million, and Ethereum (ETH) noticed inflows value $119.1 million.

different altcoins, Solana (SOL) skilled outflows of $30.2 million, whereas XRP noticed inflows of $10.7 million and Chainlink (LINK) noticed inflows of $1.3 million.

On an annual foundation, Bitcoin had $26.9 billion in inflows and Ethereum had $12.7 billion in inflows.

Curiosity in altcoins additionally remained excessive, with XRP receiving $3.7 billion in inflows and Solana receiving $3.6 billion in inflows.

“Bitcoin misplaced 35% of its worth final 12 months, with solely $26.9 billion in inflows recorded in 2025.”

The mix of worth declines led to an inflow of $105 million in short-term Bitcoin funding merchandise all through 2025.

The largest gainer was Ethereum, with inflows up 138% year-over-year to $12.7 billion.

XRP and Solana recorded will increase of 500% ($3.7 billion) and 1000% ($3.6 billion) respectively in 2025. The remaining altcoins skilled an emotional downturn, with inflows down 30% ($318 million) year-over-year.

regional capital inflows and outflows, the USA ranked first with an annual influx of $42.5 billion.

After the USA, Germany acquired $2.4 billion in inflows, and Canada acquired $1.14 billion.

In response to those inflows, Sweden noticed an outflow of $775 million and Brazil $1 million.

*This isn’t funding recommendation.