The brand new week for Bitcoin (BTC) and altcoins started with US President Donald Trump threatening NATO nations with wide-ranging tariffs over management of Greenland.

Because the occasion shook international markets, President Trump introduced that the USA would impose a ten% tariff on merchandise from the UK, Denmark, Norway, Sweden, France, Germany, the Netherlands, and Finland beginning February 1, with the speed rising to 25% by June.

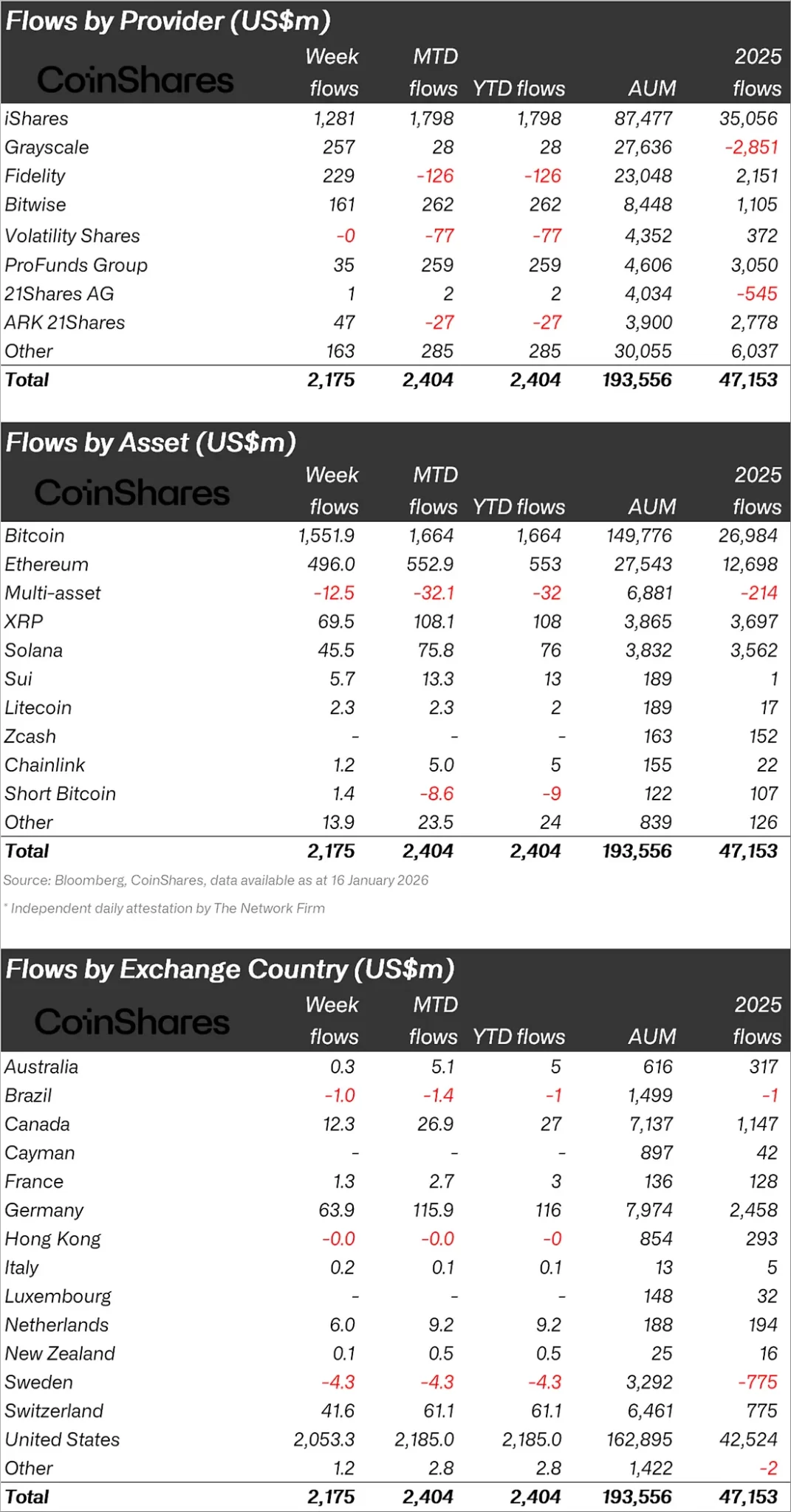

Because the market tracks US and EU tariff tensions, CoinShares launched its crypto report, saying it had $2.17 billion in inflows previously week.

“Weekly inflows into crypto funding merchandise totaled $2.17 billion on Friday, the most important influx since October 2025, at the same time as market sentiment weakened as a result of geopolitical tensions, tariff threats, and coverage uncertainty.”

Bitcoin maintains management!

When taking a look at cryptocurrency funds individually, we noticed that almost all of inflows had been in Bitcoin.

Bitcoin obtained $1.55 billion value of inflows, and Ethereum (ETH) obtained $496 million value of inflows.

different altcoins, Solana (SOL) continues to see inflows of $45.5 million. XRP $69.5 million, Sui (SUI) $5.7 million, and Litecoin (LTC) $2.3 million.

“Bitcoin led inflows of $1.55 billion.”

Ethereum and Solana recorded inflows of $496 million and $45.5 million, respectively, regardless of proposals from the U.S. Senate Banking Committee underneath the CLARITY Act that would restrict stablecoin income choices.

There was an inflow into all kinds of altcoins. Essentially the most notable of those was XRP ($69.5 million), Sui ($5.7 million), LIDO ($3.7 million), and Hedera ($2.6 million).

regional capital inflows and outflows, the USA ranked first with an influx of $2.05 million.

After the USA, Germany obtained $63.9 million, adopted by Switzerland with $41.6 million.

In response to those inflows, Sweden and Brazil skilled very small outflows.

*This isn’t funding recommendation.