Bitcoin’s reminiscence exercise has hit an all-time low, miners’ charge revenues have fallen, and a few folks within the crypto neighborhood have warned in regards to the long-term sustainability of the world’s Most worthy blockchain.

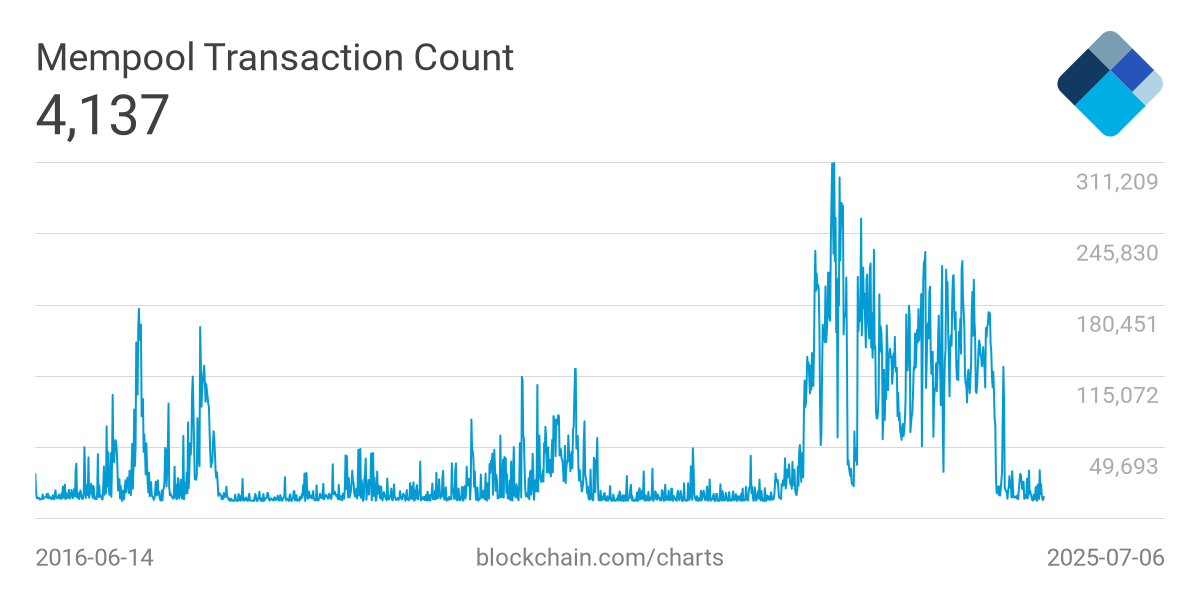

In response to information from BlockChain.com, solely 1000’s of unconfirmed transactions stay in Bitcoin’s reminiscence as of press time. Charge revenues at the moment account for lower than 0.5% of mining revenue, far beneath the extent seen in earlier bull markets.

“Merely put, virtually all the precise customers of Bitcoin have left, too, on the highest worth ever,” wrote Joel Valenzuela, Sprint’s enterprise growth chief, within the X-Put up. “We face a serious disaster. The Bitcoin community has gone bankrupt, and there was an enormous change, and property turn into totally detained property run by governments and companies.”

BTC pending transactions

Mempool – a queue of pending Bitcoin transactions – acts as a buffer when transaction demand exceeds block capability. Customers connect charges to encourage miners to incorporate transactions within the subsequent block. So does costs when actions surge. However as soon as Mempool turns into clear, Blockspace competitors disappears, and miners’ incomes are additionally from charges.

Miners face a decline in income

When Mempool is empty, the miner is already feeling the squeeze. Ethan Bela, chief working officer of Bitcoin mining infrastructure supplier Luxor Applied sciences, advised Defiant that Bitcoin’s long-term safety mannequin is determined by both worth progress or sustainable worth viewing.

“We consider that the continued funding in infrastructure and hashrate manufacturing is a key element of Bitcoin’s safety,” Bella stated, including, “It will be important that Bitcoin costs rise and buying and selling charges rise as block rewards lower…”

“So, low buying and selling charges aren’t a supply of concern within the quick time period, however they’re actually essential within the medium to long run, and miners have to encourage extra initiatives to devour block area and commerce in L1,” Vera defined.

Others level to adjustments in patterns in each consumer habits and protocol use. For instance, as Doggfather, CEO of Doggfather Analytics, as defined within the Defiant commentary, retail buyers “are investing in ETFs and comparable oblique automobiles as a result of they do not exist but or haven’t come in any respect throughout this cycle (equivalent to notes exchanged by different legal guidelines).

Community safety is in danger

One other issue behind Mempool’s vacancy is the shortage of non-financial buying and selling actions. Doggfather says that ordinal numbers just like the BRC-20 and runes and casting of dependable tokens have precipitated demand for block area to plummet as they’re now principally dormant.

“The reminiscence was busy and the charges had been excessive when there was “scorching” ordinances and rune mint. Essentially the most well-known block was after the fourth half at block 840,000. The charge was 37.626 BTC ($2,402,245) for this one block.

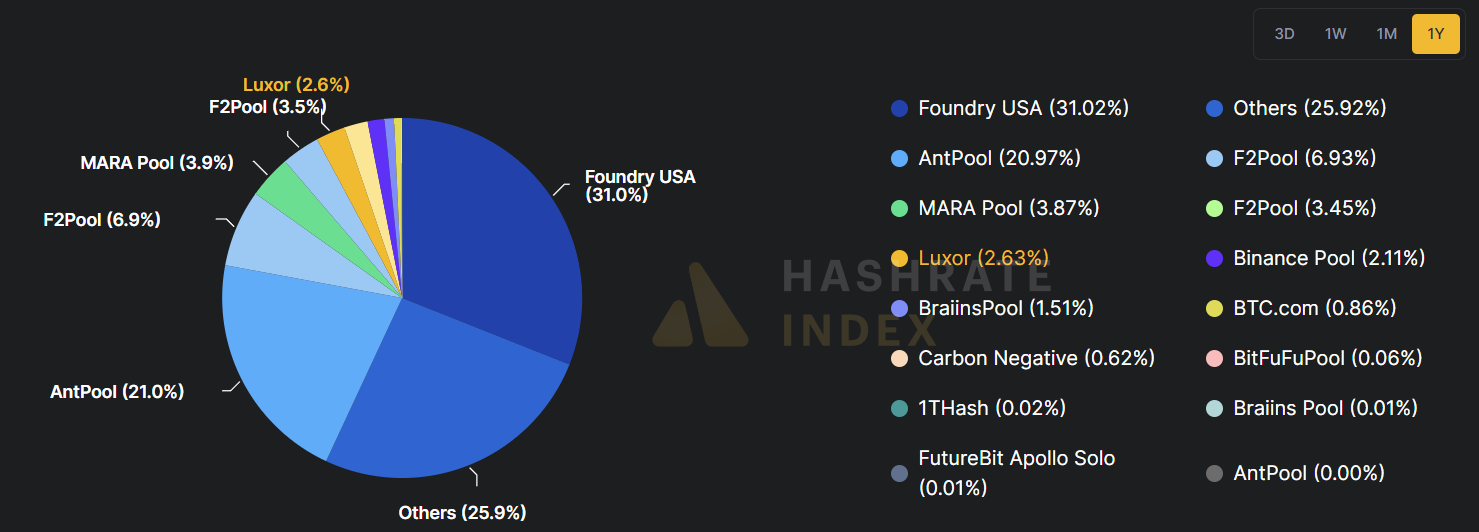

BTC Minor Market Share

However considerations run deeper than use. “Proper now, miners’ charge revenues are a pathetic fee in danger, they usually put safety in danger,” stated Nishant Sharma, head of developer ecosystems at Doma Protocol. “What’s worse, Mining is centralized, with the highest 5 swimming pools, together with Foundry and Antpool, controlling over 60% of the block.”

Sharma highlighted grassroots mining efforts as a possible method to problem centralization. He describes a brand new mining pool mannequin that does not cost taking part miners, presents Lightning Community Payouts, and is designed to permit small-scale telecommuters to compete with the dominant pool.