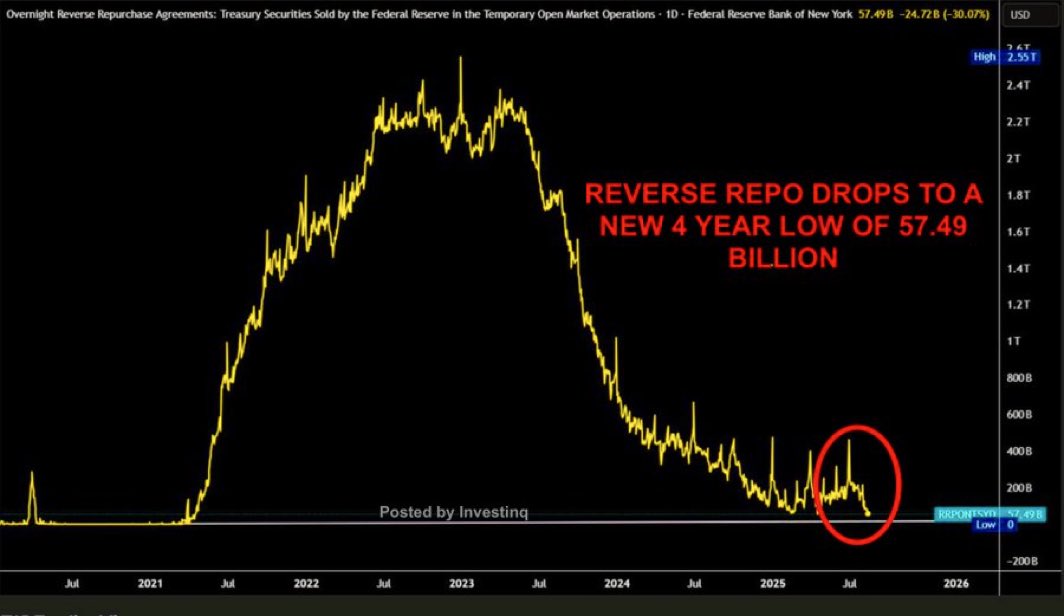

The Federal Reserve Reverse Repo Facility (RRP) fell to its lowest stage in 1,596 days, suggesting a crack within the liquidity spine of the worldwide market.

This turnout refers to tightening your monetary place, elevating alarm bells throughout Wall Avenue and the cryptography circle.

Specialists warn that the Federal Reserve reverse report will fall to its first decline in 5 years

Kevin Malone, founding father of Malone’s wealth, warned that “extra cushioning” within the monetary markets was disappearing, pointing to a decline.

Breaking Information: Federal Reserve Reverse Replies fall to their lowest ranges in 1,596 days. What is going to occur tomorrow? pic.twitter.com/fv5tl9yobs

– Kevin Malone (@malone_wealth) August 19, 2025

He defined that when RRP is empty, all new Treasury points have to be absorbed immediately by particular person consumers, reasonably than being offset by money parked within the Fed.

That shift is more likely to end in larger bond yields, he mentioned, whereas forcing banks, hedge funds and cash market funds to compete fiercely to lift funds.

“The underside row is that liquidity flowing from RRP to the market has been supportive up till now, however as soon as it reaches shut, there isn’t any cushion left.

Others imagine that the Fed’s failure to intervene will result in issues in markets, banks and even authorities funding.

Schwarzberg co-founder Bruce has linked the decline in RRP to broader dangers in shares, bonds and Bitcoin. He defined that the $2 trillion liquidity constructed up through the pandemic acted like momentum and saved the market at the same time as rates of interest rose.

Nevertheless, its fluidity is sort of exhausting, revealing underlying vulnerabilities.

“It is a unhealthy factor within the quick time period for shares, bonds and Bitcoin. The US bond market is a very powerful market on the planet. If RRP drops out as a purchaser, bond yields will proceed to rise.

In the meantime, Joseph Brown of Heresy Monetary highlights how the Treasury Division continues to borrow short-term, regardless of the dry RRP.

He estimated an extra $1.5 trillion bill might hit the market by the top of the yr.

“The Treasury is betting that rate of interest cuts will quickly come and supply band-aid,” Brown mentioned.

In the meantime, some view liquidity crunch because the prelude to the subsequent stage of foreign money mitigation. Crypto analyst Quinten argued that when the RRP stability reaches zero, quantitative mitigation (QE) and contemporary cash prints are inevitable.

“The Federal Reserve reverse repo facility is falling sharply. QE & Cash Print will likely be launched aggressively when that is emitted to zero. Bitcoin will explode,” he predicted.

FED reverse repolo will drop. Supply: X on x

Liquidity engines which have quietly supported the marketplace for years have confronted a slender path between rising funding prices, a surge in Treasury provide and market stability.

The next legal guidelines could embody bond market disruption, emergency mitigation, or Bitcoin rally. All of this relies on how shortly the final drop of RRP is dry.

Posts with Fed Fed’s fluidity cushions gone – what occurs when the tank will get dry? It first appeared in Beincrypto.