On July 18, President Donald Trump signed the Genius Act, establishing the primary complete federal framework to manage US time period cash, bringing much-anticipated readability to the rising marketplace for peg tokens within the US greenback.

Since then, at the least for now, it has globally demonstrated a stage of resilience and development that even essentially the most skeptical observers can’t simply dismiss.

Just some weeks after the legislation was signed, readability of laws on how Stablecoins should assist, audit and oversee it has calmed down giant establishments and on a regular basis traders, pushing $278 billion from round $2600 billion on July 18th to $278 billion by August twenty first, surpassing Defilla’s practically 7% bounce.

The long-awaited readability

The Genius Act was shepherded via Congress by Sen. Invoice Hagerty (R-Tenn.) and handed with a uncommon, bipartisan consensus.

A layered surveillance system may even be created. Market capitalizations under $100 billion might function beneath state supervision, but when they exceed that threshold, they may trigger a compulsory shift to federal regulators or a short lived halt of latest cash till CAPs fall under the restrict.

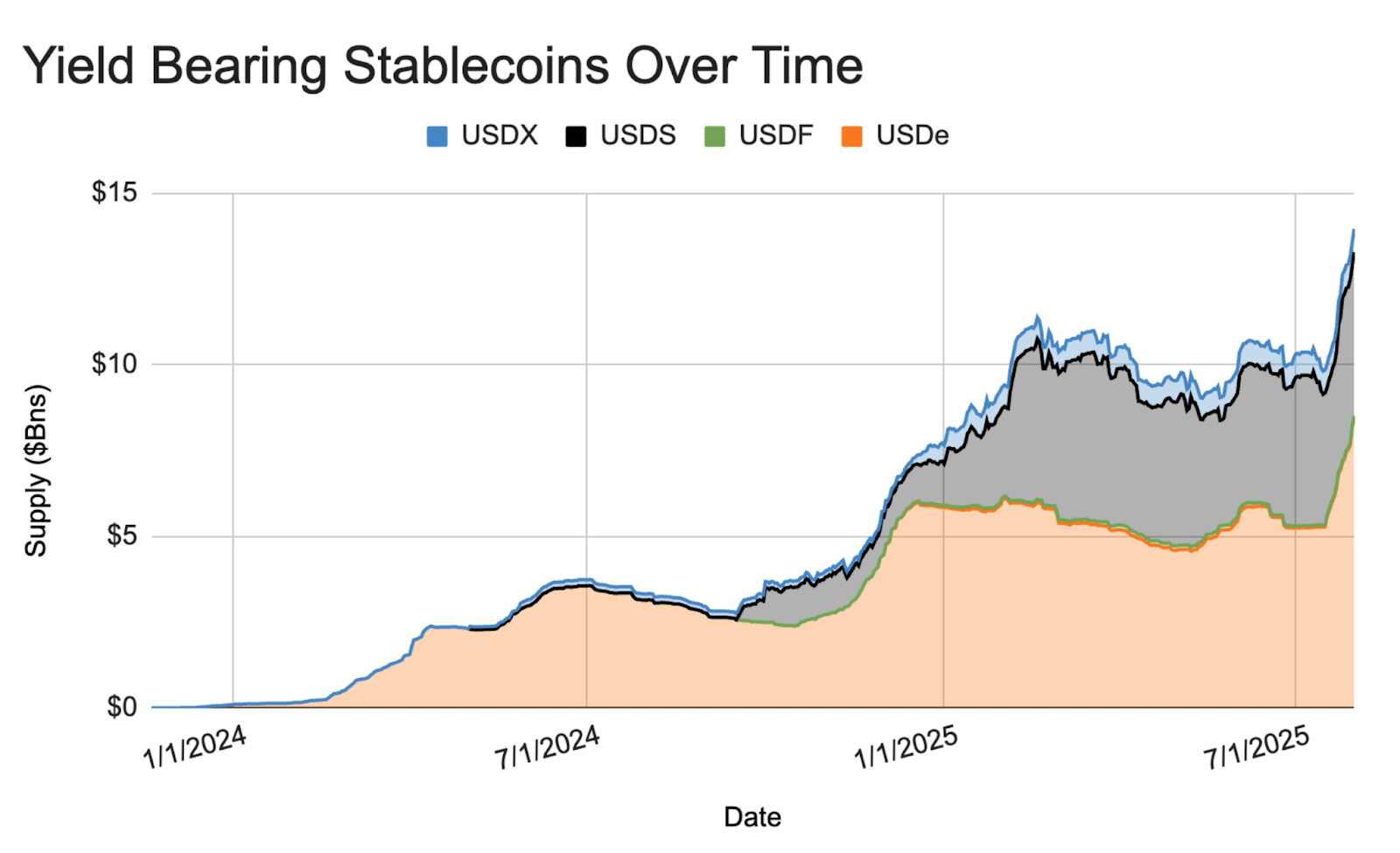

Provide surge led by tokens containing yield

In comparison with the broader crypto market capitalization, just under $4 trillion as of as we speak, Stablecoins has opened up a steadily rising area of interest, at the moment accounting for round 6.8% of the overall crypto market.

The whole safety provide has risen globally practically 7% because the steady coin legislation was signed on July 18th. It is a marked acceleration in comparison with the 1% month-to-month drift noticed within the first half of 2025.

Tether’s USDT is the biggest Stablecoin by market capitalization – over $7 billion added to the round provide alone, sustaining a market benefit of over 60%, and as of August twenty first, it boasts a market capitalization of over $167 billion.

Provide of Ecena (USDE), the biggest harvested stubcoin, has elevated much more pronouncedly, with round $6 billion (107%) rising from $5.6 billion to $11.6 billion over the identical interval. The Genius signature is rising sharply because it reveals a burgeoning demand for steady tokens with built-in yields, regardless of US legislation banning such merchandise. Nevertheless, Ethena Labs, the writer of USDE, is headquartered exterior of the US.

USDE 3 month market capitalization chart. Supply: Coingecko

The truth is, Anthony Yim, co-founder of analytics agency Artemis, mentioned earlier this month in X-Publish that Stablecoins, which helps yields, has emerged as a “stunning winner.” In accordance with legal guidelines that explicitly deal with stubcoins on USD pages designed for fee, Stablecoin issuers can’t present instantly yields to holders.

As of August 4th, stub cash comprise harvest quantities over time. Supply: X.com

Of the stablecoins from US issuers, PayPal’s PYUSD is the token that comprises the biggest yield. Its provide additionally rose sharply final month, with 35% rising from $885 million to $1.2 billion as of as we speak. Pyusd skirts the yield limits of the Genius Act by separating the issuer and the yield supplier. PYUSD is definitely issued by New York-based Paxos Belief Firm, however fee big Paypal pays the proprietor the yield.

In the meantime, the biggest Stablecoin writer in the US and the second largest on the planet, Circle has seen its non-two-person storage USDC provide improve by about 4% since its signature. USDC provide, which initially rose extra modestly, went from $64.8 billion within the Genius Act to $65.5 billion by mid-August, however that determine has lastly jumped to $67.5 billion over the previous 10 days.

USDC 3-month market capitalization chart. Supply: Coingecko

Final week, the corporate introduced its newest developments on the infrastructure facet. Circle is constructing its personal blockchain protocol, ARC. That is described as Layer 1, designed for Stablecoin transactions and to be used with USDC as native gasoline.

The chief responds

Trade leaders have shortly praised the legislation. Jeremy Allaire, co-founder and CEO of Circle, praised the act of genius as “probably the most transformative laws of many years.”

In the meantime, Tether CEO Paolo Ardoino mentioned in an interview with Bloomberg on July 23 that the corporate is “ongoing” about constructing a US home technique primarily based on the Genius Act, with plans to focus on the institutional market and supply Stablecoin designed for funds, financial institution interbanks and transactions.

Simply this week, the UK’s Virgin Islands-registered main Stablecoin writer introduced a key strategic employment that marks the corporate’s official post-Genius push to the US market. The USDT writer employed Bo Hines, former government director of the White Home Script Council beneath the Trump administration, as a strategic advisor to US technique.

USDT 3 month market capitalization chart. Supply: Coingecko

Tether’s Treasury Division minted over $6 billion in USDT in July alone, main primarily new tokens to centralized trade and Defi platforms, assembly liquidity calls for.

In the meantime, Sergey Nazarov, co-founder of blockchain Oracle Chainlink, mentioned that the genius act can encourage extra expertise and monetary establishments to launch their very own Stablecoins, doubtlessly rising the market 10 instances from $20 billion to about $2 trillion.

On Wall Road, JPMorgan predicts that the Stablecoin market might swell to $2 trillion, pushed by tokenized funds, cross-border settlements and programmable monetary use circumstances.

When consumables climb, small publishers face robust selections. The Genius Act requires individuals with belongings of over $10 billion to accumulate the federal constitution (prices and lengthy processes) or to cease development.

Create a course forward

With the present introduction of regulatory footholds, consideration is targeted on the broader financial ripple results of the genius legislation. Supporters argue that by paying for the Treasury invoice, the legislation helps demand for short-term authorities debt and not directly subsidizes US borrowing prices.

Nevertheless, the wreckage fears that if the issuer embarks on a maturity transformation, it might increase the method of borrowing from the short-term debt market and issuing long-term loans of funds, or scrutinizing actions that have been scrutinized after the 2022 Terra collapse.

In the meantime, worldwide improvement is accelerating via lockstep. The European Union’s MICA administration and Hong Kong’s new Stablecoin pointers are being developed in parallel with the US mannequin, urging international publishers to reevaluate their compliance frameworks with a number of judicial requirements.

Amram Adar, co-founder and CEO of Oobit, the Tether Backed Stablecoin Funds platform, advised Defiant that the act is a milestone in sending a transparent message. Nonetheless, he burdened that laws alone aren’t sufficient.

“Nevertheless it would not say something about spending. That is the hole. Washington is targeted on the availability facet, however who can situation who will probably be managing the reserves? The demand facet is vast open. Who’s constructing the constructing for actual customers? Who can faucet and stabilize your telephone like every other forex?” Adar identified.

The CEO of OOBIT identified that laws “can pave the way in which, however it’s as much as innovators to construct autos.”

Equally, Gitay Shafran, founding father of Fedz, writer of Fractional Reserve Stablecoin FUSD, sees genius behaviour as a “optimistic milestone” and a sign that the US is taking the digital greenback severely. Nevertheless, Shafran opposed self-complaints and mentioned that the act was only the start of what’s wanted to construct a resilient and decentralized monetary system.

“We examine new Stablecoins by conventional monetary establishments each day, however we additionally want decentralized stables and artificial {dollars} that aren’t tied to a single firm,” Shafran advised Defiant.

In the meantime, this week Wyoming grew to become the primary US state to situation its personal stubcoin. The Frontier Secure Token (FRNT), supported by USD and Treasury payments, is a welcome business milestone, however others have expressed concern about privateness and centralization.