Ethzilla CEO McAndrew Rudisill has revealed that he has determined to affix Ethereum after seeing the potential within the international remittance market of practically $1 trillion.

Two months later, the biotech firm he beforehand collided with is now the eighth largest public finance ministry on the earth.

“Ethereum is successfully a world cash provide gateway for sending in US {dollars},” Ethzilla CEO McAndrew Rudisill informed Cointelegraph.

The corporate started life as Life Science Company, a Nasdaq-listed biotechnology firm, shortly after US President Donald Trump signed the Genius Act.

“There are a number of real-world asset functions that can enable Ethereum for use, and they’re heading their path proper now,” he mentioned.

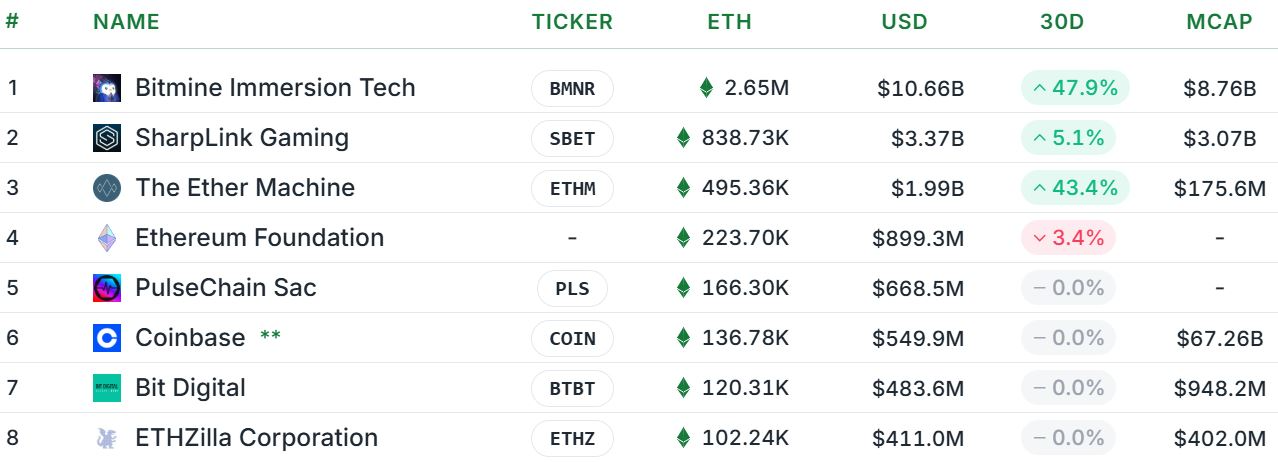

Ethzilla is the eighth largest ether (Eth) Ministry of Finance firm, surpassing 89 tokens out of the 69 listed.

Rudisill mentioned he determined which blockchain is the perfect as a result of “the race is on proper now” and determined to maneuver the ether ahead, particularly as “the horse has left the barn” at Ethereum.

Since pivoting into ether, Ethzilla Company has acquired over 102,000 tokens for the Treasury Division. sauce: StrategeTherReserve

“Most of the new networks created in Layer 2 are literally networks that interface with what is known as conventional monetary exercise in right this moment’s world, whether or not it is structured credit score or any form of Wall Avenue software.”

Etira desires “as a lot ether as attainable”

Bitmine Immersion Applied sciences is the biggest etheric financing firm, with 2.65 million tokens with over $11 billion tokens, setting a aim of holding 5% of the token provide.

Rudisill mentioned that Ethzilla would not have set numbers in thoughts, however that he hopes to get “as many ethers as attainable” and produce “considerably increased yields” than common staking as a way to “work with varied L2 protocols.”

sauce: Etzilla

“We deploy money from ether to purchase extra and successfully assist construct extra L2 networks, as Ethereum can in the end increase,” Rudisill mentioned.

“The rationale Ethzilla exists is as a result of we wish to be that bridge between what’s taking place in conventional finance and what’s taking place on the earth of digital finance. So having a number of Ethereum helps us try this.”

Ether costs rise from stubcoin development

Based on Coingecko, Ether has traded fingers for $4,148, shifting between $3,846 and $4,226 over the previous seven days.

Rudisill predicts that ether costs for the approaching years is not going to be utterly unreasonable as costs are in a consolidated sample and are poised to help Stablecoin’s development.

“I believe for those who break by $5,000, it should be a perform of the bottom load that underlies your infrastructure.

The Genius Act continues to be ready for closing laws earlier than it’s applied, however analysts additionally predict will probably be a key driver for the market.

In the meantime, Ethereum Community already has $158 billion in Stablecoin transactions, in comparison with Tron’s second-largest community, $77 billion, in accordance with information analytics platform Defilama.

Extra ether firms may ballot

In complete, the ether financing firm holds 5.5 million ether, roughly 4.54% of the token provide. Rudisill speculates that extra firms might come to thoughts, however he’s additionally skeptical that every part will survive in the long run.

“I believe there’s an enormous hole between the standard, administration groups. I believe there are lots of people who do not even have the enterprise mannequin that is constructed to maintain the enterprise going,” he mentioned.

On the similar time, Rudysir believes that extra governments may also start to interact in cryptography, combating to keep away from lacking boats.

“There is a common acceptance that the monetary infrastructure now we have in lots of locations is outdated. They’re conscious of that. If they do not get concerned in what is going on on with digital belongings, they’re going to be left behind,” Rudysil mentioned.

“That is why, you have a look at giant banks and monetary establishments, folks begin speaking about different digital belongings and accepting Bitcoin as collateral.

Based in 2016 as a clinical-stage biotech firm, LifeScience was revealed in 2020, however after the preliminary public providing, its share value has plummeted by greater than 99% over the previous 5 years.

The sharp decline was primarily as a consequence of lack of income and elevated losses, however since Etazirah’s ether pivot, the inventory has recorded a revenue of 44% per 12 months, with its greatest efficiency when it reached $10.70 in August.

Ethzilla Inventory has recorded a revenue of 44% because the begin of the 12 months since pivoting to Crypto. sauce: Google Finance

Rudysir mentioned that many small public firms are restructured or delisted with out a clear path, however Etira is completely different.

“We’re not only a cryptocurrency division, we’re constructing a Layer 2 protocol enterprise with belongings of over $1 billion,” he mentioned.

“Our focus just isn’t on short-term monetary manipulation, however on long-term technological improvement and practicality. Manufacturers and pivots replicate clear methods of development and innovation reasonably than a reactionary transfer to fairness efficiency.”