- Lengthy-term Bitcoin holders are displaying robust conviction as promoting stress stays low round $111,000.

- On-chain information helps the bullish construction and factors to a possible rally in direction of $150,000.

After a interval of consolidation over the previous few weeks, Bitcoin has as soon as once more proven some attention-grabbing indicators.

Though there was a slight decline in surrounding areas, $108,884backside 0.71% throughout the final 24 hours and 1.14% Over the previous 4 hours, optimism stays prevailing amongst on-chain analysts.

The each day spot buying and selling quantity reached $6.95 billion, however the market capitalization remained at $2.18 trillion. In the meantime, open curiosity stays excessive at $71 billion, indicating that speculative curiosity within the subsequent transfer has not subsided.

Sturdy Holder Beliefs Lay the Basis for the Subsequent Rise

PelinayPA, on-chain analyst at CryptoQuant, believes that Bitcoin remains to be in a wholesome market construction. In line with his information, costs peaked round $120,000 to $125,000 after which adjusted barely to $111,000.

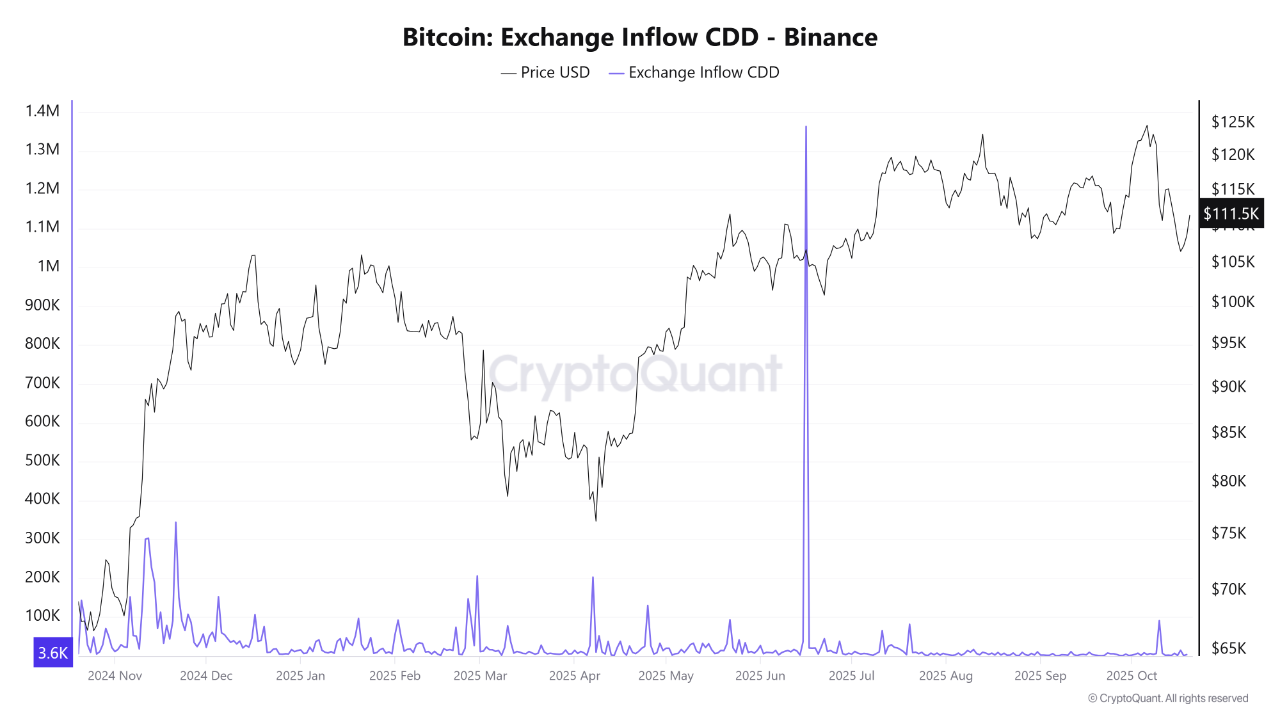

Nonetheless, curiously, the change influx coin discard days (CDD) metric stays low, indicating that long-term holders usually are not flocking to exchanges. In market phrases, there’s little promoting stress from the “old-timers.”

Supply: CryptoQuant

In line with PelinayPA, a surge in inflows appeared in June 2025 as an indication of partial profit-taking, however the market rapidly absorbed it. she mentioned:

“Knowledge exhibits that long-term holder confidence stays robust.”

He added that this sample lays the inspiration for a subsequent rally that would see costs attain $150,000.

Apparently, from September to October, the CDD chart stabilized at a decrease degree. This exhibits that the distribution scenario has calmed down and the market is now present process gradual consolidation.

Some analysts describe this case as “taking a deep breath earlier than working once more.” Within the context of Bitcoin market cycles, this sample usually lays the inspiration for additional upside.

Bitcoin is poised for a parabolic breakout

Standard analyst Javon Marks additionally expressed a optimistic outlook. He believes Bitcoin is poised to counter USDT’s dominance, which may spark the subsequent massive rally.

In line with Marks, the measured motion signifies that it may exceed $180,000 and even break $200,000.

Bitcoin appears to be like poised to breakout towards the USDT dominance and this might result in one other massive bullish transfer for BTC, as value is understood to exhibit a possible parabolic transfer every cycle.

Measured actions point out Bitcoin may attain over $180,000 and even $200,000…$BTC pic.twitter.com/xTNPjpu0mh

— JAVON MARKS (@JavonTM1) October 20, 2025

Furthermore, final week’s CNF report helps this optimism. Historic information exhibits that large-scale liquidations within the Bitcoin market usually take away extra leverage and make the market extra prepared for the subsequent rally.

In October 2025, on-chain alerts as soon as once more confirmed a “wholesome reset” section brought on by inflows from Bitcoin ETFs and elevated institutional liquidity.

Moreover, demand traits from massive buyers counsel a long-term bullish trajectory for this correction.

With low promoting stress, excessive holder confidence, and liquidity flowing in from the institutional sector, Bitcoin seems to be getting ready for brand new footing earlier than shifting larger.

In the meantime, we not too long ago highlighted that Japan’s Monetary Companies Company could quickly permit banks to carry Bitcoin. Moreover, because the variety of digital forex accounts quickly will increase to over 12 million, main banks are being attentive to the launch of yen-backed stablecoins.