A chart shared by GordonGekko reveals Bitcoin buying and selling under an “equilibrium” line primarily based on international cash provide, whereas one other submit hyperlinks the brand new Russell 2000 breakout to the previous rally in BTC. Collectively, the charts revived a well-recognized cycle narrative, though neither submit supplied clear targets or timelines.

Bitcoin falls under international cash provide line as merchants warn of hole ‘undershoot’

Right here is the chart shared by GordonGekko on X Bitcoin It’s buying and selling under an estimated “equilibrium” worth tied to the worldwide cash provide, framing present ranges as an undershoot to the mannequin.

The mutual integration of Bitcoin and the world’s cash provide implies equilibrium. sauce: Bloomberg, Bitwise Europe

The determine, labeled “Bitcoin vs. World Cash Provide: Co-integration Implicit Equilibrium,” plots the market worth of BTC in opposition to a dotted equilibrium line on a logarithmic scale from the early 2010s to 2025. Within the newest phase, the inexperienced BTC line is under the dotted sequence, indicating a detrimental hole to the mannequin’s implicit degree.

Moreover, the underside panel labeled “Mispricing (%)” shows the unfold between Bitcoin and the equilibrium estimate. The most recent studying is under zero, which signifies that Bitcoin is buying and selling under its implied benchmark, quite than above it, primarily based on the chart.

In a submit, Gordon Gekko known as the system “Bitcoin and the worldwide cash provide” and wrote, “It is clear what occurs subsequent,” including, “Sellers will reside in deep remorse for the subsequent 12 months.” The submit doesn’t point out any particular worth targets or timing past that assertion. This chart cites Bloomberg and Bitwise Europe as sources.

Russell 2000 breakout submit brings again “Bitcoin bull market” hyperlink on X

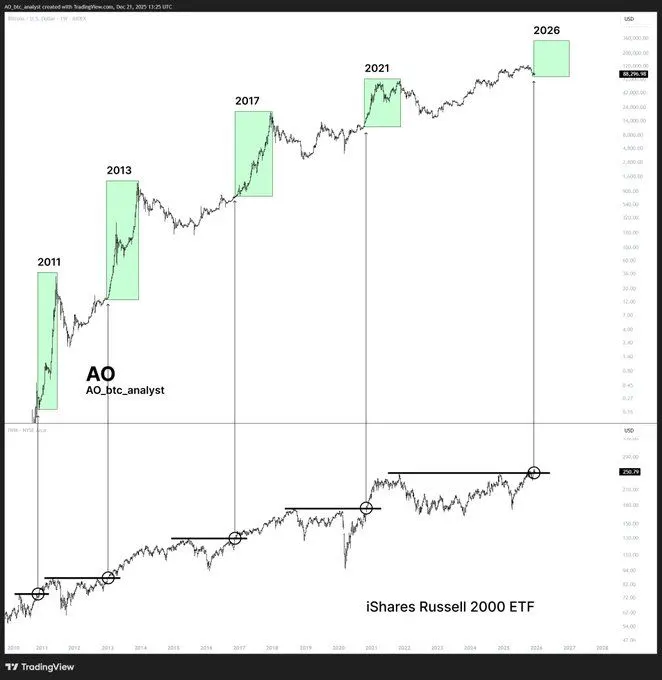

In the meantime, a submit on X by AO, who makes use of the deal with AO_btc_analyst, claimed that Bitcoin’s bull run is following a earlier breakout within the iShares Russell 2000. ETF He additionally mentioned that small-cap benchmarks have as soon as once more damaged out.

iShares Russell 2000 ETF. sauce: AO_btc_analyst for TradingView, X

The chart marks earlier Russell 2000 breakout factors with horizontal resistance strains and circles, visually juxtaposing them with earlier Bitcoin uptrends highlighted by inexperienced packing containers labeled 2011, 2013, 2017, and 2021. A brand new inexperienced field labeled 2026 seems close to the highest proper, suggesting a predicted continuation if the sample repeats.

AO writes: “Each time the Russell 2000 breaks out, Bitcoin Bruladopted by n,” and added, “Russell simply broke out.” This submit didn’t embrace any particular Bitcoin worth targets or time intervals past the historic comparisons proven on the chart.