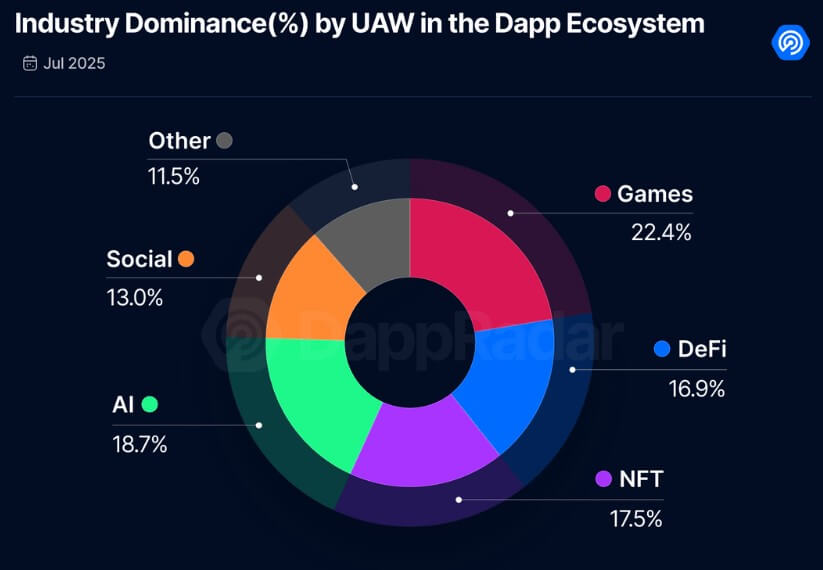

In accordance with a Dappradar report on August 7, the NFT market confirmed a notable revival in July, surpassing Defi when it comes to consumer exercise.

This shift is a major milestone and will point out that NFTs are as soon as once more attracting public consideration following the numerous lull that has continued for the reason that NFTs fell into the bear market in 2022.

Surge in NFTS quantity in July

Dappradar’s knowledge confirmed NFT buying and selling volumes skyrocketed 96%, reaching $530 million in July. Nevertheless, the full variety of transactions fell by 4%, with 5 million NFTs altering their fingers that month.

This pattern reveals clear adjustments in purchaser conduct, and whereas NFTs are much less more likely to change fingers, they promote at considerably increased costs. Actually, the typical NFT promoting value has greater than doubled, rising from $52 in June to $105 in July.

The platform that caters to energy customers and creators has grown probably the most over the interval. Blur accounted for as much as 80% of Ethereum-based NFT buying and selling quantity, pushed by skilled merchants and their mix lending capabilities.

In the meantime, Opensea, the most important NFT market, remained probably the most energetic in day by day consumer rely, with round 27,000 merchants due to its long-term tail checklist and multichine help.

In the meantime, Zora, a platform constructed for creators on the Coinbase-backed base community, has gained momentum with Layer 2 options and native Zora tokens, lowering NFT mint prices.

Dappradar concluded that these figures point out a major evolution throughout the NFT panorama, from early market hype to the rising utility of those digital property.

In accordance with the blockchain firm, area is not restricted to artwork and digital collectibles. As an alternative, they expanded to actual use instances comparable to digital identification, occasion tickets, video games, and precise asset tokenization.

Defi additionally grows

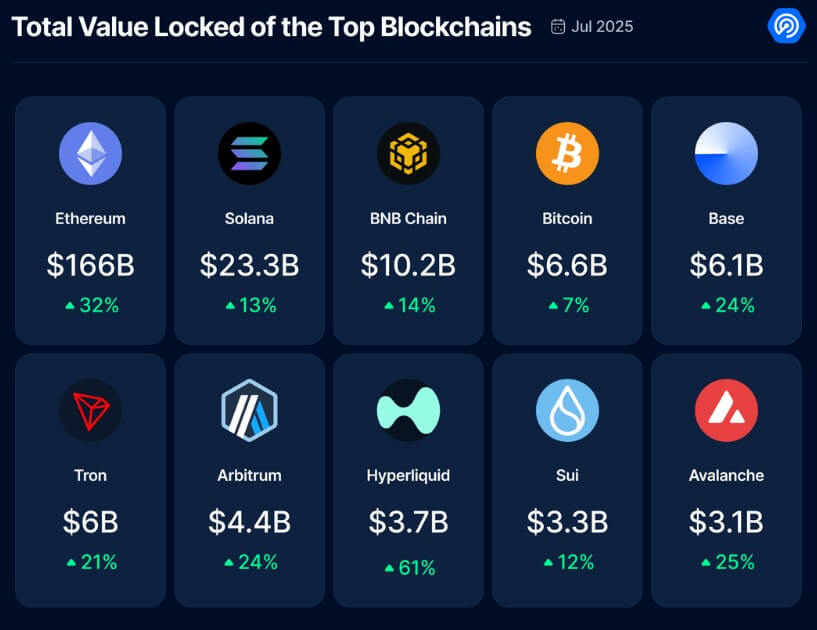

The NFTS had a wave in July, however Defi continued to expertise spectacular progress. Dappradar reported that Defi’s complete locked property (TVL) skyrocketed by over 30%, reaching $259 billion by the tip of the month.

Specifically, the sector reached a brand new excessive of $270 billion on July twenty eighth. This was pushed by elevated consumer demand and contemporary liquidity injections throughout lending, buying and selling and tokenized property.

Defi’s excellent pattern, in the meantime, stemmed from tokenized stock, with pockets interactions rising from round 1,600 to over 90,000. This surge contributes to a 220% improve out there capitalization of tokenized shares, indicating that real-world property (RWAs) are gaining substantial traction.

Past property, Ethereum continues to guide Defi, main a $166 billion TVL, far surpassing Solana’s $23 billion.

The large rise in ETH could possibly be attributed to a surge in costs at almost 60% in July. This could possibly be attributed to the event of optimistic laws alongside because it reaches APY of 29.4%.

At Solana, excessive lipids have emerged as key gamers, accounting for 35% of blockchain income in July. The platform has seen an rising demand for derivatives, and now handles greater than 60% of its 24-hour everlasting buying and selling quantity, with $15.3 billion in public curiosity and $5.1 billion in USDC bridging.