vital notes

- THETA has fallen to its 2020 value vary regardless of a number of crypto rallies passing by way of.

- On the long-term chart, THETA has fallen greater than 97% from ATH and has repeatedly made new highs.

- The whistleblower lawsuit alleges value inflation and deceptive partnerships by insiders.

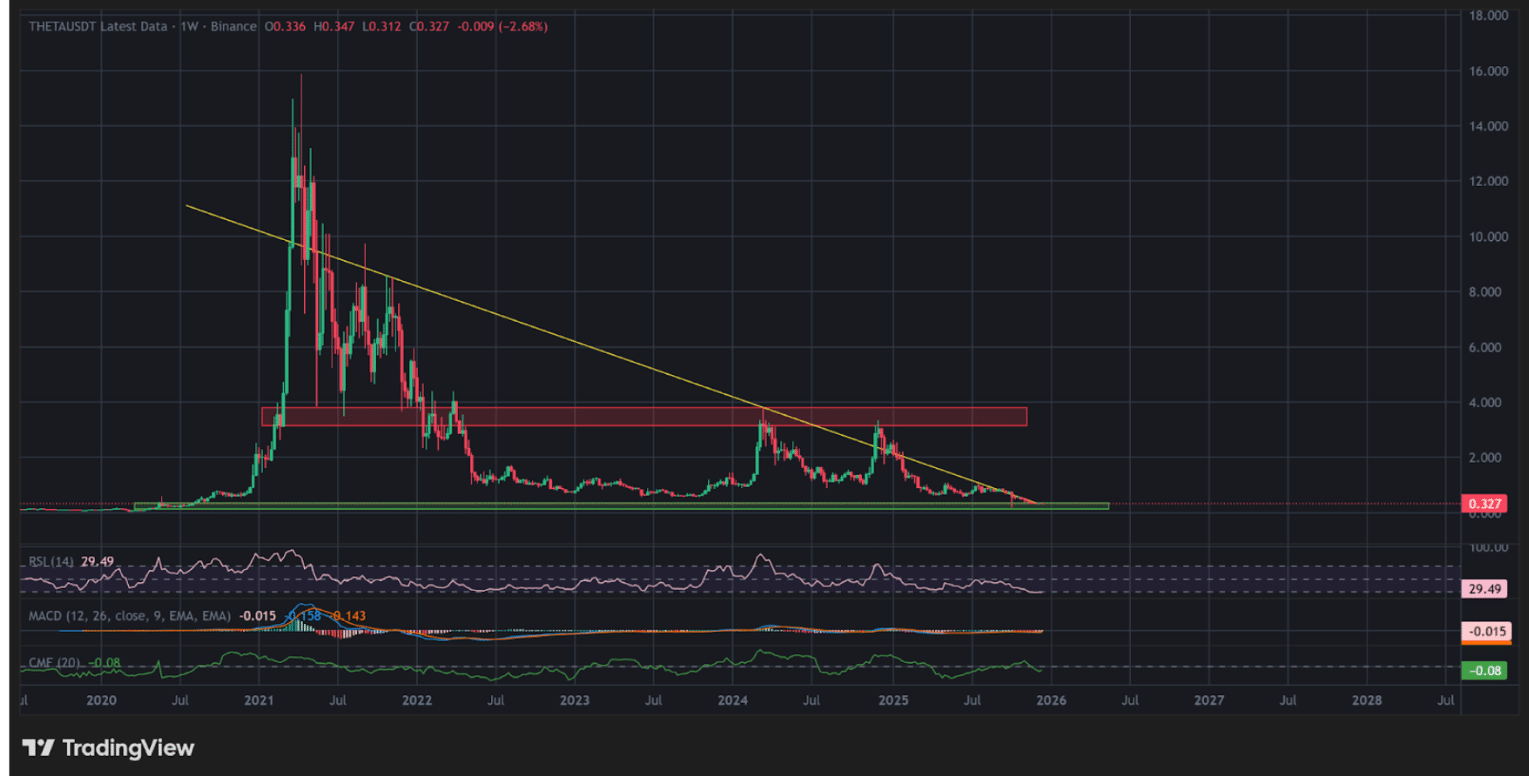

THETA has returned to cost ranges final seen in 2020 after erasing positive aspects from a number of bull market rallies alongside the way in which. The long-term weekly chart reveals a transparent distribution construction, with every restoration try restricted by a downtrend line extending from the 2021 peak.

Regardless of a quick rally from late 2020 to early 2022, THETA continues to commerce at $0.3278, down 97.95% from its all-time excessive of over $15, in line with CoinMarketCap. The altcoin has fallen by an enormous 21% up to now 30 days.

The weekly chart of THETA under resembles a typical post-bubble easing interval. The 2021 peak is the excessive of the cycle, and the rebound has grow to be more and more weak in subsequent years. Every pullback was capped sooner than the earlier one, and assist was regularly eroded till the worth returned to its authentic cumulative vary.

THETA has a long-term downward pattern | Supply: TradingView

Associated article: Do Kwon case: Prosecutors set situations for Korean trial

The failure to make additional lows through the market’s robust restoration signifies that the earlier rally was primarily sentiment-driven. The charts don’t assist giant capital allocations until long-term resistance is decisively damaged and volumes develop considerably.

Whistleblower lawsuit casts shadow over Theta Institute

THETA’s value might fall additional resulting from two whistleblower lawsuits filed in California by former Theta Labs senior executives Jerry Kowal and Andrea Berry. The grievance alleges that the corporate and its administration engaged in misleading conduct over time associated to the THETA token and associated NFT exercise.

Bloomberg reported that the submitting cited inner considerations about token gross sales, disclosure practices and governance that allegedly resulted in retaliation relatively than reform.

The lawsuit describes a sample during which insiders allegedly diminished their publicity in periods of excessive buying and selling quantity, whereas token-related bulletins and promotional actions had been used to assist value will increase.

Former Theta Lab executives file whistleblower lawsuit

Two former senior Theta Labs executives have filed a whistleblower lawsuit in California accusing the corporate and CEO Mitch Liu of years of deception, market manipulation, and retaliation, in line with @DecryptMedia.

— ME (@MetaEraHK) December 17, 2025

Former staff declare they witnessed repeated efforts to extend demand for THETA. Though this suspicion has not but been confirmed, the token’s value efficiency lends additional legitimacy to Kowal and Berry’s statements.

Celeb Advertising and Disputed Partnerships

The lawsuit focuses on using high-profile advertising to draw liquidity. Promotional actions related to celebrities corresponding to Katy Perry are stated to have served to foster speculative curiosity relatively than pure recruitment.

The grievance additionally alleges that sure NFT-related actions have created a man-made look of demand by way of inner or coordinated actions. The connection between Theta and Google can be being mentioned.

The lawsuit alleges that a regular cloud providers settlement was publicly framed as a strategic partnership, giving the impression of approval and validation the place none existed.

Disclaimer: Coinspeaker is dedicated to offering honest and clear reporting. This text is meant to supply correct and well timed info however shouldn’t be taken as monetary or funding recommendation. Market situations can change quickly, so we suggest that you simply confirm the knowledge your self and seek the advice of knowledgeable earlier than making any choices based mostly on this content material.