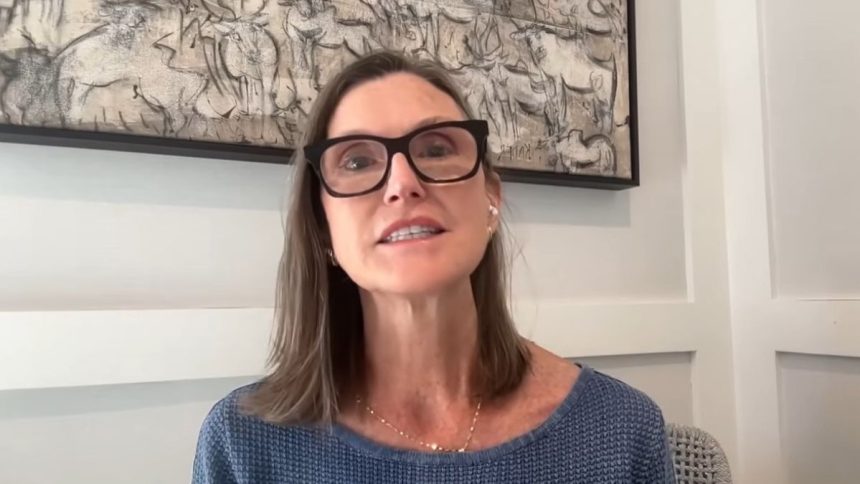

Cathie Wooden, CEO of funding agency Ark Make investments, has proposed a situation wherein the value correction construction of Bitcoin (BTC) has mutated. In line with his imaginative and prescient, asset maturity will shorten the contraction interval and supply unprecedented stability. In actual fact, specialists declare that BTC is dealing with a shorter Bitcoin bear cycle in comparison with historic data.

The narrative that has dominated value evaluation since Bitcoin’s creation is predicated on the halving, a technical occasion that reduces the reward for mining Bitcoin by half. Traditionally, halvings have characterised Bitcoin’s cycles of bull and bear markets each 4 years. Because of this After three years of average and strong progress, the fourth 12 months (2026) shall be a bear market section..

Nevertheless, Wooden explains, “By Bitcoin requirements, we’ve not had a really sturdy bull cycle.” For that reason, she could check Bitcoin’s $80,000 to $90,000 vary, as she believes we’re already “fairly superior” within the present bear cycle,” says the businessman.

This view means that an anticipated correction after hitting an all-time excessive final October will Not as deep or lengthy as earlier cycles. For Wooden, the resilience proven when costs rise is an indication of a paradigm shift.

“Nevertheless, we imagine that this check will succeed. This would be the shallowest four-year decline in Bitcoin’s quick historical past. And we’ll take off once more,” the businessman mentioned, stressing that the capital construction supporting Bitcoin has gone from being purely speculative to having sturdy institutional components.

Elements driving Bitcoin’s short-term bearish cycle

Wooden’s thesis is predicated on the intrinsic worth that BTC brings to the monetary system. She defines this asset as “three revolutions in a single.” It’s a chief within the international financial system, a technological revolution, and a brand new asset class.

For that reason, durations of decline are likely to resolve extra shortly. Institutional calls for search safety from inflation; Bitcoin’s quick bearish cycle permits it to develop into established as the brand new norm within the face of disaster From the earlier 12 months.

Institutional and regulatory implications

The outlook for shorter, shallower cycles is echoed by different Wall Avenue gamers who handle Bitcoin exchange-traded funds (ETFs). Matt Hogan, funding director at Bitwise, agrees. The standard four-year cycle may very well be considerably disruptedas reported by CriptoNoticias.

Hogan mentioned the phenomenon “is pushed by elevated institutional curiosity and regulatory adjustments within the U.S., which have been the primary drivers up to now, whatever the halving.”

Huge capital inflows by regulated means created a constituency that didn’t beforehand exist. Hogan attributes a few of this alteration to favorable U.S. regulation by the creation of a nationwide reserve for digital property, the creation of a Digital Asset Advisory Board, and laws such because the Genius Act.

These components act as shock absorbers that stop digital foreign money costs from falling considerably and speed up market restoration.

Variations of opinion on the Bitcoin cycle

Regardless of Ark Make investments and Bitwise’s optimism, not all specialists agree with the thought of a brief or shallow bear cycle. Henrik Seberg, chief economist at Swissbloc, warned: BTC just isn’t a secure asset as many imagine, however somewhat a high-risk asset.

If a worldwide recession have been to happen, Seberg mentioned, the corporate “may very well be topic to a catastrophic decline resulting from its correlation to the inventory market, particularly the Nasdaq.”

Willy Wu, analyst and SwissBloc contributor, argues: Bitcoin is within the last levels of a bull market. Though he acknowledges there may be “nonetheless a protracted solution to go” for brand new positive aspects, he expects these highs to be adopted by a big decline.

“We anticipate a bear market in BTC as soon as the worldwide macroeconomic market reverses,” Wu mentioned, suggesting that international liquidity stays the first driver somewhat than cycle shortening principle.

The decision of this debate will rely on how Bitcoin reacts to the assist vary talked about by Mr. Wooden. If costs handle to solidify above $80,000 throughout the coming financial turmoil, the four-year cycle principle may develop into out of date, confirming that this digital asset has entered a mature section and that the bear market is only a pause in a long-term upward development.