Gold and silver hit new all-time highs this week, making a funding hole that might result in a possible catch-up rally for Bitcoin.

In line with gold value knowledge, gold has reached an all-time excessive of over $4,600, with business consultants predicting a rise of over $5,000. On the identical time, silver topped $90 and its market cap exceeded $5 trillion for the primary time.

Market analysts stated the worth actions in these treasured metals mirrored the dominance of “laborious property” as traders sheltered from sovereign debt dangers amid heightened world macro uncertainty.

Contemplating this, Bitcoin, which is broadly thought to be “digital gold,” can be off to a strong begin, topping $95,000 for the primary time this 12 months up to now 24 hours.

Nonetheless, the development is slower than that of treasured metals.

For some observers, this delay is extra of a well-recognized signal of rotation than a warning. Their view is that Bitcoin tends to comply with laborious asset momentum late, and {that a} mixture of timing indicators and institutional flows may propel Bitcoin towards six-digit costs.

Bitcoin lags behind gold

The principle technical argument for an impending Bitcoin rally is predicated on statistical proof that gold costs act as a number one indicator for the crypto market.

André Dragosch, Head of Analysis at Bitwise Europe, highlighted sure correlations that recommend that the present rise in metallic costs is successfully indicative of subsequent actions in digital property.

His place focuses on the idea of a “gold-to-Bitcoin rotation,” a situation he argues stays sturdy throughout the present market trajectory.

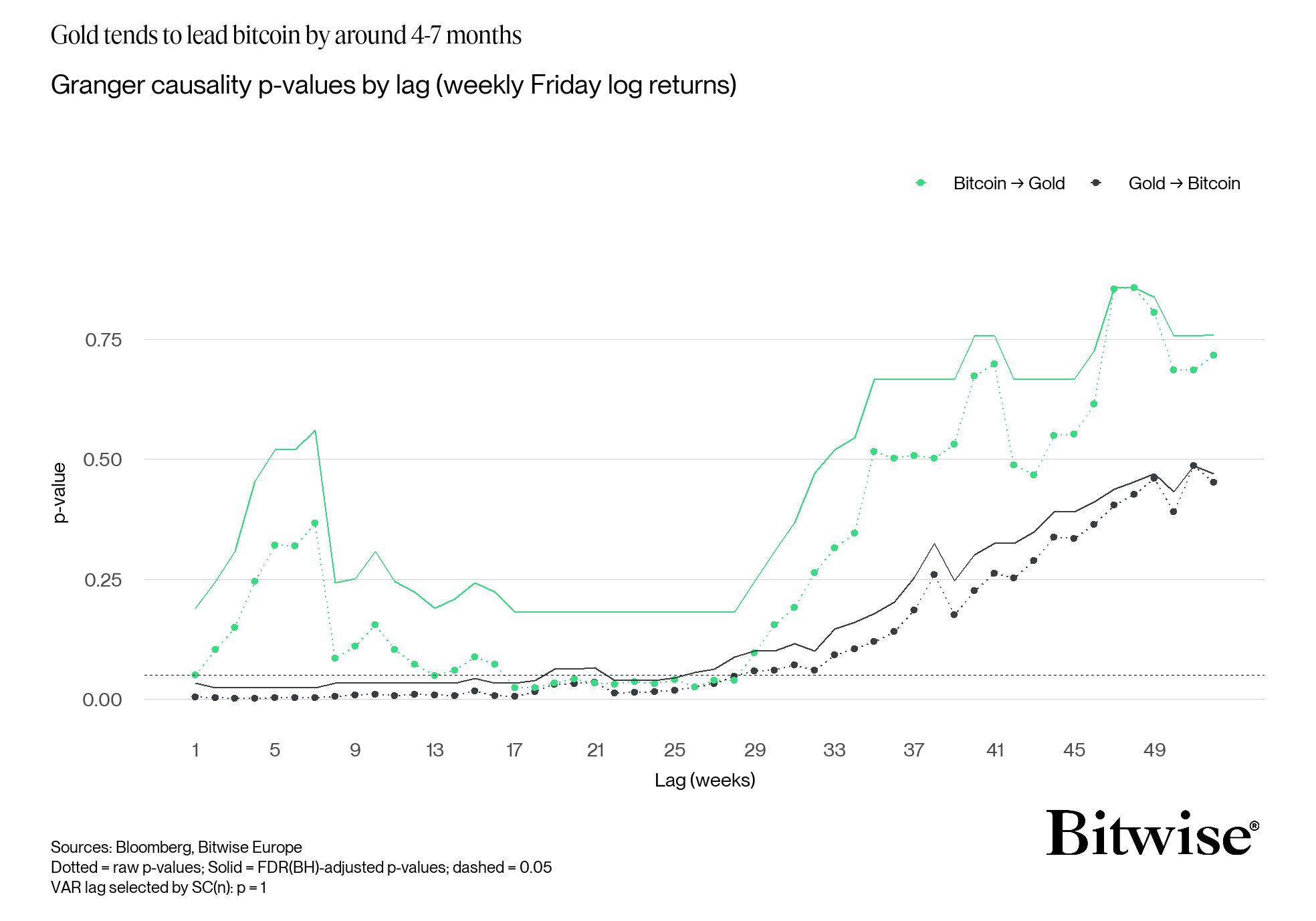

Utilizing the Granger causality take a look at, Dragos famous that gold tends to guide Bitcoin by about 4 to seven months.

This lag interval implies that institutional capital that has flooded into gold as a protected haven will ultimately rotate into Bitcoin as danger urge for food adjusts inside a tough asset framework.

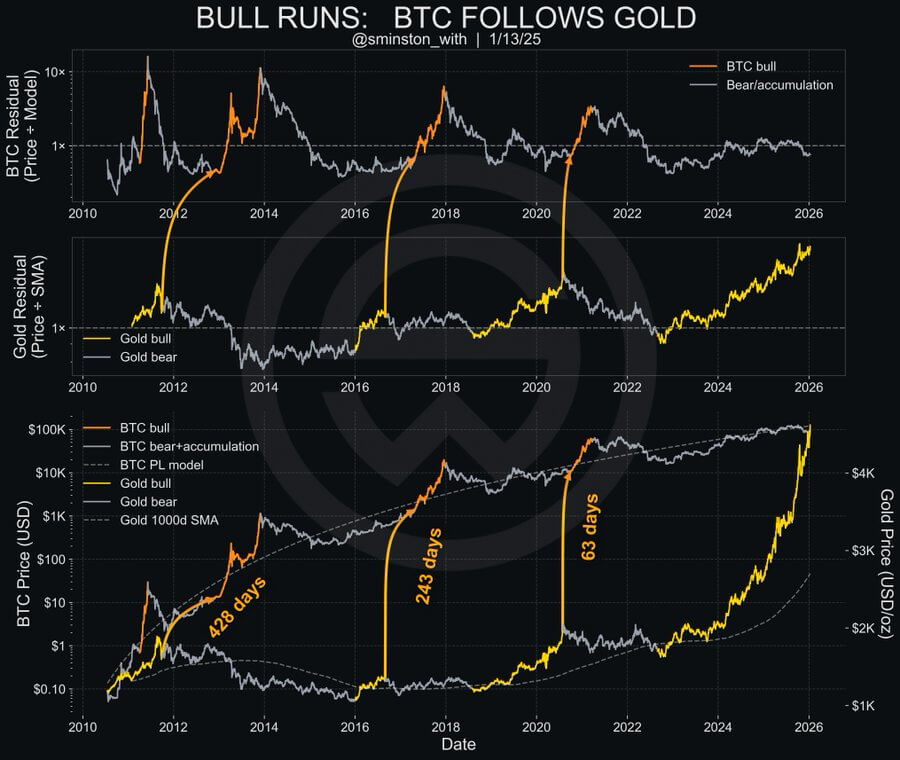

Further knowledge from Bitcoin analyst Sminston With helps his view.

In line with With, historic knowledge reveals a repeating sample during which gold bulls rise earlier than Bitcoin breakouts.

He identified that within the present technical setup, gold has entered the vertical value discovery stage, whereas Bitcoin continues to be within the early levels of a corresponding transition.

This discrepancy is in keeping with Dragosh’s rotation principle and means that gold’s explosive actions are at the moment “loading” the spring into the crypto market.

If the development of reducing lag time continues, Bitcoin will seemingly have a shorter time frame to shut its valuation hole than in earlier cycles, confirming the urgency seen in current institutional flows.

Function of ETF

Past statistical correlation, Bitcoin’s basic scenario helps the speculation of an imminent breakout.

Matt Hogan, chief funding officer at Bitwise, disputes the prevailing principle that gold’s 2025 surge was a sudden response to fast demand. Relatively, he argues, value discovery was a operate of provide depletion that occurred over a few years.

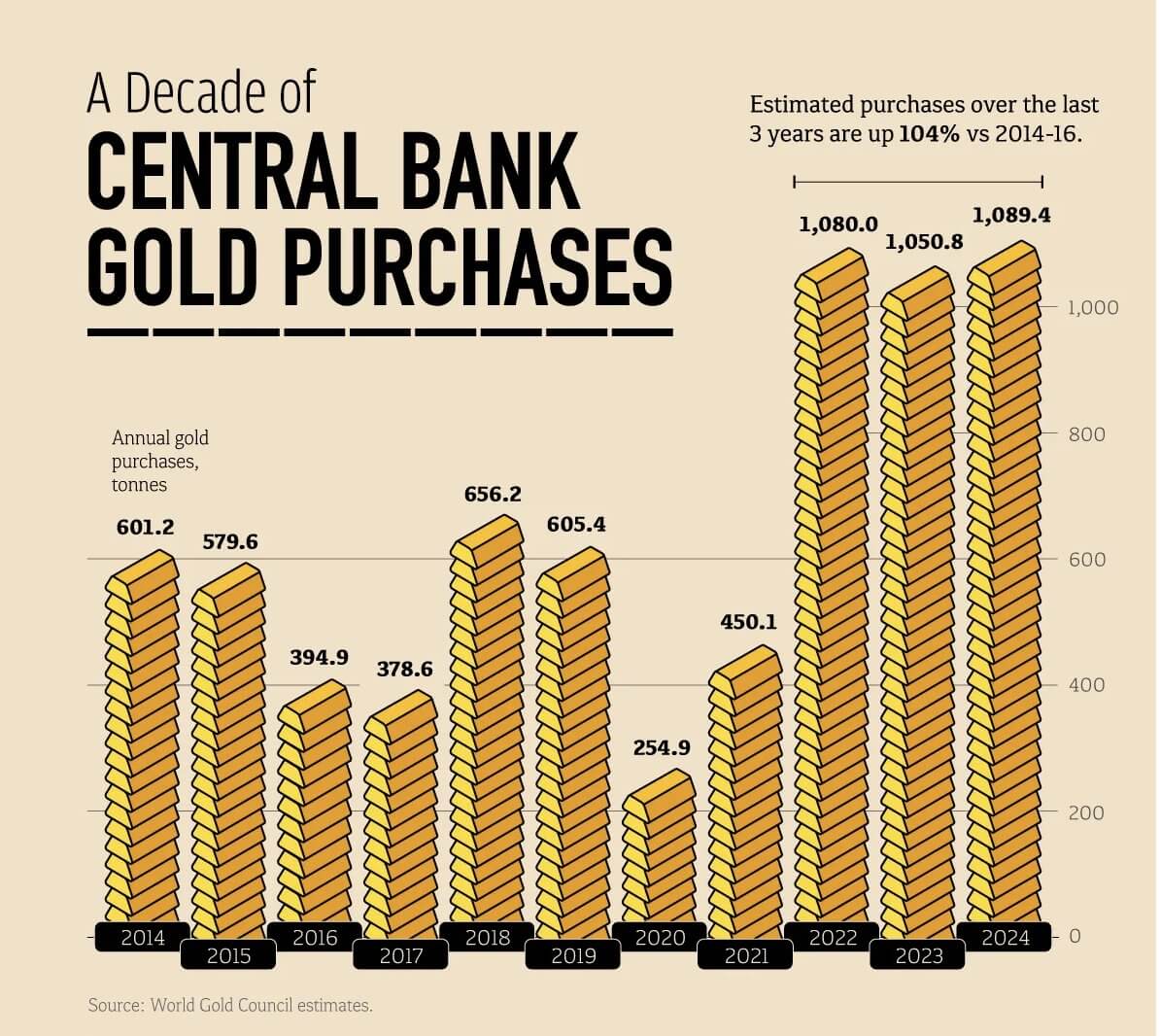

He stated the modern-day gold hoarding started in 2022, when central financial institution gold purchases jumped from about 500 tonnes to 1,000 tonnes a 12 months after the US seized Russian Treasury deposits.

He famous that these purchases essentially tilted the supply-demand steadiness, however costs didn’t instantly replicate this variation. Throughout this era, gold costs rose solely 2% in 2022, 13% in 2023, and 27% in 2024.

Nonetheless, it wasn’t till 2025 that the gold value went parabolic, rising by 65%. Hogan explains that the preliminary giant central financial institution demand was met by current holders keen to promote their gold holdings. Due to this fact, the worth of gold solely rose after these sellers lastly “ran out of ammunition.”

Hougan applies precisely this framework to the present state of the Bitcoin market. Since its debut in January 2024, the US Spot ETF has constantly bought over 100% of the brand new Bitcoin provide issued by the community.

Nonetheless, the worth of the flagship cryptocurrency has not but gone vertical as current holders are keen to promote to energetic accumulation in ETFs. certainly, crypto slate It was beforehand reported that long-term Bitcoin holders have been among the many high asset’s most prolific sellers over the previous 12 months.

Contemplating this, Hogan argues that: BTCAs with the gold market, when the availability of keen sellers ultimately dries up, the worth will rise.

As soon as that depletion level is reached, the disconnect between provide and demand may pressure a parabolic repricing just like gold’s efficiency in 2025.

Macro elements and the Fed disaster

In the meantime, the catalyst for the rise in gold and silver costs gives additional proof that Bitcoin will comply with swimsuit. Metals markets are reacting to a extreme take a look at of confidence within the independence of the US Federal Reserve.

Stories of a legal investigation into Fed management have shaken confidence within the stability of the greenback and the neutrality of financial coverage. This uncertainty is driving world capital towards property which can be much less vulnerable to political interference.

Gold acts as a main safe-haven asset throughout such crises and reacts immediately to information. Bitcoin is commonly seen as a “risk-on” protected haven, however traders are usually gradual to react as they first safe defensive positions in bullion earlier than allocating to the digital retailer of worth.

In different phrases, that “confidence premium” that’s at the moment driving the worth of gold to $4,600 is similar basic driver behind Bitcoin’s funding case.

Because the preliminary shock of the Fed information wears off, we count on the market to search for property with related shortage and independence, however with greater upside potential. Bitcoin suits this profile completely, providing a convex hedge towards the excessive sovereign danger at the moment disrupting conventional markets.

Bitcoin value prediction

Ahead-looking Bitcoin traders are figuring out particular value ranges that might catalyze a catch-up commerce.

Within the choices market, that place is altering, however it nonetheless exhibits that the market is concentrated on the upside breakpoint.

Deribit knowledge exhibits: BTC Merchants constructed bullish publicity by way of near-expiring name choices, such because the Jan. 30 $98,000 name and February’s $100,000 name.

This week, a few of that short-term optimism was taken off the desk. Nonetheless, a number of the outdated January $100,000 calls have been rolled ahead to March’s $125,000 calls, suggesting some merchants want to transfer greater over time whereas sustaining their upside outlook.

These bets can create what merchants name a “gamma magnet.” When the spot value of Bitcoin approaches this degree, market makers who offered choices might be pressured to purchase the underlying asset to hedge their publicity.

This shopping for stress creates a suggestions loop that causes the worth to rise quickly, doubtlessly exceeding the underlying goal.

Analysts consider Bitcoin is concentrating on a near-term rally to the $120,000-$130,000 vary if the correlation with gold is maintained and the four-to-seven-month lag is resolved, as recommended by Dragosh.

This represents an analogous proportion enhance to silver’s current transfer, which tends to outperform gold within the later levels of laborious asset bull markets.