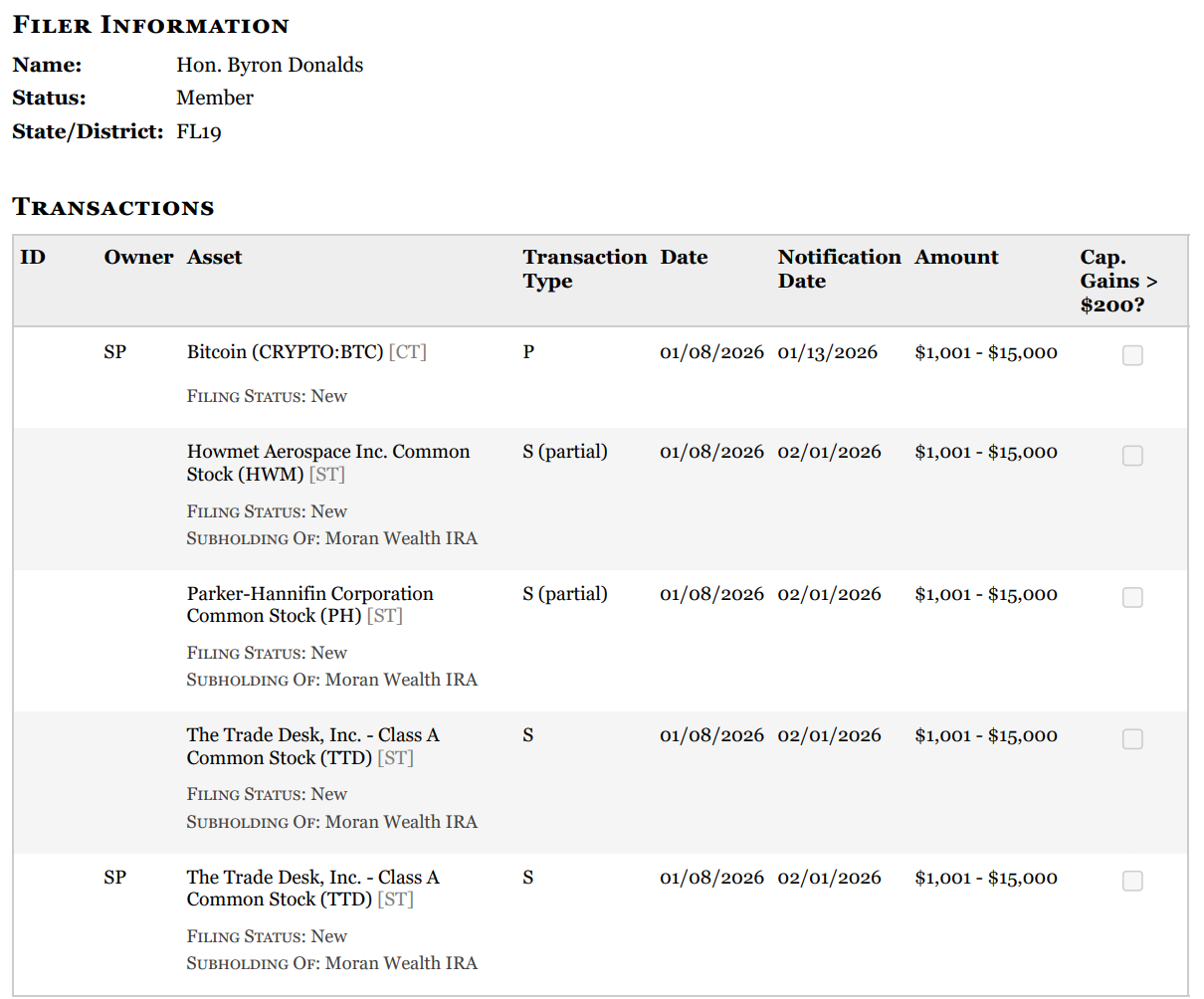

US Congressman Byron Donald has launched new monetary disclosures exhibiting his purchases of cryptocurrencies amid stress within the digital asset market.

The submitting describes purchases of Bitcoin (BTC) value between $1,001 and $15,000 that have been recorded on January 8, 2026 and printed on February 12, 2026. This commerce coincides with Bitcoin struggling to take care of key help ranges and at present buying and selling under the $70,000 spot.

Along with the Bitcoin purchases, the disclosure reveals some gross sales of conventional shares, together with Howmet Aerospace (NYSE: HWM), Parker Hannifin Company (NYSE: PH), and The Commerce Desk (NASDAQ: TTD), all of which have been reported in late January.

Certainly, on condition that he serves on the Home Monetary Companies Committee, his trades are prone to proceed to lift questions on Congressional trades.

Donald’s inventory buying and selling controversy

The submitting follows earlier controversies over cryptocurrencies and inventory buying and selling throughout Donald’s tenure. In late 2025, on the identical day that he and different lawmakers despatched a letter to the Inner Income Service asking for modifications to digital forex tax guidelines, he and his spouse reportedly purchased Bitcoin, elevating questions in regards to the timing given their involvement in digital asset coverage.

His inventory buying and selling historical past has additionally come beneath scrutiny. In a associated transfer, a bipartisan watchdog group has filed a grievance with the Workplace of Congressional Ethics, alleging that the Donalds didn’t well timed disclose greater than 100 inventory trades value as much as about $1.6 million in 2022 and 2023, doubtlessly violating the Congressional Data Buying and selling Suspension Act, which requires members of Congress to report trades inside 45 days.

The grievance additionally notes that among the personal transactions concerned corporations overseen by the Home Monetary Companies Committee, elevating considerations about potential conflicts of curiosity when investing in sectors that lawmakers assist regulate.

Though there have been no enforcement actions or authorized findings associated to his Bitcoin or inventory buying and selling, his funding actions have been beneath fixed scrutiny resulting from his high-profile buying and selling patterns, proximity to coverage actions, and previous ethics complaints.