September has traditionally been the weakest month for Ethereum, with a median return of over 12% losses. There was nothing totally different this September. ETF outflows and the hesitation of the broader markets have led to Ethereum costs lowering stress in opening week.

Nevertheless, September 2025 could not observe historical past that neatly. Within the traditionally weakest month, three bullish indicators have emerged that would flip the script over and push Ethereum costs as much as new highs. Nicely, that may be such an anti-climax.

Whales purchase massive as an outlet for weak arms

At press time, Ethereum trades almost $4,406. Simply this week, ETH touched on the $4,261 low, however rapidly regained the bottom.

Over the previous 24 hours, ETH costs have been largely flat, with no indicators of a potential paper breakout. Nevertheless, whales are accumulating actively. The availability held by the alternate wallets by whales elevated from ETH 9572 million to ETH 99.41 million inside a day. This represents a web pickup of three.69 million, over $16 billion at present costs.

Ethereum whales add tens of millions of ETH:santiment

Need extra token insights like this? Join Editor Harsh Notariya’s day by day crypto publication.

Such a big inflow from whales suggests confidence. Retailers could also be hesitant, however the whales look like positioning for the gathering.

Nevertheless, the acquisition of whales can meet resistance when retailers, particularly when bought by short-term holders. Nicely, it appears he took care of that too. Their purchases coincide with weaker strikes.

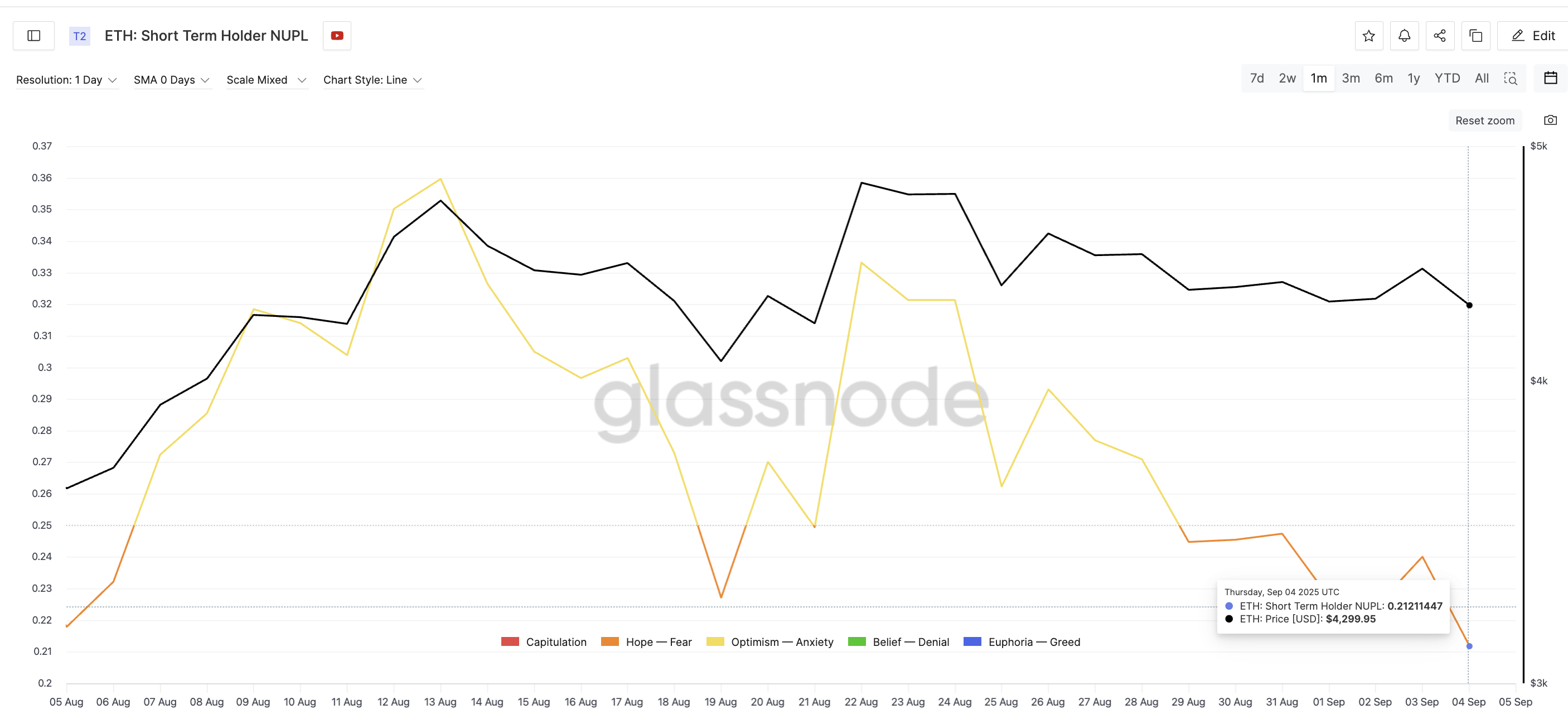

If Nupl hits, you may get a weaker transfer: GlassNode

Brief-Time period Holder Internet Unrealized Revenue/Loss (NUPL) metrics (indicating short-term holder revenue or loss) decreased to 0.21, the second lowest stage in a month. Traditionally, native lowest values for this metric usually point out rebound factors to counsel that weaker arms are popping out and others are sitting on smaller advantages.

For instance, on August 19, when NUPL fell close to 0.22, the Ethereum worth was $4,077. Within the subsequent session, ETH was almost 20%, at $4,829.

This mixture of whale purchases and weaker homeowners sells paint. Even a ten% transfer from the present stage (not 20%) permits ETH to strategy a brand new excessive take a look at.

Ethereum worth ranges and RSI divergence take a look at bullish

The third purpose for its highest peak ferociousness of all time comes from the chart itself. Ethereum’s day by day worth chart reveals the divergence of hidden bullishness. The ETH was decrease, however the relative energy index (RSI) was lowered by measuring momentum shopping for and promoting.

Ethereum Value Evaluation: TradingView

This department is vital because it signifies a continuation of the conventional pattern. It reveals that sellers are operating out of steam regardless of the agency worth of Ethereum. RSI divergence, when mixed with whale accumulation, additional strengthens the upside-down case.

At Ethereum costs, the important thing resistance to viewing is $4,672, breaking $4,496. A clear break above this stage opens the go to $4,958, doubtlessly growing your worth discovery.

On the draw back, in case your ETH falls beneath $4,210, you’ll get a nullification. It will weaken bullish instances.

Three the explanation why Ethereum costs may peak within the weakest month was first launched in Beincrypto.