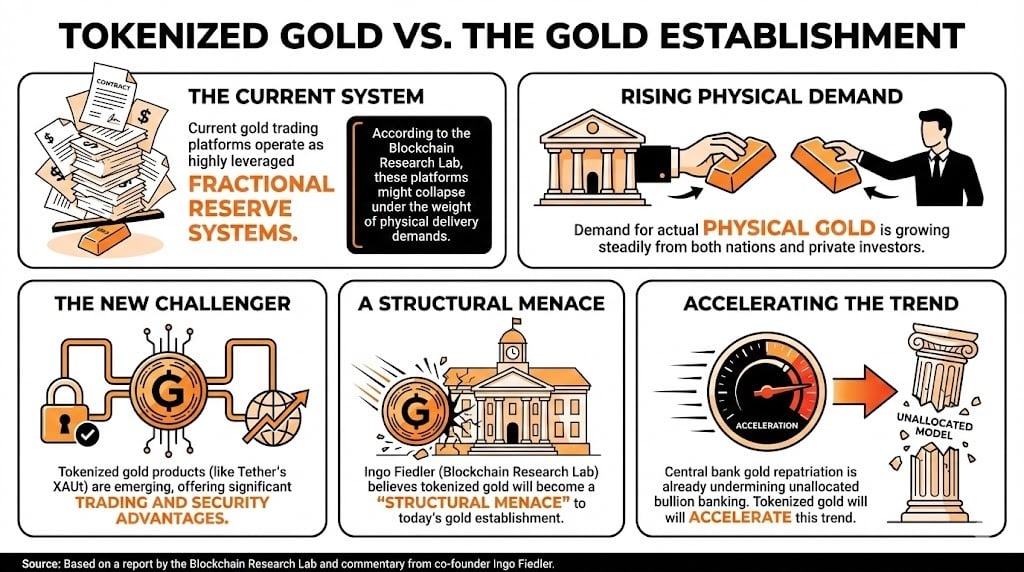

A current report by Blockchain Analysis Lab examines the advantages of tokenized gold and the present paper gold platforms in use and predicts that tokenization will immediate gold traders to exit conventional techniques and destabilize world gold establishments.

Tokenized gold triggers liquidity disaster as traders shift

reality

A current report by Blockchain Analysis Lab, a German non-profit group that research using blockchain for social good, considers the influence that the rise of tokenized gold could have on the present system.

Ingo Fiedler, co-founder of the institute, stated that as demand for bodily gold will increase from each sovereign and retail traders, present gold buying and selling platforms that operate as extremely leveraged fractional reserve techniques might collapse below the load of bodily deliveries.

Whereas geopolitical elements may mitigate this disaster, Fiedler believes that tokenized gold might pose a structural menace to at this time’s gold institution, as it will positively displace extra traders from its buying and selling and security advantages.

Fiedler stated:

Over the previous few years, central financial institution accumulation and repatriation have steadily eroded the foundations of the bullion banking unallocated mannequin. This pattern will speed up with the appearance of tokenized gold merchandise like Tether’s XAUt.

learn extra: Schiff doubles down on Bitcoin criticism, pushes tokenized gold as actual asset on blockchain

Why is it related?

Fiedler’s views on the way forward for the gold market are a first-rate instance of how blockchain might be a part of a greater designed system to help real-world belongings (RWA), and the way substitution can result in the collapse of legacy platforms.

Whereas Fiedler’s evaluation could appear far-fetched to some, because the numbers moved in London, New York, and Shanghai are large, and tokenized gold remains to be in its infancy, the advantages of tokenization are simple.

“Historical past teaches us that leveraged and fragile techniques not often unravel gently. Bitcoiners intuitively perceive that, as Hemingway describes chapter: progressively after which instantly,” he concluded.

I am wanting ahead to it

Monetary analysts predict that tokenization will sweep the monetary world and gold can be no exception, however given the extent of leverage within the gold market, the implications of this transformation may very well be disastrous.

FAQ

What’s mentioned within the current Blockchain Institute report?

This report is tokenized gold It could influence conventional gold buying and selling techniques based mostly on fractional reserves.What are the doubtless results of elevated demand for bodily gold?

Resulting from elevated demand, present gold buying and selling platforms might face difficulties in bodily delivering gold, resulting in the collapse of the present system.How might tokenized gold influence the normal gold market?

Ingo Fiedler believes in tokenized gold like Tether XAUtmight undermine conventional bullion banking by shifting investor preferences in the direction of its transparency and security advantages.What are the longer term predictions for tokenization in finance?

Analysts are tokenization The rise in belongings will revolutionize finance, however the transition within the gold market might trigger issues on account of excessive ranges of leverage.