A mix of accelerating token provide and rising market costs has pushed tokenized shares and merchandise to peak valuations. Shares and commodities are nonetheless the smallest class of tokenized RWA, however have been rising actively over the previous few months.

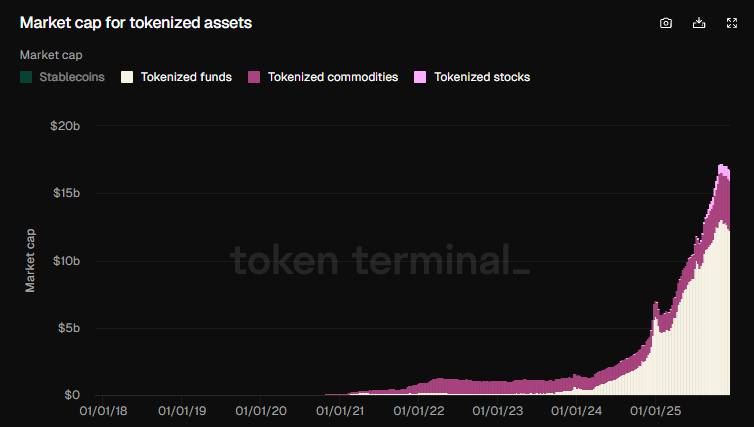

Based mostly on Token Terminal knowledge, tokenized shares and merchandise have reached the best valuation. Asset tokenization is among the development tales of 2025, with extra platforms trying so as to add their very own fairness requirements.

Tokenized merchandise reached $3.7 billion in December, largely primarily based on the efficiency of gold. Tokenized shares are floating round $808 million. The expansion of tokenized merchandise depends totally on Tether’s gold-backed tokens. Tether has additionally set the business normal for gold reserves.

Regardless of silver’s current speedy growth, there’s little or no treasured steel current in tokenized belongings.

Tokenized shares are the newest pattern and have proven speedy development over the previous few months. |Supply: Token Terminal

Tokenized shares are tough to completely describe as there are a number of requirements and platforms. Ondo report $368 million With tokenized shares. XStocks Report 300 million {dollars} Token models excluding Chainlink (LINK) market capitalization.

Different markets additionally exist with completely different approaches to tokenization. Nonetheless, in 2025, the tokenized shares of Ondo and XStocks reworked into business leaders.

Tokenized shares attain a wider investor base

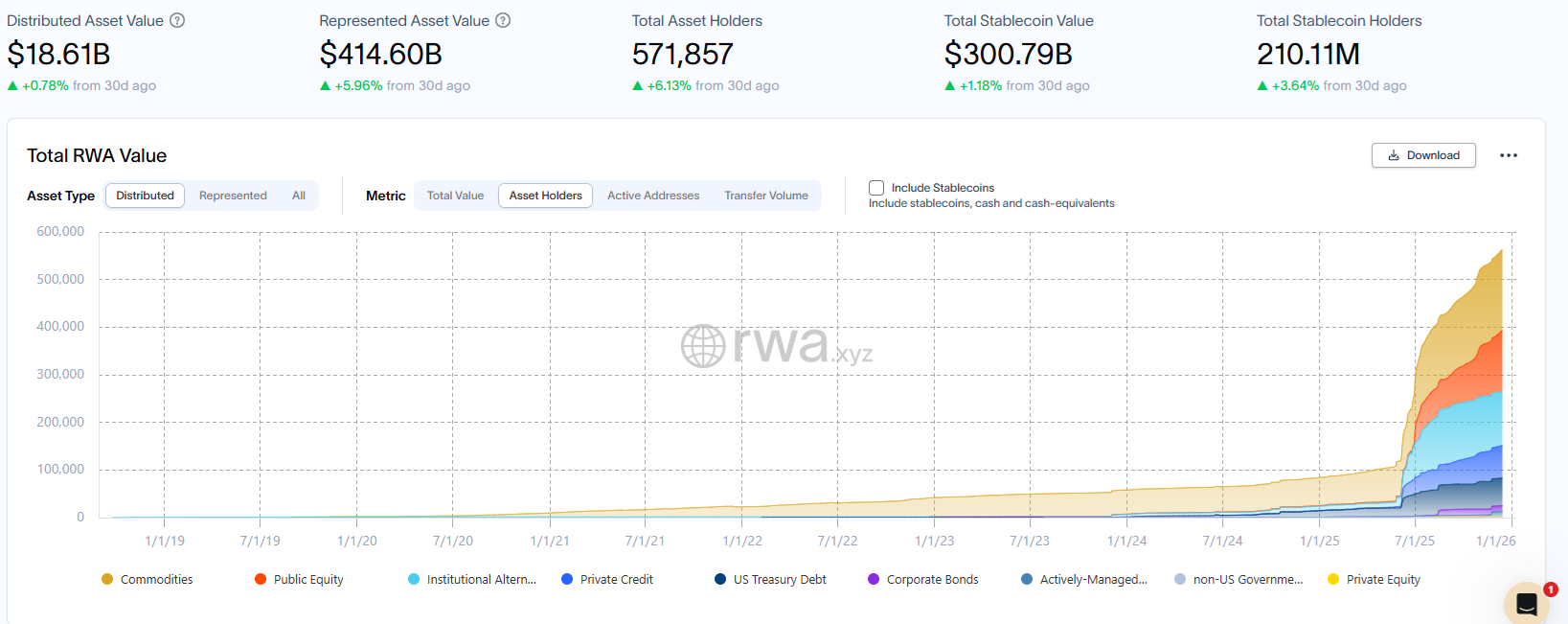

Tokenized shares are seeing document adoption primarily based on new pockets additions. Stablecoins make up the vast majority of tokenized RWA, however extra wallets are transferring to commodities, shares, funds, and personal credit score.

Along with the elevated adoption of tokenized merchandise, 2025 additionally noticed a rise in possession of tokenized shares. |Supply: RWA.xyz

All through 2025, possession of assorted tokenized asset lessons expanded quickly. Though the variety of pockets homeowners has elevated to over 571,000, they’re nonetheless solely a fraction of conventional stablecoin homeowners. Nonetheless, with the expansion of infrastructure, tokenization is proving to be a everlasting pattern.

XStocks solves bridging

One of many points with inventory tokenization is how company occasions equivalent to splits and dividends are mirrored on-chain.

Lately, XStocks launched XBridge, which lets you transfer shares between Solana and Ethereum. Whereas easy tokens are bridged every day, tokenized fairness bridges can pose challenges as a result of alternative ways company occasions may be mirrored.

Introducing xBridge

xStocks can now be moved freely between chains. Utilizing @chainlink’s CCIP because the cross-chain infrastructure, xBridge is the primary bridge to attach Solana to Ethereum and extra, sustaining rebases for tokenized shares.

The longer term is open, configurable, and omnichain. pic.twitter.com/x1zD436500

— xStocks (@xStocksFi) December 12, 2025

This bridge is step one to launching XStocks on a number of chains whereas preserving the precise worth and performance of every tokenized share.

Tokenized shares are one of many driving forces behind Solana adoption. Lately, tokenization of shares has turn into mainstream. quickest rising Solana belongings exchange earlier stars like meme tokens.

Competitors can also be rising from different platforms, equivalent to Robinhood’s inventory tokenization. choice. General, the attraction of tokenized shares is rising after a protracted season of betting on tokens with no inherent backing.

Tokenization of shares provides worldwide merchants easy accessibility to US shares. In 2025, worldwide traders purpose to make the most of the expansion of US corporations, creating tensions within the authorized standing of US corporations. tokenized belongings.

Among the tokenized shares accessible are permissionless, whereas others are tied to completely vetted KYC accounts on centralized exchanges.