Bitcoin (BTC) merchants stay nervous because the cryptocurrency pioneer consolidates beneath $115,000. Liquidity heatmaps present quick positions are crowded, with whales quietly growing publicity forward of Wednesday’s Federal Open Market Committee (FOMC) assembly.

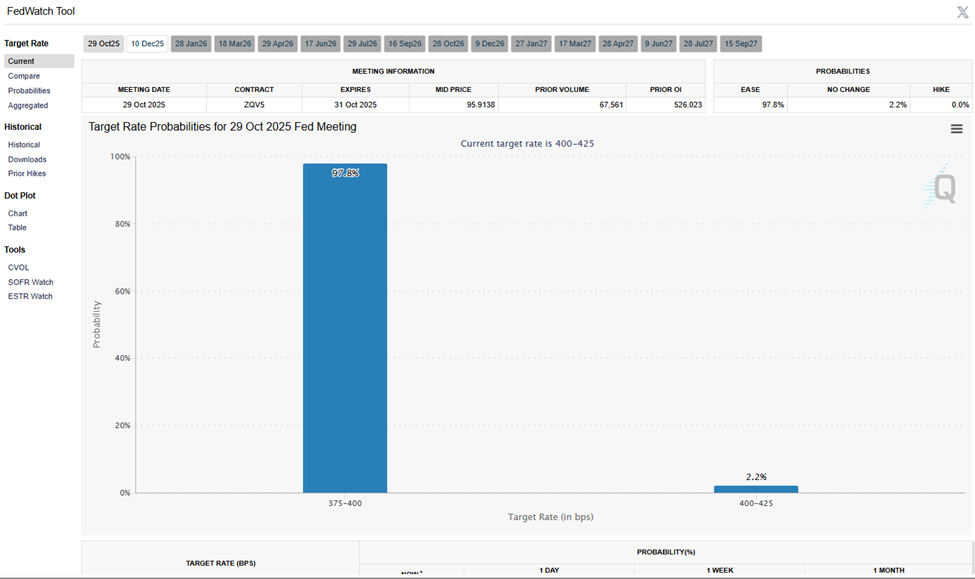

Buyers are betting on a 97.8% probability that the Fed will lower rates of interest by 1 / 4 of a share level (25 bps).

Liquidity will increase forward of FOMC as bears fall into lure

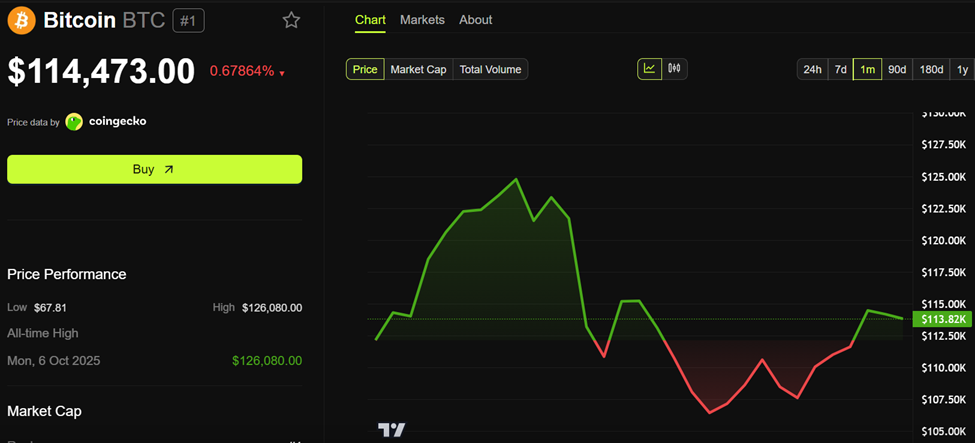

As of October 28, Bitcoin was buying and selling between $114,473, calming down from final week’s $116,000 take a look at. Analysts say the subsequent large transfer might rely extra on the Fed than on the charts.

Bitcoin (BTC) worth efficiency. Supply: BeInCrypto

AlphaBTC market analyst Mark Cullen described the present state of affairs as a “Bitcoin liquidity sandwich,” noting that quick positions above the October 13 excessive are trapped.

“Makes an attempt to construct liquidity above the highs of the Monday thirteenth rebound will solely worsen short-term liquidity because the bears piled on the sweep. They are going to be washed out once more earlier than an opportunity for a deeper correction arises,” Cullen wrote on X (Twitter).

Cullen’s evaluation, primarily based on Coinglass’ liquidation heatmap, exhibits growing short-side stress between $115,000 and $121,000, suggesting a doable squeeze forward of a deeper correction.

Bitcoin liquidation heatmap. Supply: Karen on X

This view displays a broader bullish bias amongst merchants, who count on a short-term “downfall” earlier than hitting new highs.

Elsewhere, information aggregator CoinAnk warns that liquidation zones are tightening on each side of the market, with heatmap pressure growing between $102,000 and $112,000.

“Thermal depth within the 102,000-105,000 vary rises to pink-orange colour with excessive stress on assist…whereas the 108,000-112,000 band exhibits dense resistance,” the platform famous.

Such double-sided stress typically precedes sharp volatility in Bitcoin and displays widespread dealer indecision forward of coverage bulletins.

Crypto Banter host Ran Neuner highlighted the CME futures hole on the $111,000 stage, saying this can be a zone that’s typically topic to retracement earlier than a bigger breakout.

“The CME differential is now right down to the $111,000 stage,” he teased.

In line with TradingView information, CME Hole’s historic fill fee is 70%. Neuner’s feedback counsel that Bitcoin’s present decline may precede a brand new rally, relying on whether or not the macro catalysts align post-FOMC.

FOMC looms as whales regain confidence

Knowledge from the CME FedWatch software exhibits {that a} fee lower on the FOMC assembly is nearly sure.

Chance of rate of interest cuts. Supply: CME FedWatch Software

In opposition to this backdrop, dealer Crypto Rover reminded his followers {that a} comparable setup precipitated a “huge Bitcoin pump” in 2024. Expectations for a dovish pivot have revived bullish sentiment, particularly amongst giant firms.

Rover additionally revealed that the whale with a “100% win fee” added $237 million lengthy BTC and $194 million lengthy ETH, demonstrating deep perception {that a} short-term dip may very well be a shopping for alternative.

“This whale is betting large on the upside after the FOMC,” Lorber stated, “a sign that the good cash is anticipating acceleration, not hesitation.”

Bitcoin’s order guide tells a narrative of hesitation and hope as merchants achieve a bonus over the Fed. Bears see a crowded market ripe for a correction, whereas bulls are bracing for additional upside, armed with liquidity maps and macro bets.

However, this week will likely be an necessary one for Bitcoin, as predicted by Customary Chartered. The FOMC outcomes may resolve whether or not Bitcoin breaks out of the $110,000 to $116,000 vary or units off the subsequent large sweep in crypto’s ongoing liquidity recreation.

The submit Whales double down lengthy as merchants break up forward of FOMC as Bitcoin liquidity will increase appeared first on BeInCrypto.