Hong Kong-based funding agency Pattern Analysis continues to build up ether though one of many largest company ETH holders predicts a major withdrawal within the first quarter of 2026.

In keeping with blockchain knowledge platform Lookonchain, Pattern Analysis acquired $35 million in Ether (ETH), bringing its holdings to over 601,000 ETH, value roughly $1.83 billion.

The corporate has borrowed a complete of $958 million in stablecoins from decentralized lending protocol Aave, with a mean buy worth of roughly $3,265 per ETH, Lookonchain wrote in an X publish on Monday.

Pattern founder Jack Yee mentioned he’s “bullish” on cryptocurrencies for the primary half of 2026 and pledged to proceed shopping for Ether “till the bull market arrives” with “our largest place in ETH” and a “heavy” place within the Trump family-linked World Liberty Monetary (WLFI) token.

He added, “2026 might be an total optimistic surroundings for monetary on-chain, stablecoins, rate of interest minimize cycles, crypto coverage, and so forth.”

sauce: look on chain

Associated: Bitcoin rises to $88,000 as Aave faces governance drama: redefining finance

Bitmine Immersion Applied sciences, the most important company holder of Ether, depends on dollar-cost averaging, however Pattern Analysis has pledged to proceed buying Ether no matter “fluctuations of some hundred {dollars}.”

Pattern Analysis is the third largest Ether holder after Bitmine and SharpLink Gaming, however as a non-public firm it isn’t listed on most monitoring web sites resembling StrategicEthReserve.

Associated: Crypto Hypothesis Hits 2024 Lows as TradFi Leveraged ETF Hits File Excessive of $239 Billion

FundStrat calls $1.8,000 ETH a backside, however sensible cash shorts ETH worth

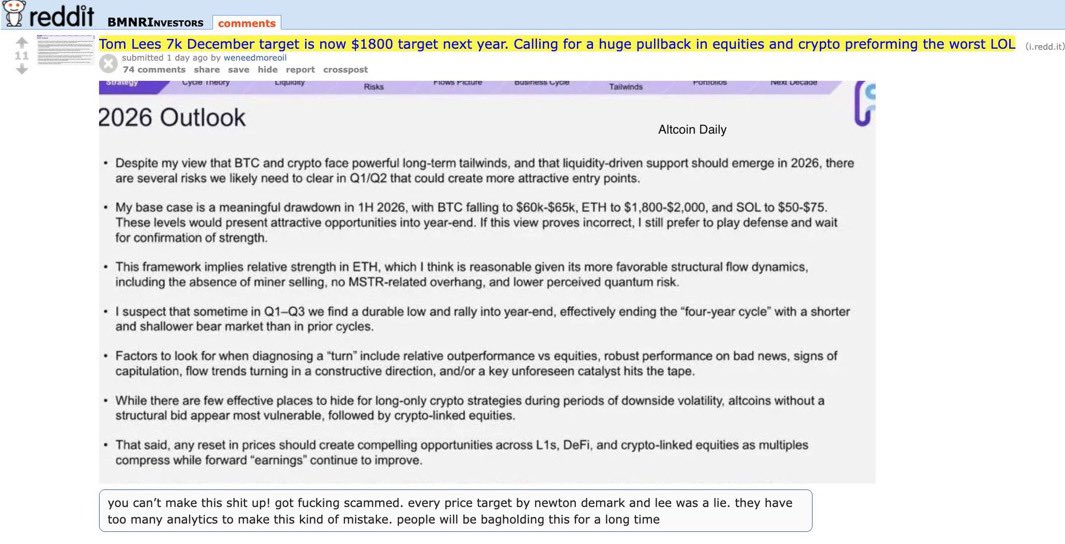

Mr. Yee’s optimistic outlook contrasts with insights shared by Fundstrat International Advisors, which predicted that Ether would backside close to $1,800 within the first quarter of 2026.

On December twenty first, screenshots of Fundstrat’s inside analysis notes by Tom Lee, co-founder and managing associate, have been launched. He predicted a “vital drawdown” within the first half of subsequent 12 months.

“My base case is a major drawdown within the first half of 2026, with BTC falling from $60,000 to $65,000, ETH from $1,800 to $2,000, and SOL from $50 to $75. These ranges signify engaging alternatives in direction of the tip of the 12 months.”

The word suggests the market may kind a “sustained low” within the first or third quarter earlier than rebounding in direction of the tip of the 12 months, leading to a shallower bear market than in earlier cycles.

The bearish prediction got here as a shock to traders, on condition that Lee can also be the chairman of Bitmine, the most important company ether holder with roughly $12.3 billion in ETH holdings.

sauce: Alejandro BTC

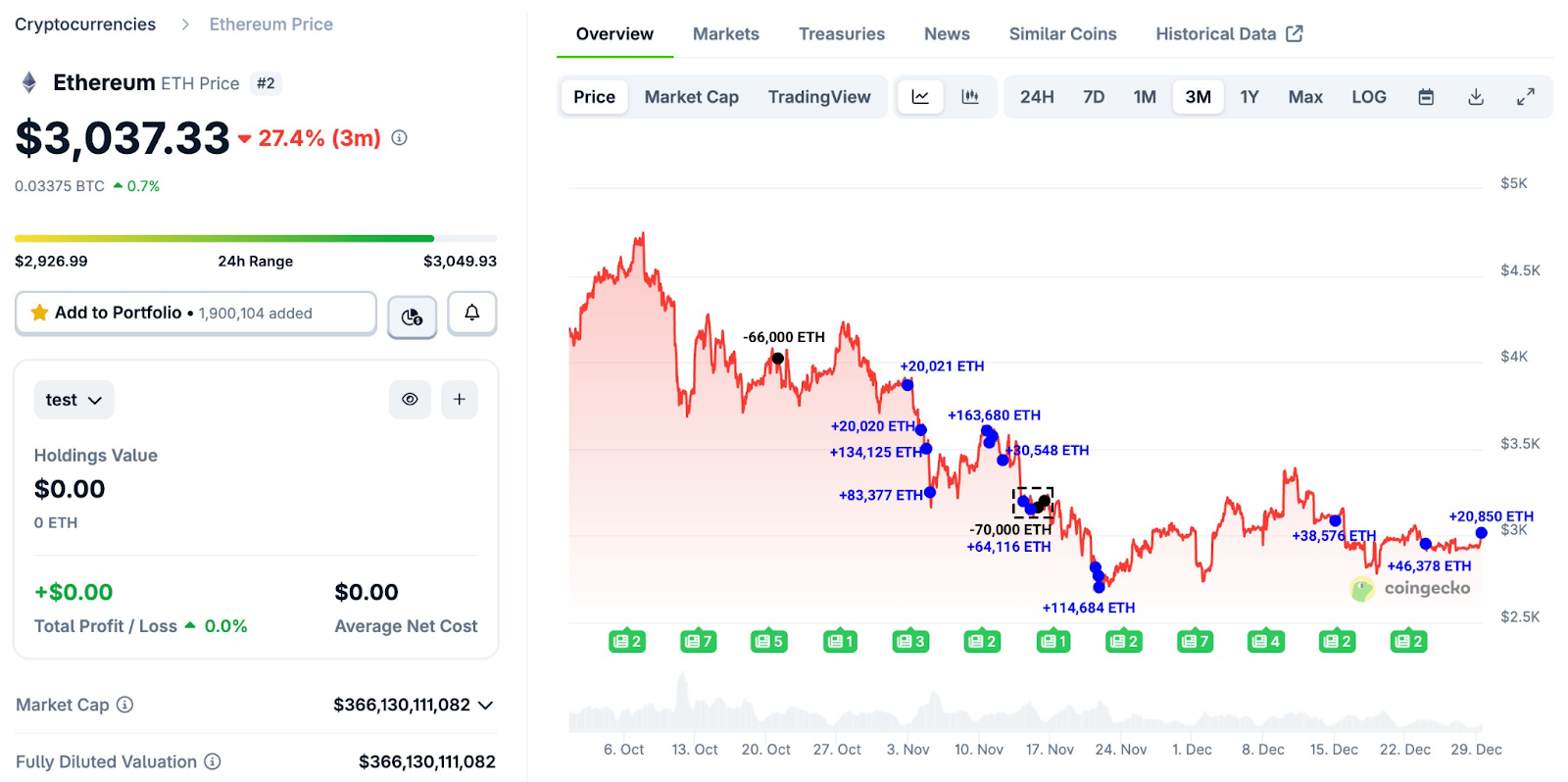

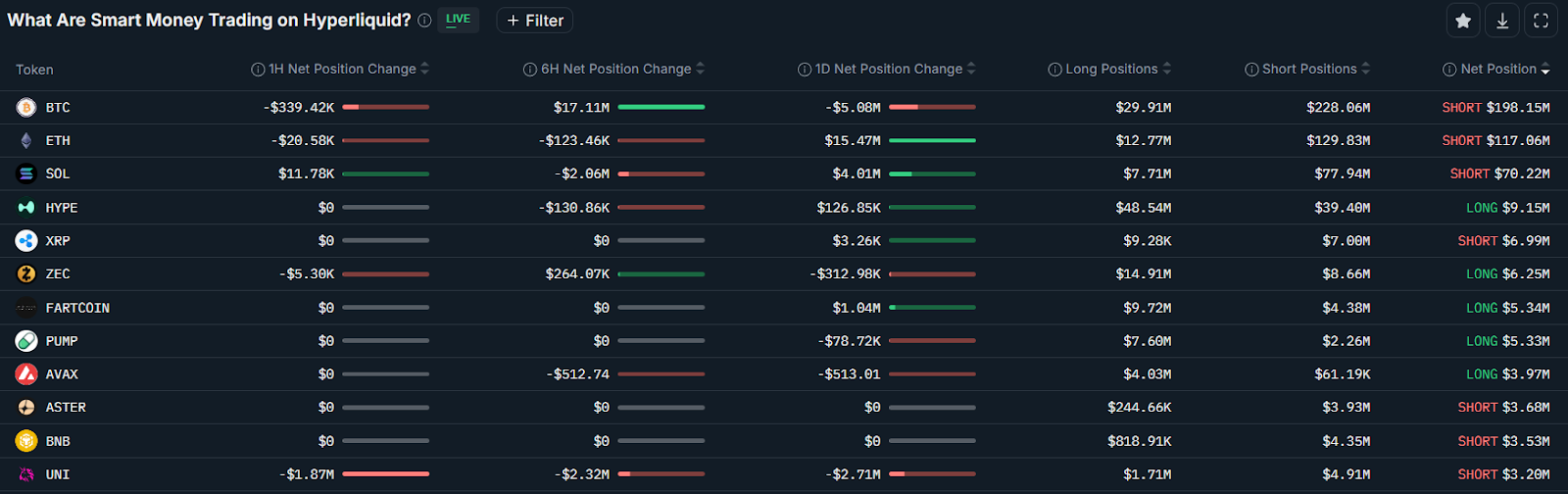

In the meantime, the trade’s most worthwhile merchants, tracked as “sensible cash” merchants on Nansen’s blockchain intelligence platform, additionally continued to guess on a short-term worth decline for Ether.

Sensible cash merchants maintain high perpetual futures positions in Hyperliquid. Supply: Nansen

Sensible cash had a cumulative web brief place of $117 million in Ether, in accordance with Nansen knowledge, however added $15 million value of lengthy positions up to now 24 hours, indicating a slight restoration in threat urge for food amongst this key section.

journal: Sharplink executives shocked by BTC and ETH ETF holdings — Joseph Chalom