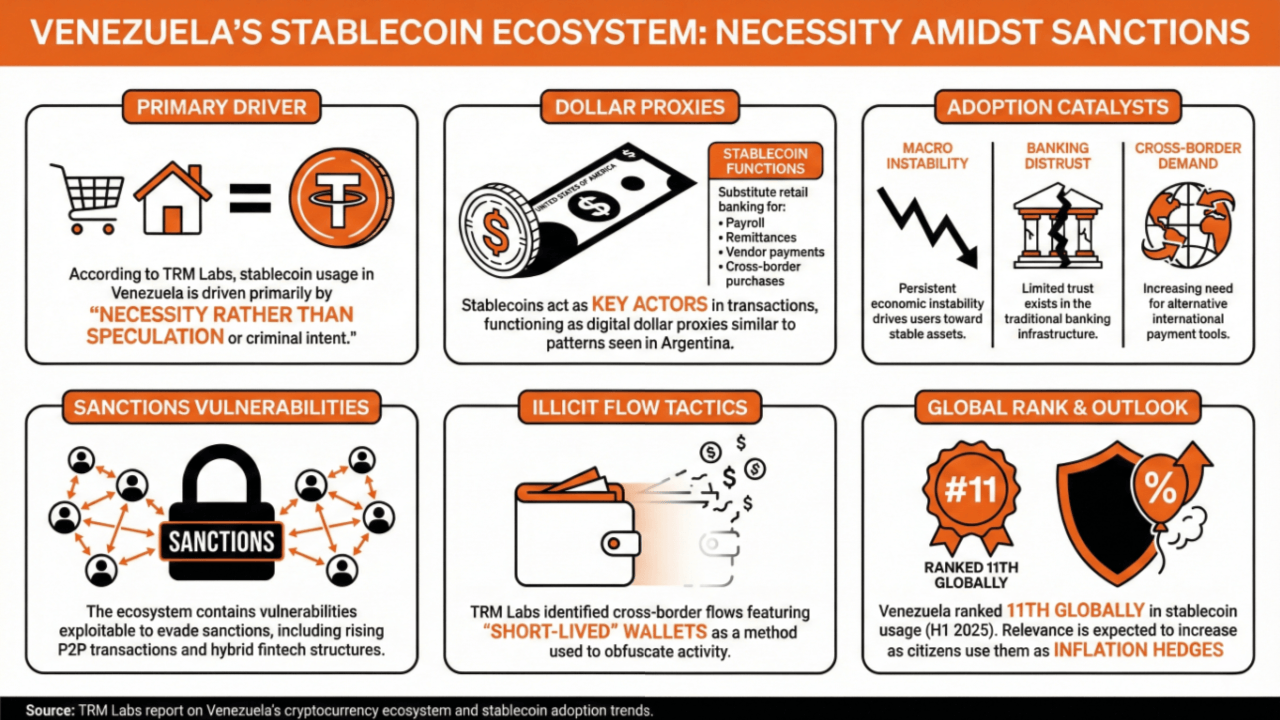

In a current report, TRM Labs argued that natural adoption is dominating buying and selling volumes, as stablecoins have develop into a key driver for Venezuelans to beat financial instability and exclusion from conventional world cost and settlement platforms, even in an ecosystem with structural dangers.

TRM Institute: Venezuela’s natural cryptocurrency adoption outweighs unlawful actions

TRM Labs, a world blockchain forensics and evaluation firm, mentioned the present state of Venezuela’s cryptocurrency ecosystem within the context of tightening sanctions.

In a current article, the corporate acknowledged that regardless of renewed world compliance issues, the usage of stablecoins stays primarily pushed by “necessity slightly than hypothesis or legal intent.”

The TRM Institute discovered that the adoption of stablecoins in Venezuela follows an identical sample to that noticed in international locations resembling Argentina, the place they play an essential function in each family and industrial transactions as brokers for the greenback.

For the corporate, three components are driving stablecoin adoption within the present Venezuelan financial local weather: continued macroeconomic instability, restricted belief in conventional banking infrastructure, and rising demand for different cross-border cost instruments.

TRM Institute says:

Stablecoins at present function a substitute for retail banking, facilitating payroll, household remittances, vendor funds, and cross-border purchases even within the absence of constant home monetary companies.

Nonetheless, TRM Labs additionally recognized a number of vulnerabilities inside the Venezuelan ecosystem that could possibly be exploited to avoid unilateral sanctions. These embody the rising recognition of P2P (peer-to-peer) transactions, the usage of hybrid fintech constructions that mix banking companies with blockchain wallets, and the existence of cross-border flows that includes “short-lived” wallets.

The TRM Institute’s report comes within the wake of the US authorities’s current seizure of a tanker carrying Venezuelan oil, an act deemed “piracy” by Venezuelan authorities.

Earlier reviews have linked the sale of Venezuelan oil to 3rd events to stablecoin transactions, however no official assertion has been made and the corporate has neither confirmed nor denied these allegations.

Lastly, TRM Labs concludes that if nothing modifications, the relevance of stablecoins in Venezuela is anticipated to proceed to develop as most of the people continues to depend on these instruments as a hedge in opposition to inflation and foreign money devaluation.

The corporate’s proprietary Stablecoin Cryptocurrency Adoption Report ranked Venezuela because the eleventh nation with the best stablecoin utilization within the first half of 2025.

learn extra: The Economist: Using USDT to settle Venezuelan oil gross sales

FAQ

What insights has TRM Labs not too long ago offered concerning the usage of cryptocurrencies in Venezuela?

TRM Labs emphasised that the usage of stablecoins in Venezuela is especially pushed by the necessity because of tightening sanctions and financial instability.What patterns have you ever noticed in stablecoin adoption?

The adoption of stablecoins in Venezuela mirrors traits in Argentina, the place they function a proxy for the greenback in each family and industrial transactions.What components are driving the usage of stablecoins in Venezuela?

There are three predominant components: macroeconomic instabilitylack of belief in conventional banking, and rising demand for different cross-border cost strategies.What traits do you foresee for Venezuelan stablecoins sooner or later?

TRM Labs expects stablecoins to develop into more and more essential as Venezuelans proceed to depend on these digital property to guard in opposition to inflation and foreign money devaluation.