Bitcoin (BTC) mining firm backed by family members of US President Donald Trump, US Bitcoin exercised the choice to buy as much as 17,280 application-specific built-in circuits (ASICs) from Bitmain earlier this month.

The mining firm bought a fleet of 16,299 Antminer U3S21ECTPH items from Bitmain, with a computing energy (Eh/s) of 14.02 exahash (Eh/s) per 14.02 exahash (Eh/s) from Bitmain, in line with Theminermag.

The transaction additionally dominated out potential value will increase from the Trump administration’s swept commerce duties and import duties affecting bitmain mining {hardware} manufactured in China.

In response to tariff stress, Bitmain introduced that it’s going to open its first ASIC manufacturing facility in the US by the top of the yr. The corporate can even open its headquarters in both Florida or Texas.

Commerce tariffs and different macroeconomic pressures have put a pressure on all ranges of the Bitcoin mining provide chain as miners and {hardware} producers equally regulate their financial accounts in response to the altering monetary atmosphere.

Associated: Jack Dorsey’s Block targets the 10-year life cycle of Bitcoin mining rigs

Mining responds to commerce tariffs and financial uncertainty

The tariffs spurred main mining {hardware} producers and thought of transferring a few of their operations to the US at the least to keep away from import taxes on merchandise.

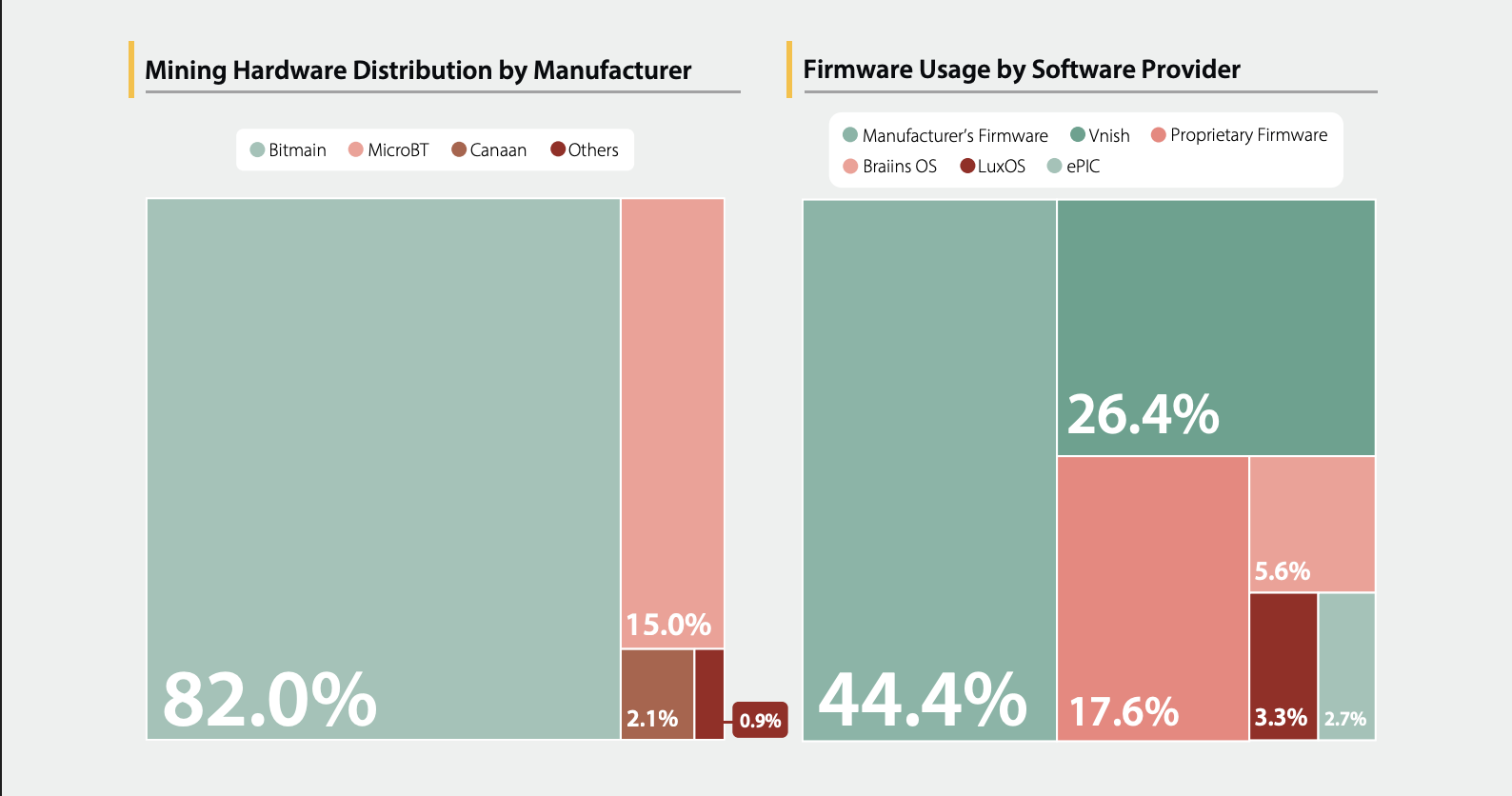

Over 99% of all Bitcoin mining {hardware} are produced by three producers. Microbt;In accordance with a research revealed by the College of Cambridge, Canaan.

Bitmain is the world’s largest mining {hardware} producer, accounting for round 82% of its complete market share.

Mining {hardware} market share is split into three massive producers. sauce: Cambridge College

The Trump administration’s technique of utilizing commerce tariffs to carry manufacturing again to the US is stuffed with blended reactions.

Critics say that coverage is inflation in the long run and will backfire. Jaran Mellerud, CEO of BTC Mining Firm Hashlabs, stated value will increase from tariffs may result in a collapse in demand from US miners.

ASIC producers can have inventory with out demand and export it to different international locations at a less expensive value, Mellerud stated.

This is able to put US miners at a aggressive drawback, opposite to the Trump administration’s objective of selling mining in different international locations and repurposing the US crypto trade.

journal: We threat being “entrance run” in Bitcoin reserves by different international locations: Samson Mo