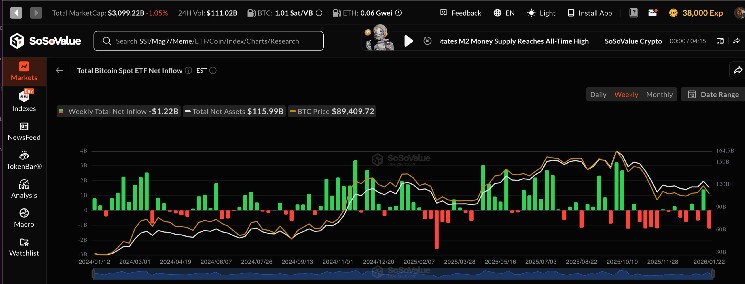

usa bitcoin BTC$89,477.17 Alternate-traded funds (ETFs) posted their greatest weekly outflows since November in an indication that the largest cryptocurrency could also be about to rebound.

A web $1.22 billion exited the market within the 4 days ending Thursday, with Tuesday and Wednesday seeing withdrawals of $479.7 million and $708.7 million, respectively, based on SoSoValue knowledge. Bitcoin fell 5% throughout the identical interval and is presently little modified for the reason that starting of the 12 months.

Intervals of mass ETF outflows typically coincide with native bottoms within the Bitcoin worth. In November, there have been $1.22 billion in withdrawals in 4 days, and Bitcoin hit a low of about $80,000, however recovered to over $90,000 within the subsequent few days.

The same sample appeared in March 2025, simply earlier than President Trump’s tariff scandal, when Bitcoin fell to $76,000. In August 2024, Bitcoin bottomed out at round $49,000 as a result of unwinding of the yen carry commerce.

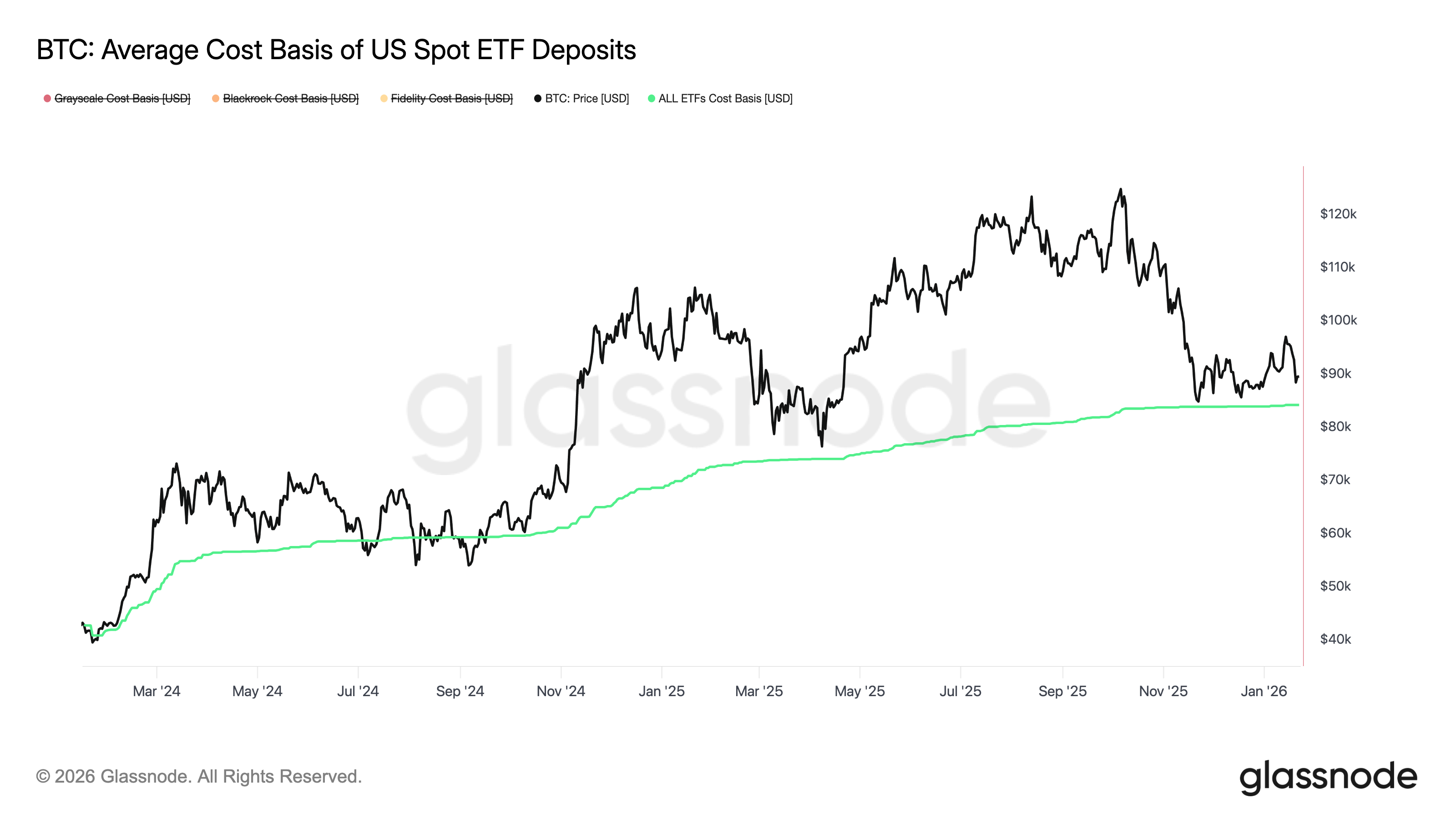

The common value foundation for ETF buyers is presently $84,099. Based on Glassnode knowledge, this degree served as a key assist space, particularly through the pullback round $80,000 in November and in April 2025.

Common cost-based ETF (Glassnode)