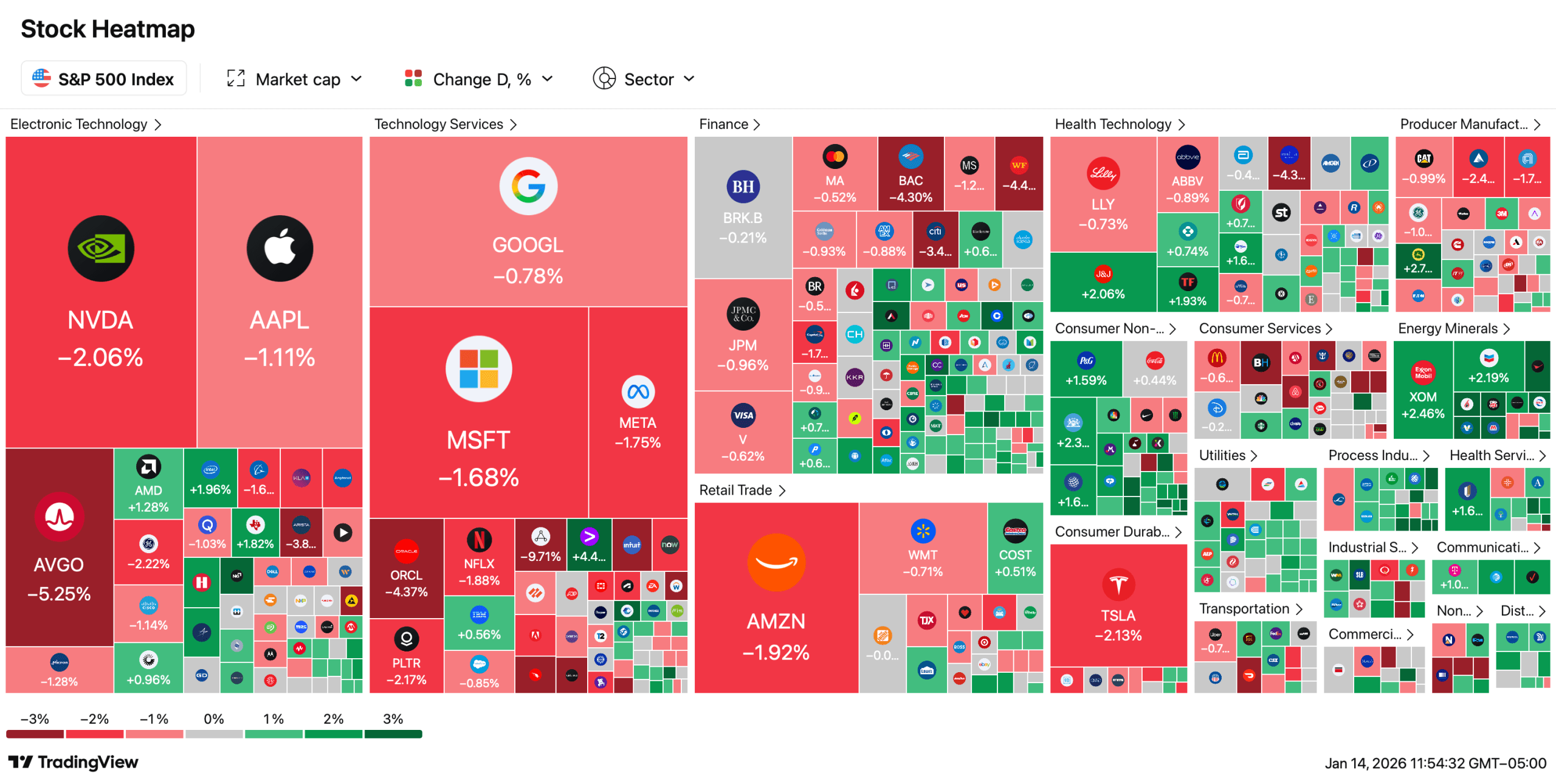

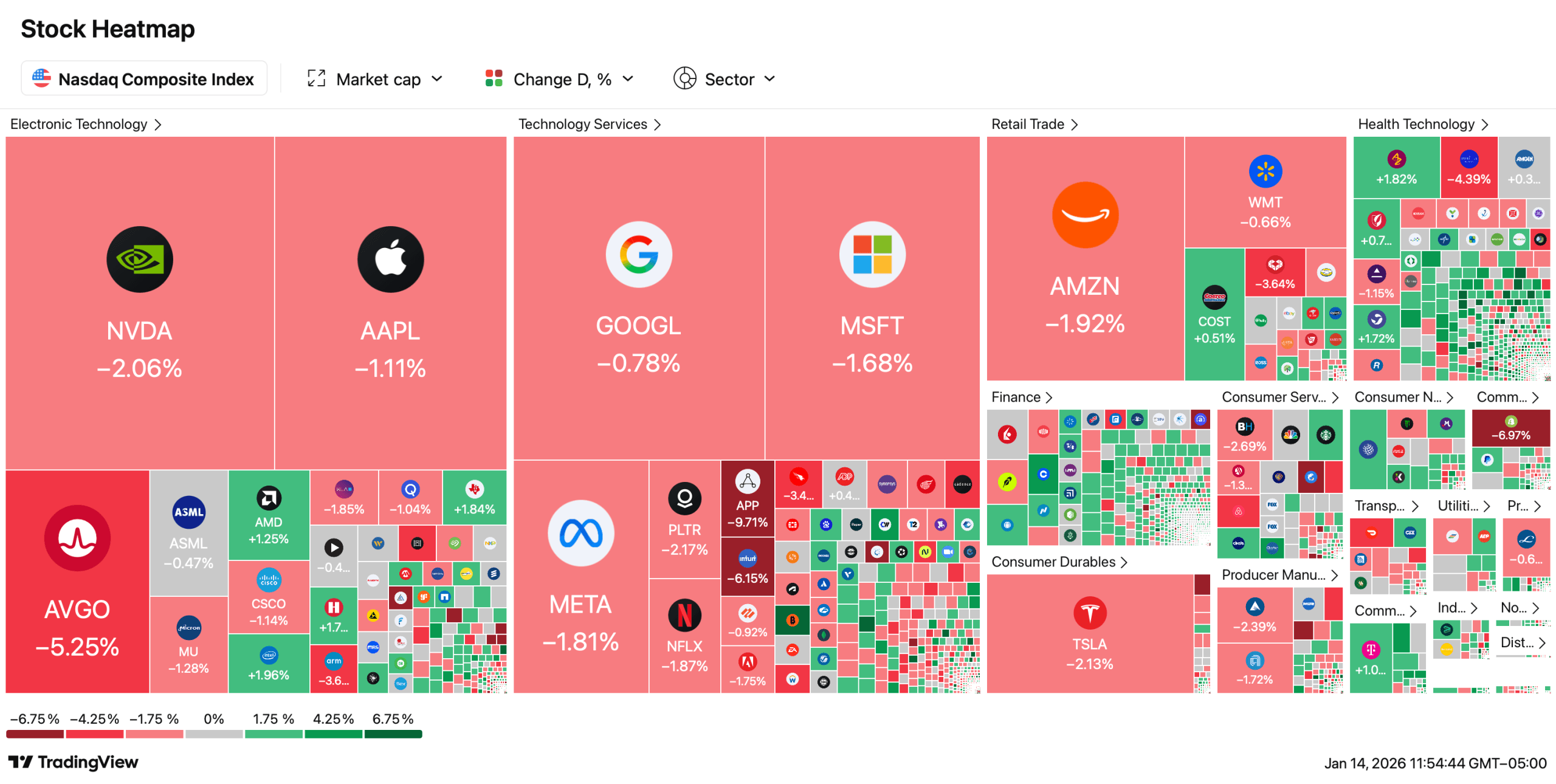

Following Tuesday’s pullback, U.S. shares had been all down on Wednesday, with purple ink splattered throughout all main indexes. The inventory market hasn’t stored up with valuable metals — gold and silver are nonetheless falling — whereas the crypto financial system has elevated by 3.66% prior to now day to $3.29 trillion.

Purple ink on inventory market as digital forex market and valuable metals shine

The inventory market was out of step with the rhythm of the cryptocurrency market and valuable metals, and the Nasdaq Composite Index set the tone, plunging 344.05 factors in morning buying and selling.

The Dow Jones Industrial Common fell 224 factors. The S&P 500 Index fell 63 factors, and the New York Inventory Alternate Composite Index fell 15.39 factors, ending the morning session dyed head-to-toe in purple. All 4 automobiles started to indicate indicators of life because the afternoon progressed, and the New York Inventory Alternate was again within the inexperienced by 11:50 a.m. ET. The inventory market droop comes as markets attempt to value within the ongoing battle between the Trump administration and the US Federal Reserve.

After Chairman Jerome Powell’s video message, President Trump ramped up the strain, declaring that “the assholes might be gone quickly.” The earnings of Financial institution of America and Wells Fargo are additionally within the highlight. Financial institution of America launched its fourth-quarter 2025 outcomes on Wednesday, delivering a combined however principally upbeat report that in the end didn’t impress traders.

Wells Fargo additionally reported its fourth-quarter 2025 outcomes on the identical day, with extra risky outcomes displaying that regardless of indicators of restoration, challenges stay. The financial institution’s web earnings rose 6% yr over yr to $5.36 billion, with earnings per share of $1.62 ($1.76 adjusted for severance), beating the adjusted estimate of $1.66.

In the meantime, gold and silver are at lifetime highs, and analysts anticipate demand for the valuable metals to proceed. Digital belongings additionally rose on Wednesday, with the sector gaining 3.66% towards the greenback. Bitcoin has risen 4% towards the US greenback and is at the moment buying and selling above the $97,000 degree. Actual property was additionally among the many winners, because the Nationwide Affiliation of Realtors introduced that present house gross sales within the U.S. elevated by greater than 5%.

Wednesday depicts a split-screen state of affairs acquainted to traders. Whereas equities wrestle with coverage tensions and uneven returns, capital continues to movement into harder belongings. Shares had been making an attempt a modest afternoon rebound, however the general temper instructed extra hesitation than conviction, as merchants weighed political strain, central financial institution messages and struggling company earnings.

Additionally learn: Bitcoin ETF surges with $754 million inflows as crypto ETFs report huge positive factors

Outdoors of shares, the tone was far more assured. Treasured metals proceed to interrupt information, digital belongings proceed to increase their advances, and housing information has added new energy to the combination. This divergence has led to markets with rotating winners relatively than built-in buying and selling, with cash clearly favoring belongings which are perceived to be extra secure or just extra thrilling than equities for the time being.

Regularly requested questions ❓

- Why had been U.S. shares down right now? Markets retreated as traders weighed combined financial institution earnings in addition to political tensions between the Trump administration and the US Federal Reserve.

- Why is the crypto sector rising whereas inventory costs are falling? The digital asset rose as merchants shifted to cryptocurrencies, pushing the sector general greater than 3% on the day.

- What’s driving gold and silver to all-time highs? Demand for valuable metals continues to be sturdy as traders search for options to shares.

- What does the most recent housing information present? Current house gross sales within the U.S. rose greater than 5%, based on the Nationwide Affiliation of Realtors.