The US-led commerce warfare has had a significant influence on Bitcoin mining, and the looming dispute with the Customs and Border Safety (CBP) might expose American firms to huge debt.

It is a key level from Miner Magazine’s newest Bitcoin mining replace, inspecting how mining firms are navigating the advanced tariff setting formed by ongoing US-China commerce tensions.

Because the White Home has modified tariff costs in a number of Asian international locations, it’s now reaching 57.6% for mining machines in China and Origin, and 21.6% for Indonesia, Malaysia and Thailand, in keeping with the report.

Miner Magazine additionally revealed that two publicly obtainable US mining firms, Iren and Cleanspark, have not too long ago acquired an bill from CBP for allegations that a few of their tools had occurred in China.

CleanSpark warned that potential debt might resist $185 million, however Iren challenged a $100 million dispute with the company.

Past tariffs, the report mentioned mining revenues are “beneath strain,” with the community’s hash worth falling under $60, with two-second peta hash and buying and selling charges falling under 1% of block’s reward.

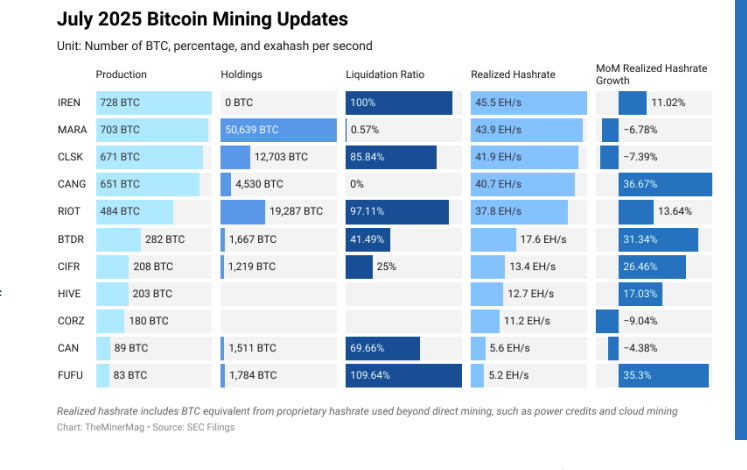

Iren and Mara Holdings every produced greater than 700 BTC in July. Supply: Minor journal

Amid the commerce warfare, American Bitcoin — supported by members of President Donald Trump’s household — exercised the choice to amass greater than 16,000 mining rigs from Chinese language producer Bitmain earlier this month. As reported by Cointelegraph, the contract excludes potential worth impacts from customs duties.

Associated: Jack Dorsey’s Block targets the 10-year life cycle of Bitcoin mining rigs

Bitcoin mining suppliers are additionally compelled to adapt

Bitcoin mining is going through fixed strain to adapt. They’re tackling rising prices, decrease margins and rising regulatory dangers. The continuing commerce warfare solely accelerated this development, and miners grew to become extra refined importers whereas diversifying their provide chains.

Some analysts counsel that US tariffs on mining tools might attenuate home demand for rigs and favor abroad operators. However the final influence will rely upon how US tariff coverage develops.

On the {hardware} entrance, Chinese language producers Bitmain, Canaan and Microbt have begun establishing amenities within the US to mitigate the influence of tariff escalation.

Canaan’s technique stands out. Not solely has the corporate moved its headquarters to Singapore, it additionally introduced US investments geared toward side-tipulating commerce limitations.

https://www.youtube.com/watch?v=xkvojawp688

journal: An invisible tug of warfare between a bitcoin swimsuit and cypherpunks