Decentralized finance big Uniswap has launched Steady Liquidation Auctions (CCA), a brand new protocol geared toward facilitating the providing of tokens via its infrastructure.

In line with Thursday’s announcement, Uniswap’s CCA will “assist the workforce bootstrap liquidity in Uniswap v4 and discover market costs for brand spanking new and illiquid tokens.” The corporate stated that is simply the “first of a number of instruments” it’s constructing to assist tasks launch and improve token liquidity on the platform.

This announcement coincides with preparation for the primary CCA-enabled gross sales. Privateness-focused Aztec Community launched a community-only AZTEC token sale on Thursday, with the general public section scheduled for December 2nd.

The Aztec workforce claimed that it had “gained entry to the neighborhood that made the 2017 ICO period nice and made it even higher.” The workforce reportedly labored with Uniswap to develop the brand new protocol, “prioritizing honest pre-launch entry to neighborhood members and most people, permissionless on-chain entry.” The workforce acknowledged that after the token is unlocked, the AZTEC token might be 100% community-owned.

Uniswap and Aztec didn’t reply to requests for remark.

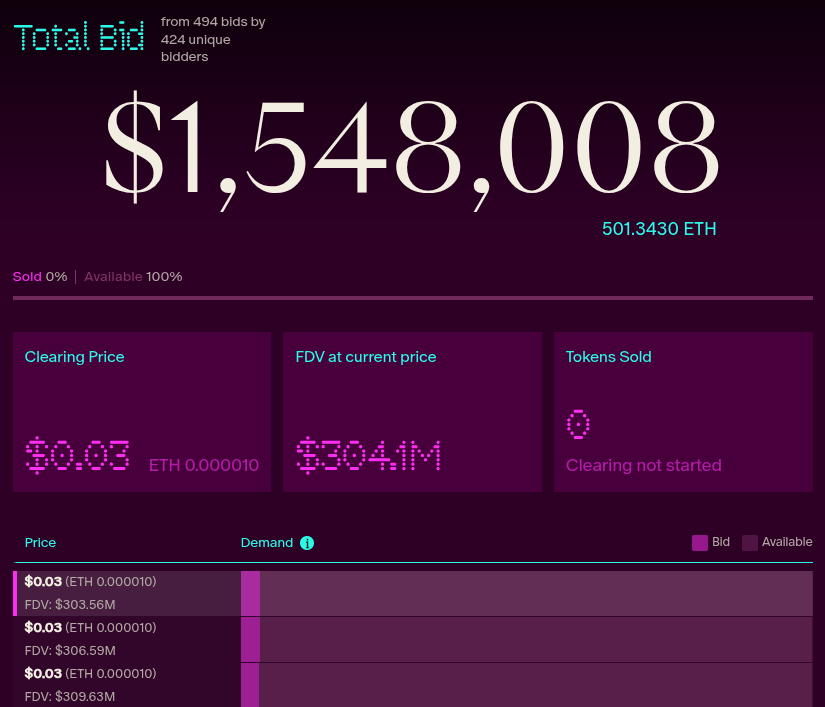

Aztec’s CCA-enabled token gross sales interface. Supply: Aztec

New token gross sales system

Uniswap stated in a press launch that “liquidity creation typically takes place behind closed doorways”, resulting in “digital divides, the privilege of some gamers” and generally “skinny and unstable” markets. By leveraging CCA, each companions hope to create an on-chain native market with clear pricing, bidding, and settlement, in addition to implement tiered value discovery and automated liquidity seeding to Uniswap’s decentralized trade (DEX).

“There are not any gatekeepers or off-chain transactions,” Uniswap stated.

Associated: DeFi gamers launch alliance to defend Ethereum to policymakers

The sale of CCA begins with the mission defining the variety of tokens to be bought, the beginning value, and the period of the public sale. It could actually additionally assist cut up execution, validation instruments similar to ZK Passport (a privacy-enhanced, zero-knowledge proof-based Know Your Buyer implementation), or utterly customized modules.

Customers can bid by specifying a most value and complete quantity spent. Bids can’t be canceled inside the vary, however there is no such thing as a restrict to the variety of bids. Every bid is robotically distributed throughout the remaining blocks within the public sale and is crammed provided that the block’s liquidation value is lower than or equal to the restrict value.

Associated: DeFi turns into the default monetary interface

CCA value discovery mechanism

On the finish of every block, the protocol units a most value for the tokens bought in that block. The upper bid fills first, then the best bid. Everybody who fills a block pays the identical value.

Uniswap defined that the liquidation value may stay the identical or improve as extra bids cut up up the mounted provide per block. Early bidders are anticipated to get higher offers as a result of “a big portion of their bids could also be crammed with early, cheaper blocks.”

The decentralized finance (DeFi) firm introduced that its CCA sensible contract has been printed and is now out there for anybody to make use of. Within the coming months, Uniswap can even launch extra modules for the brand new token gross sales system.

The report comes days after Uniswap (UNI) tokens rose greater than 38% following a proposal by the Uniswap Basis and Uniswap Labs to allow a protocol-level payment mechanism to burn Uniswap (UNI) tokens. The workforce additionally introduced plans to burn 100 million UNI from the nationwide treasury, equal to about 16% of UNI’s circulating provide.

journal: 2026 is the 12 months of sensible privateness in crypto: Canton, Zcash and extra