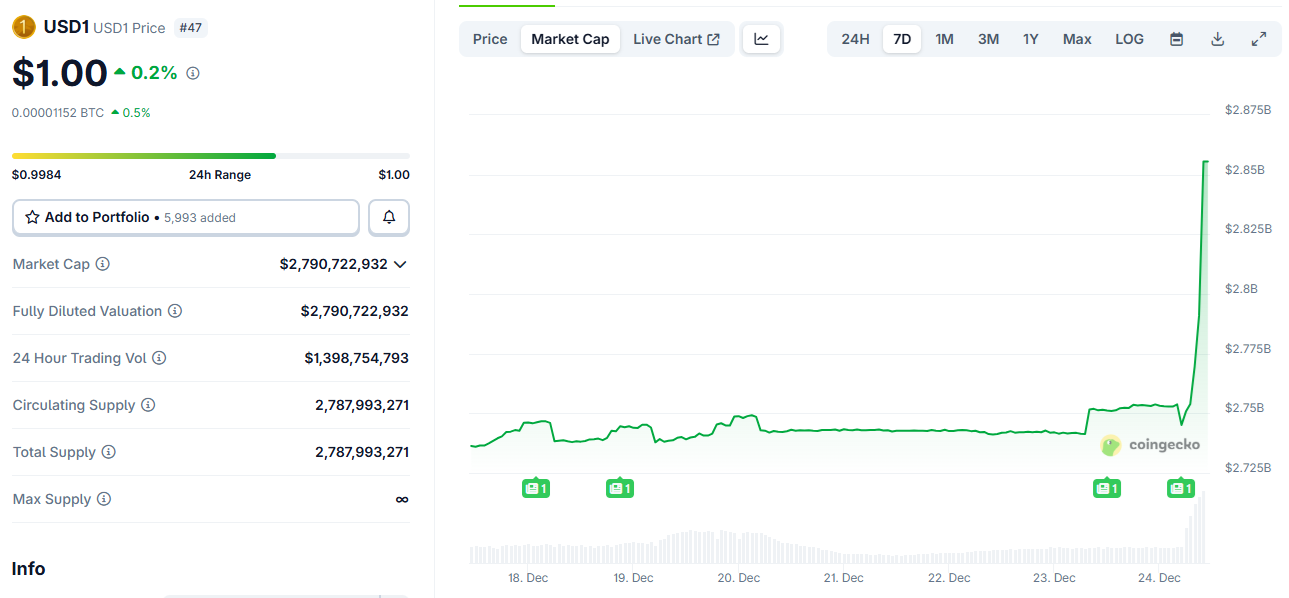

USD1 elevated its provide by over 45 million tokens, increasing to 2.79 billion tokens. The stablecoin joins the Binance ecosystem with a 20% yield product.

USD1 has expanded its provide over the previous day, shortly after including one other yield product to the Binance ecosystem. New provide entered the market simply as USD1 was added to the Binance Booster program.

This system is proscribed to deposits of fifty,000 USD1 and presents a 20% annualized yield. This yield is a part of Binance’s common incomes program, with a particular addition of USD1.

The stablecoin issued by World Liberty Fi has a restricted subscription interval from December twenty fourth to January twenty third, 2026.

USD1 is represented on Binance by the USD1/USDT pair. Moreover, Binance proposed that customers can purchase tokens by the P2P Specific market. Present holders can deposit USD1 into their Binance account.

Will USD1 increase its affect?

A lot of the USD1 provide is already lively on the BNB chain, pushing the entire float even greater. $2.85 billion. This token has been added to a number of DeFi protocols, however has a considerably decrease APY.

The stablecoin is already lively and may earn income by PancakeSwap, Uniswap, and Venus Protocol. Nevertheless, its addition to Binance’s official yield program will additional enhance the token’s publicity.

Instantly after the minting of the brand new token, the buying and selling quantity of USD1 additionally elevated to a one-month peak. The brand new injected provide coincided with sudden investor curiosity, pushing every day quantity to $1.39 billion.

Because of a surge in buying and selling exercise, USD1 has expanded its provide by over 45 million tokens. Instantly after saying the 20% yield product, over $150 million in purchase orders had been positioned on the Binance USD1/USDT pair. |Supply: CoinGecko.

For the USD1/USDT pair on Binance, $150 million Buy quantity elevated after the announcement. This centralized change additionally holds the biggest share of USD 1 spot buying and selling. Elevated buying and selling curiosity will be seen as a sign of demand for protected yields.

Excessive-yield stablecoins have gotten one of many staples of the cryptocurrency market. Massive buyers and establishments are abandoning most different dangerous narratives and opting as a substitute for essentially the most liquid ecosystems.

Can WLFI be revived?

The rising affect of USD1 has sparked debate in regards to the eventual progress of the World Liberty Fi venture. The platform plans to launch an app in early 2026, which might result in a resurgence of the WLFI token.

Previous to the launch of the newest yield product, USD1 was extensively utilized in meme token pairs within the Binance ecosystem. For a short while, these pairs had been one of the lively meme token hubs. The extremely erratic conduct of the meme led to consumer abandonment. Now, 1 USD is utilized in a extra predictable manner, with the potential to generate income in a consumer’s account on daily basis.

As of December twenty fourth, the WLFI token is buying and selling above $0.13, up from final week’s native low of $0.12. WLFI isn’t contributing to the ecosystem and didn’t rise even after World Liberty Fi added buybacks.