In keeping with Eva Oberholzer, chief funding officer at VC agency Ajna Capital, enterprise capital (VC) corporations are making crypto tasks extra selective and representing a shift from earlier cycles attributable to market maturation.

“It is tough as a result of we have reached one other stage of cryptography, similar to each cycle we have seen with different applied sciences previously,” Oberholzer advised Cointelegraph.

She added that market maturity slows pre-seed investments as VCS focuses consideration on established tasks utilizing a transparent enterprise mannequin. Oberholzer stated:

“It is about predictable income fashions, institutional dependence, irreversible adoption. So what we’re now could be that crypto isn’t pushed by the mimecoin frenzy or different traits, however that is about institutional adoption.”

The change in VC exercise focuses on the digital asset enterprise that generates wider traits in institutional crypto funding and income, versus worth hypothesis that inspired funding in the course of the earlier crypto cycle, together with the 2021 bull market.

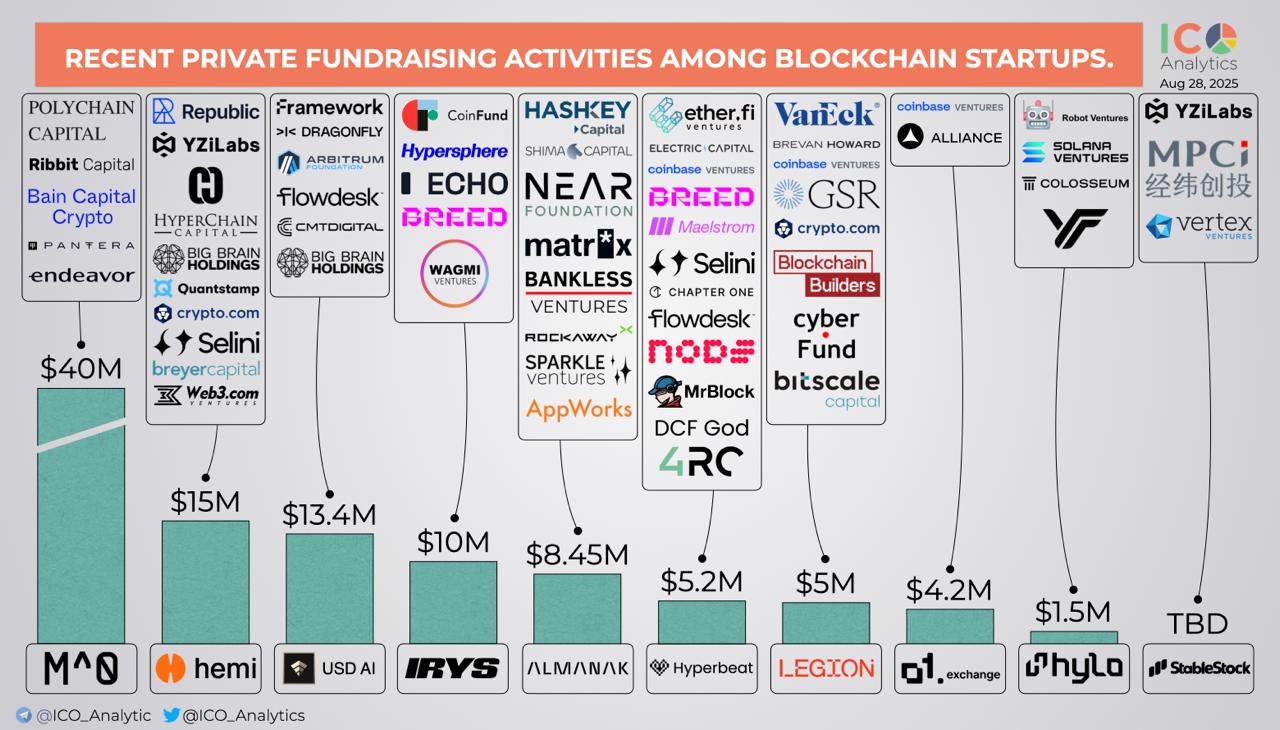

This week, a personal donation settlement between blockchain startups. sauce: ICO evaluation

Associated: VC Roundup: Bitcoin obstacles skyrocket, however tokenization and stablecoins get steam

The normal monetary world calls for crypto companies that generate yields and revenues

Conventional monetary traders, together with Wall Avenue corporations, enterprise capitalists and institutional funds, are demanding crypto tasks that present a longtime and predictable income stream.

VC corporations are specializing in Stablecoin tasks and investing in different types of cost infrastructure that may generate charges, Oberholzer stated.

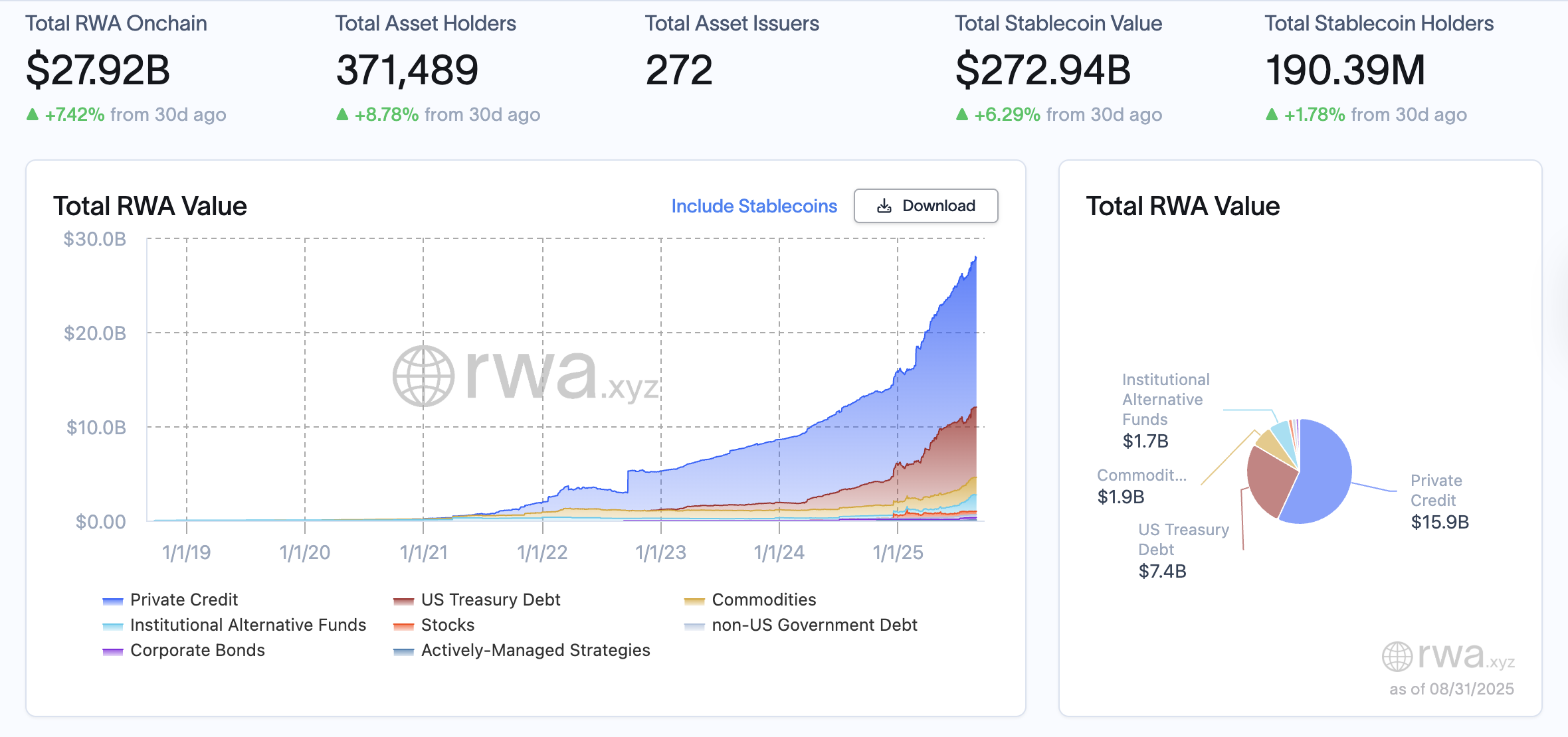

The Actual World Asset Tokenization (RWA) platform can be featured on the VC firm’s radar attributable to its income mannequin associated to the minting and administration of tokenized RWAS Onchain.

The tokenized RWA market continues to develop. sauce: rwa.xyz

Matt Hougan, chief funding officer at funding agency Bitwise, not too long ago advised Cointelegraph that the hunt for yields is driving Wall Avenue investments in Ether (ETH).

“In the event you obtain a billion {dollars} of ETH, put it in your organization and immediately you guess on it, you make a revenue. And traders are used to being an organization that basically generates income,” says Hougan.

The Sensible Contract Layer-1 Blockchain hosts the vast majority of Stablecoin, RWA markets and Decentralized Monetary (DEFI) actions that generate steady revenues by way of proprietor charges and different types of monetary hire.

journal: Tradfi is constructing Ethereum L2 to tokenize trillions in rwas: Inside Story