Ethereum co-founder Vitalik Buterin is selling a brand new mechanism to mitigate sudden spikes in transaction prices on the community.

His newest proposal outlines a trustless, on-chain prediction market designed to assist customers safe future gasoline costs and management relatively than react to fluctuations.

Buterin helps Ethereum gasoline worth market

On December sixth, Buterin argued that Ethereum wants market-based alerts to foretell future demand for block house.

This construction would alternate publicity to the community’s base charge by permitting contributors to purchase and promote gasoline commitments related to future slots.

The purpose, he stated, is to present builders and heavy customers a option to lock in prices and plan even when spot gasoline costs stay low.

The proposal comes at an uncommon time, with gasoline costs close to multi-year lows.

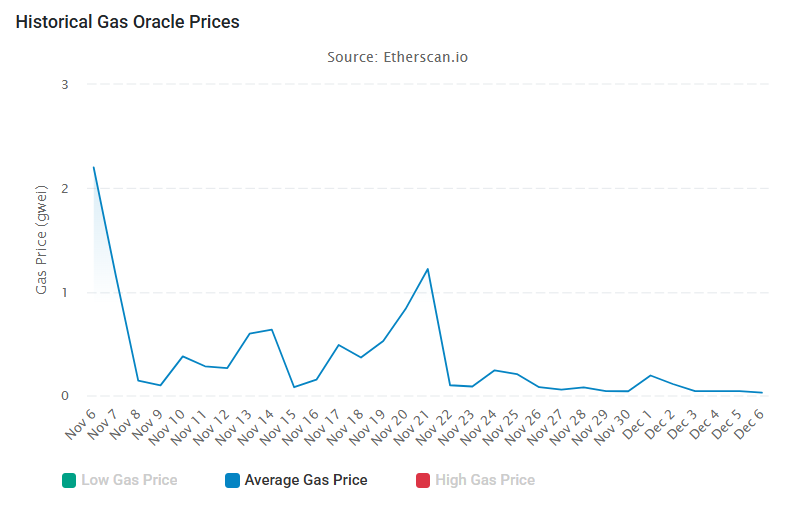

In response to EtherScan information, the typical gasoline worth for Ethereum is about 0.468 Gwei, or about 3 cents. It’s because a lot of the community’s retail exercise is shifting to cheaper layer 2 networks comparable to Base and Arbitrum.

Common Ethereum gasoline worth over the previous 30 days. Supply: Etherscan

However Buterin argues that the present calm breeds complacency.

He emphasizes that the on-chain futures curve will present a transparent sign of long-term market expectations. This enables customers to prepay for block house and lock in prices no matter future spikes.

“Folks will have the ability to clearly see what their expectations are for future gasoline costs, and they’ll additionally have the ability to hedge future gasoline costs, successfully pre-paying for a certain amount of gasoline for a selected time period,” he stated.

Trade specialists weigh in

Supporters think about this proposal an undervalued pillar of Ethereum’s long-term design. They argue that the trustless gasoline futures market will fill a structural hole relatively than introducing a brand new DeFi novelty.

Of their view, the BASEFEE market will present clear pricing and alignment of expectations, offering the ecosystem with a typical reference level for future community circumstances.

A fluid marketplace for gasoline publicity may subsequently change this dynamic by permitting builders to buy gasoline insurance coverage to restrict working prices earlier than a big occasion. Heavy customers may offset future worth will increase by taking a reverse market place.

“If Ethereum is turning into the fee layer for all the things, then gasoline itself turns into a monetary asset. So a trustless gasoline futures market will not be a nice-to-have. “It seems like a pure evolution for a series aiming to collaborate globally,” the analyst stated.

However, one in all Titan Builder’s trade advisors identified that it might be troublesome to function this as a traditional derivatives market, as validators may generate empty blocks and manipulate the outcomes.

He added {that a} block house supply futures market with a liquid secondary venue stays viable. Such a construction could also be ample to help public worth discovery and hedging.

The publish Vitalik Buterin pushes ahead with Ethereum gasoline futures concept appeared first on BeInCrypto.