For years, main banks have handled cryptocurrencies primarily as a containable threat. That angle is now being changed by a extra intentional type of engagement. Somewhat than debating the legitimacy of cryptocurrencies, banks are more and more deciding the place and how you can combine them into all the pieces from regulated funding merchandise to blockchain-based cost rails.

This shift is on full show on this week’s Crypto Biz. JPMorgan extends its USD deposit token to new blockchain infrastructure, signaling that tokenized money is nearing manufacturing use inside world banking.

In the meantime, Morgan Stanley is positioned to supply publicity to Bitcoin (BTC) and Solana (SOL) by exchange-traded funds (ETFs), doubtlessly bringing crypto investing to tens of millions of wealth administration shoppers.

Barclays is the primary to wager on stablecoin infrastructure by backing a funds rail designed to attach regulated issuers and monetary establishments.

And Financial institution of America has taken one other step towards normalcy by permitting advisors to suggest Spot Bitcoin ETFs to their shoppers.

Taken collectively, these developments recommend that the banking sector is not content material to take a seat on the sidelines.

JPM Coin joins Canton Community

JPMorgan has introduced plans to difficulty JPM Coin (JPMD), a USD-denominated deposit token, natively on the Canton Community, marking one other step for Wall Avenue in the direction of production-ready blockchain infrastructure.

Canton Community builders Digital Asset and JPMorgan’s Kinexys will prolong JPM Coin from current rails to Canton’s privacy-focused Layer 1 blockchain, enabling the motion of regulated digital money throughout interoperable networks.

In keeping with an announcement shared with Cointelegraph, JPM Coin is billed as the primary bank-issued institutional US dollar-denominated deposit token, represents a digital declare on JPMorgan’s greenback deposits, and is designed to facilitate sooner and safer motion of regulated funds on public blockchains.

“This partnership realizes our imaginative and prescient of regulated digital money that may transfer on the velocity of the market,” mentioned Yuval Ruth, co-founder and CEO of Digital Asset.

Morgan Stanley enters the crypto ETF race

US funding financial institution Morgan Stanley is coming into the crypto exchange-traded fund market with a product providing publicity to Bitcoin and Solana, following the robust debut of its spot crypto ETF within the US.

The financial institution has utilized to the U.S. Securities and Trade Fee to launch two funding automobiles, the Morgan Stanley Bitcoin Belief and the Morgan Stanley Solana Belief. These are designed to offer passive funding publicity to the efficiency of the underlying digital belongings.

If permitted, the funds could be obtainable to greater than 19 million shoppers inside Morgan Stanley’s wealth administration division, doubtlessly considerably increasing entry to crypto-related funding merchandise.

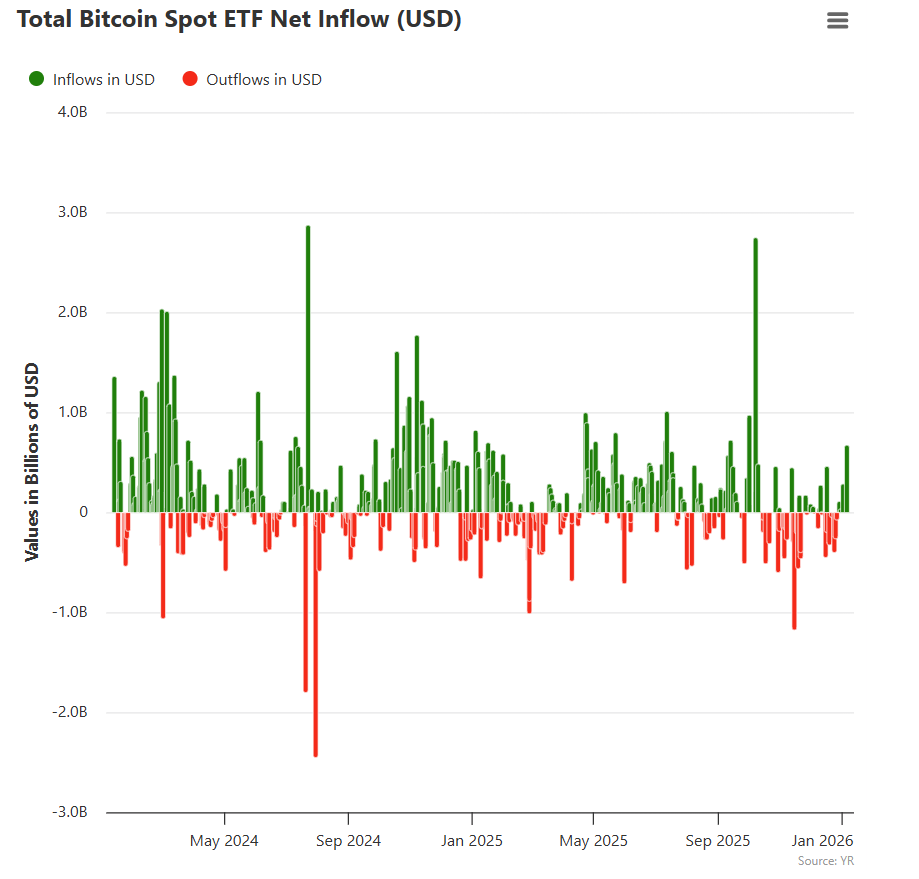

The Spot Bitcoin ETF ranks as one of the vital profitable ETF launches in historical past, with vital inflows in its first two years of buying and selling. The momentum continued into the brand new yr, with renewed investor demand and an inflow of latest cash through the first buying and selling session.

The 12 Spot US Bitcoin ETFs have collected over 1.3 million BTC, equal to roughly $120 billion in worth. sauce: Vitobo

Barclays invests in stablecoin infrastructure

London-based banking big Barclays has made its first funding in a stablecoin-focused firm, demonstrating conventional finance’s rising curiosity in digital greenback infrastructure.

The financial institution introduced an undisclosed funding in Ubyx, a US-based stablecoin clearing platform that connects regulated issuers and monetary establishments to facilitate funds and interoperability. The transfer can also be a notable change for Barclays, which has publicly highlighted the dangers related to digital belongings lately.

“This funding is in step with Barclays’ strategy to exploring alternatives based mostly on new types of digital cash, resembling stablecoins,” the financial institution mentioned in a press release.

Ubyx beforehand raised $10 million in seed funding with help from Galaxy and Coinbase. The corporate was based by former Citibank govt Tony McLaughlin.

Financial institution of America Wealth Advisors Are Permitted to Advocate Bitcoin ETFs

U.S. buyers may quickly obtain suggestions to purchase Bitcoin ETFs from Financial institution of America’s non-public financial institution and Merrill Edge platform, offering additional proof of Bitcoin’s growing integration into conventional finance.

The financial institution’s Chief Funding Workplace has permitted protection for 4 U.S. Spot Bitcoin ETFs, together with merchandise from Bitwise, Constancy, BlackRock, and Grayscale. Collectively, these funds handle greater than $100 billion in Bitcoin belongings.

The transfer comes a few month after Financial institution of America reportedly suggested its wealth administration shoppers to allocate 1% to 4% of their portfolios to digital belongings.

“For buyers with a robust curiosity in thematic innovation and luxury with elevated volatility, a modest 1% to 4% allocation to digital belongings could also be acceptable,” Chris Heisey, chief funding officer at Financial institution of America Personal Financial institution, advised Yahoo.

sauce: cointelegraph

Crypto Biz is your weekly tackle the enterprise behind blockchain and cryptocurrencies, delivered straight to your inbox each Thursday.