Current knowledge exhibits that income within the cryptocurrency business is more and more flowing to user-facing functions slightly than the underlying blockchain networks, indicating that the place traders and builders focus could shift.

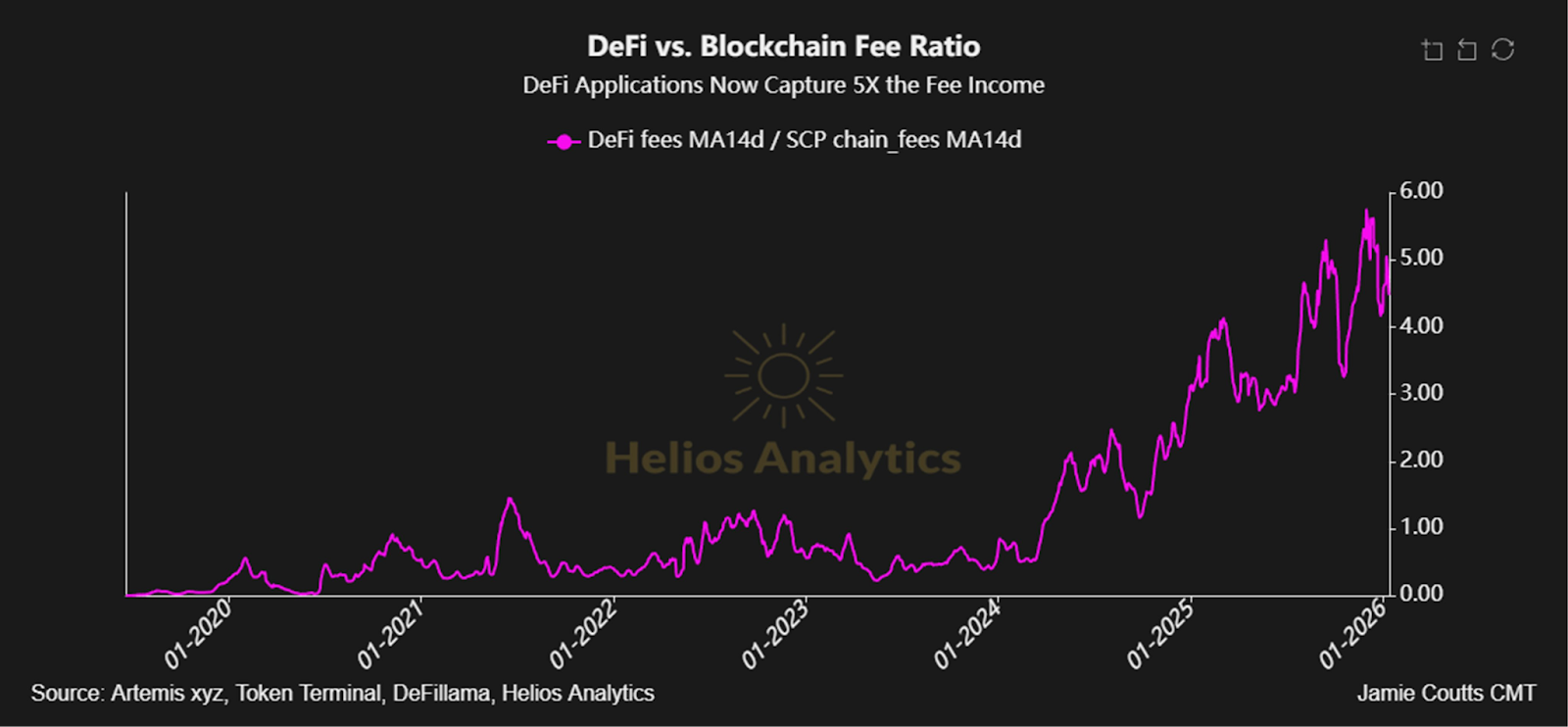

Decentralized finance (DeFi) functions at the moment acquire 5 occasions the charges generated by blockchain, in accordance with knowledge shared by Jamies Coutts, chief crypto analyst at crypto intelligence platform RealVision.

This development means that extra of the business’s charges can be captured by DeFi functions akin to wallets, decentralized exchanges (DEXs), and different protocols, whereas the underlying community will obtain a smaller share of income.

“I imagine that blockchain community results will all the time command a premium, nevertheless it stands to cause that extra worth will circulation to the entrance finish – the wallets, DeFi apps, and protocols closest to the consumer – than is at the moment thought,” Coutts wrote in a put up on X on Thursday.

Supply: Jamie coots

This graph exhibits that the payment share captured by DeFi protocols has elevated considerably from about the identical in mid-2024.

Associated: Quick squeeze hits prime 500 cryptocurrencies as merchants unwind bearish bets

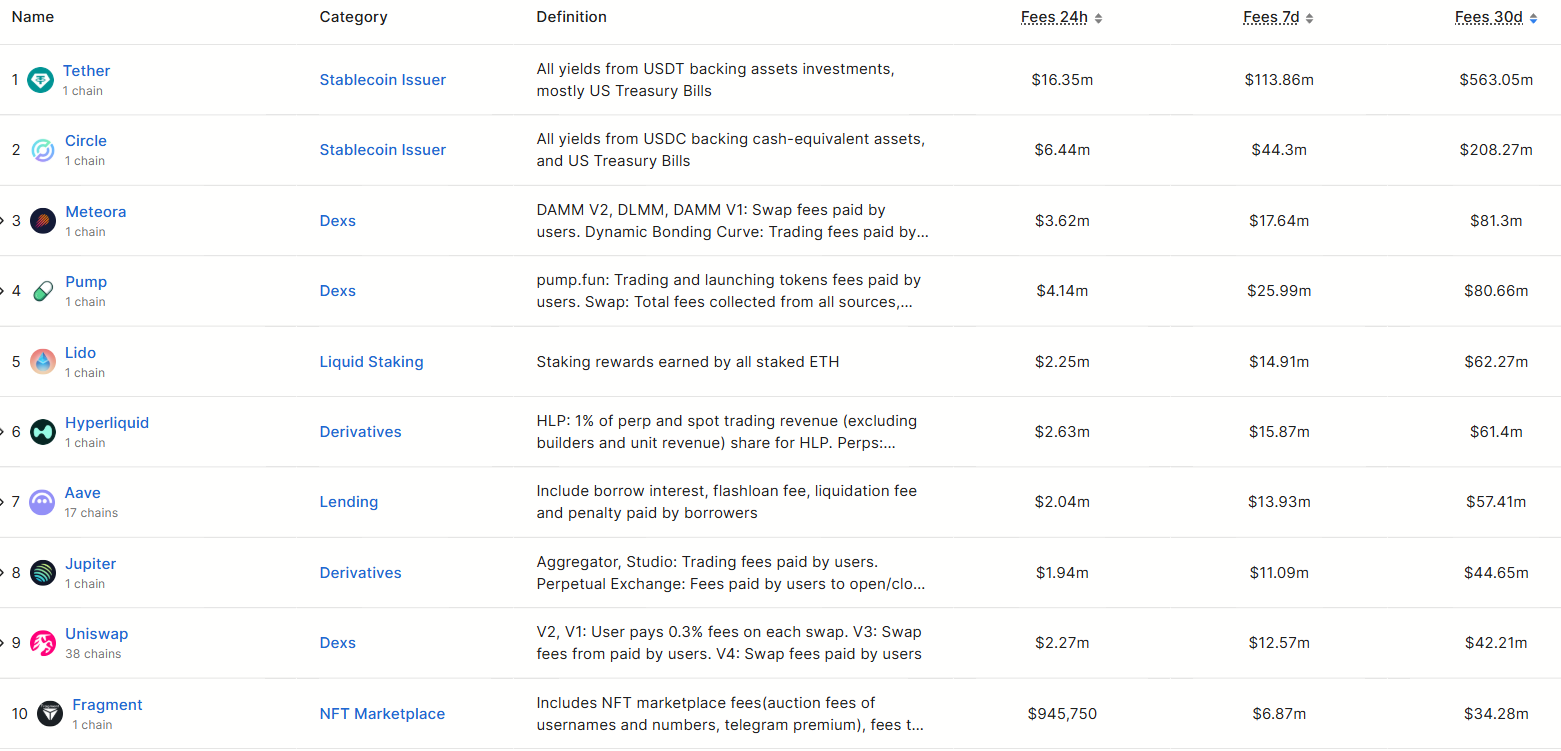

DeFi apps and protocols rank among the many prime 17 by income within the blockchain business

DeFi protocols at the moment dominate the rating of probably the most worthwhile cryptocurrency merchandise, in accordance with knowledge compiled by DeFiLlama. The highest 17 fee-generating entities previously 30 days have been functions or protocols, not base-layer blockchains.

Solana was the one blockchain within the prime 20 with over $20.4 million in charges over the previous 30 days. Nevertheless, this pales compared to the $563 million generated by stablecoin issuer Tether, the highest protocol by charges, in accordance with DeFiLlama.

Prime protocols and chains by charges incurred within the final 30 days. Supply: Defilama

The one different blockchain within the prime 30 was Ethereum, which ranked twenty seventh with $10.3 million generated.

This transfer means that builders and institutional traders could more and more deal with DeFi functions slightly than the underlying blockchain layer as functions account for an growing share of whole income.

Associated: BitMine to take a position $200 million in YouTuber MrBeast’s Beast Industrie

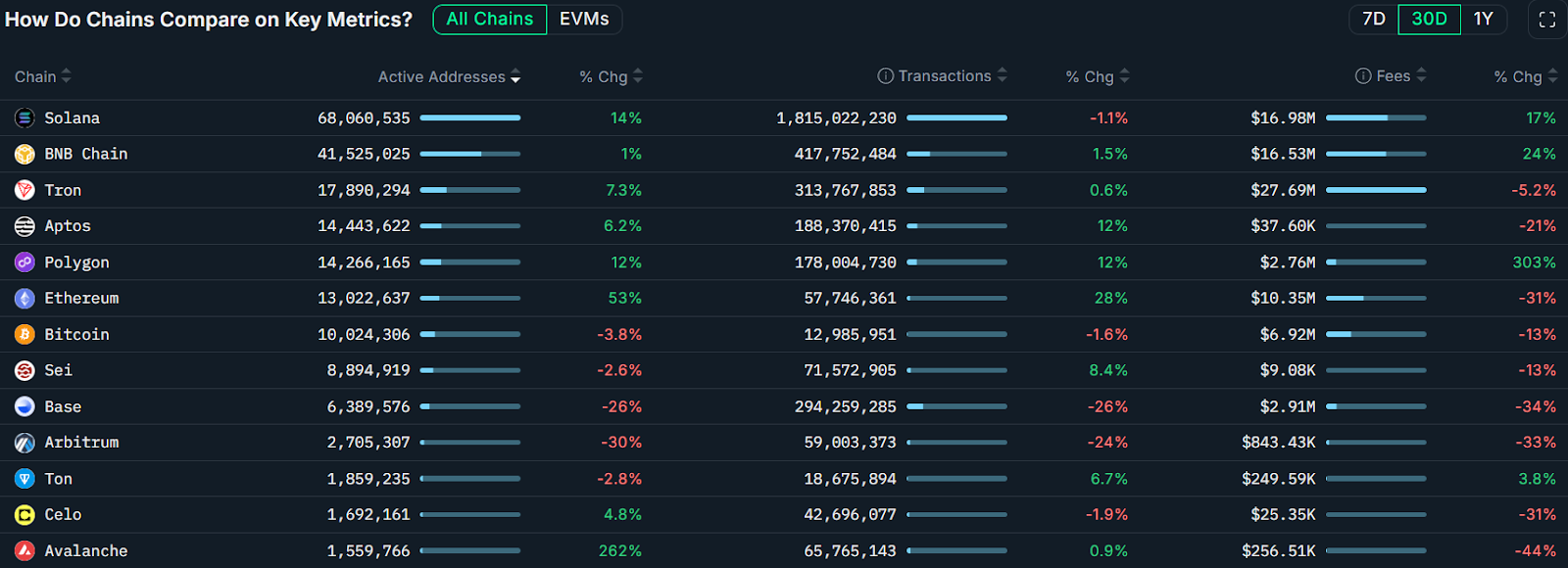

Blockchain by energetic customers, 30 day chart. Supply: Nansen

Solana’s lead among the many chains could be attributed to its exercise, as Solana was probably the most used community previously 30 days with greater than 68 million energetic addresses, a rise of 14%, in accordance with cryptocurrency intelligence platform Nansen.

Ethereum is in sixth place with 13 million energetic month-to-month addresses, a rise of 53% previously 30 days.

journal: Pakistan will deploy Bitcoin reserves to DeFi for yield, says Bilal bin Saqib