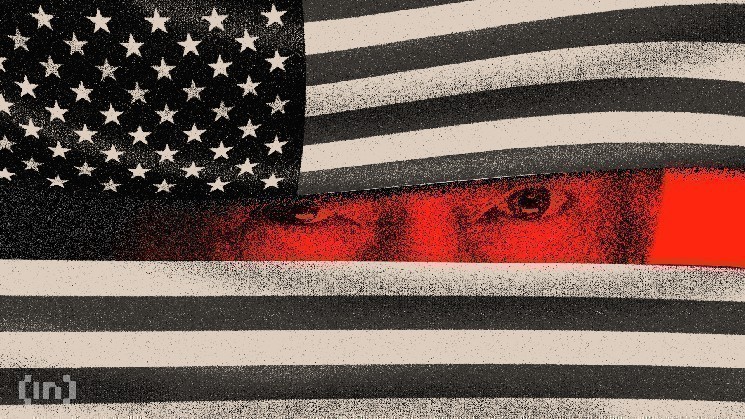

Confidence within the US greenback is below stress because the US Federal Reserve (Fed) comes below elevated scrutiny. Geopolitical tensions are additionally rising, stemming from disputes associated to Washington’s pursuits in Greenland.

In opposition to this background, China is rising as an oblique beneficiary. By increasing its renminbi-denominated commerce and funds system, the Chinese language authorities stands to profit from the worldwide motion towards diversification amid political and coverage uncertainty.

Greenback stability comes into query amid Fed turmoil

Coverage strikes from Washington in latest weeks have created uncertainty in world markets, with the greenback being one of the crucial affected property.

Confidence on the earth’s dominant foreign money has declined amid a sequence of political developments, significantly the legal investigation into Federal Reserve Chairman Jerome Powell.

We could also be seeing the start of the tip for the greenback’s dominance.

And in the event you nonetheless maintain dollar-denominated property whereas this unfolds in actual time…

Let me inform you one thing:

On Friday, the Division of Justice advised Federal Reserve Chairman Jerome Powell… pic.twitter.com/2UGqcaZIAb

— George Noble (@gnoble79) January 13, 2026

The transfer is broadly interpreted as an try by the Trump administration to stress the central financial institution to chop rates of interest, although financial knowledge and the Federal Open Market Committee haven’t advised a necessity for a fee minimize.

Trump just isn’t the primary US president to conflict with the Federal Reserve over coverage path. However the Justice Division’s involvement marks an uncommon and strange escalation.

This transfer has buyers fearful. Questions have arisen about central financial institution independence and the way a lot belief must be positioned within the greenback.

The White Home’s geopolitical strikes are deepening this nervousness.

The unification of the US and EU begins to unravel

The US and the European Union have lengthy introduced a united entrance, however that bond has begun to fray since President Trump took workplace.

Tensions are rising because the president focuses on Greenland.

After European leaders dominated out the opportunity of the US buying the semi-autonomous area below Danish sovereignty, President Trump responded by threatening to impose a ten% import tax on merchandise from eight European international locations.

European leaders have since moved to retaliate. The leaders of the EU’s 27 member states are scheduled to satisfy within the coming days to debate a coordinated response to the U.S. risk.

Up to now, neither aspect has taken steps to ease tensions. U.S. Treasury Secretary Scott Bessent warned reporters on the World Financial Discussion board in Davos that it could be “extremely unwise” for European international locations to pursue retaliatory measures towards the US.

Word: Scott Bessent warned at Davos that it could be “extremely unwise” for Europe to retaliate towards US ambitions to purchase Greenland. pic.twitter.com/NZ8cLFnRwA

— BeInCrypto (@beincrypto) January 19, 2026

In the meantime, rising geopolitical dangers, commerce uncertainty and questions over institutional credibility are clouding the greenback’s function within the world economic system. On the identical time, it leaves a gap for rival international locations which might be able to take advantage of these new weaknesses.

China takes benefit of Western fragmentation

China has lengthy been laying the foundations for an alternate monetary system.

Over time, China has expanded renminbi-denominated commerce funds, promoted its personal cross-border funds infrastructure, and inspired better use of the renminbi in worldwide transactions.

These efforts purpose to scale back the affect of U.S. coverage choices and sanctions, whatever the present geopolitical local weather.

These at the moment are much more essential as questions concerning the institutional stability of the US develop. For Beijing, the present atmosphere supplies a strategic opening formed by rising uncertainty surrounding U.S. management somewhat than its personal actions.

China doesn’t want to exchange the greenback to profit from this alteration. Its attraction lies in its selectivity somewhat than its dominance, offering companions with further channels for funds and funding.

Tensions between the US authorities and the EU are reinforcing this chance. As Western nations develop into much less cohesive, the notion of a unified order that underpins the greenback’s world function weakens.

Increasing China’s monetary infrastructure may very well be a viable choice for international locations cautious of commerce disruption.

As Washington exams its management, it could be creating room for Beijing to quietly develop its affect.

The article Western tensions and Fed stress presents sudden alternatives for China appeared first on BeInCrypto.