Ethereum (ETH) is popping out of a bearish scenario. Ethereum value has been hovering round $3,016, up about 2.3% in 24 hours, however is at present lower than 2% under a key degree that might reverse sentiment.

This enhance comes at a tough time because the market is skinny in the direction of the top of the 12 months. The query is straightforward. Is ETH about to beat the bears or is that this one other faux?

Bearish Head and Shoulders hits roadblock

ETH has fashioned a head-and-shoulders sample on the every day chart, a bearish construction that usually collapses as soon as the value loses its neckline. Right here, the neckline is round $2,809. Based mostly on sample predictions, a 20% drop could possibly be the purpose if the breakdown is confirmed.

Need extra token insights like this? Join Editor Harsh Notariya’s Every day Crypto Publication right here.

Bearish ETH Danger: TradingView

This decline is probably not straightforward.

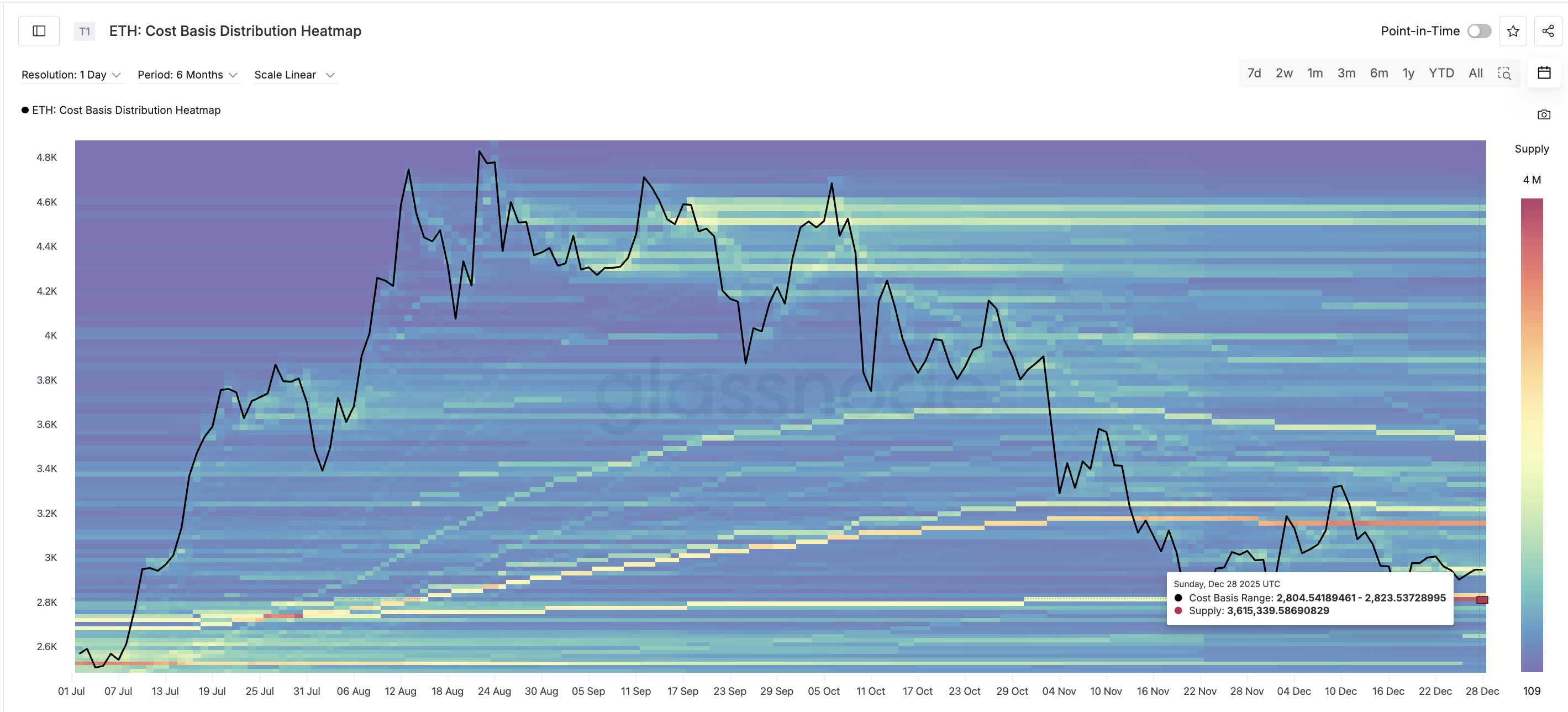

Within the cost-based heatmap, the massive provide cluster is positioned between $2,804 and $2,823 and holds roughly 3.6 million ETH. That is the place a big group of holders final established positions. These holders usually defend that zone when the value returns to that zone. There may be nonetheless a threat of Ethereum failing resulting from this cluster, but it surely appears much less doubtless.

Sturdy neckline assist: Glassnode

Briefly, the bearish image exists, however there isn’t a clear path for the bears.

Whale shopping for responds to 98% discount in long-term promoting

At the moment, two on-chain shifts are supporting ETH’s makes an attempt to combat again.

Whales (excluding exchanges) elevated its holdings from 100.65 million ETH on December twenty eighth to 101.05 million ETH right now.

This implies roughly 400,000 ETH has been added. At present costs, meaning about $1.2 billion was purchased inside 24 hours.

Whales Add Close to Assist: Santiment

This soar coincided with ETH regaining floor from the precise shoulder of the sample. When massive holders settle for chapter threat, it usually alerts confidence. On the identical time, twelve months to 2 years of spent cash fell from 45,846 ETH on December twenty seventh to 1,076 ETH right now.

This can be a 98% discount within the motion of outdated cash. Spent cash metrics monitor cash which might be returned to circulation after being held unused.

Lengthy-term ETH holders transfer fewer cash: Santiment

Diminished motion means long-term holders are now not promoting on energy. This takes strain off and permits the whale to maneuver ahead with its restoration makes an attempt. Provide dynamics are at present on the upside as whales purchase and long-term holders chorus from promoting.

Ethereum value is near defeating the bears

ETH is buying and selling round $3,016. The primary line that issues: $3,069. That is lower than 2% from present ranges. Brief-term bearish management can be damaged if the value closes above $3,069 for the day.

Above that, the bearish sample’s deactivation zone is positioned at $3,449. That degree is the highest of the pinnacle in Head and Shoulders. A detailed of the day above $3,449 breaks the bearish construction and transfers management to consumers.

Ethereum Worth Evaluation: TradingView

Beneath, $2,809 is the neckline, and a lack of this can re-open a 20% draw back. And that might push the value under $2,623 first, invalidating the bear market setup. For now, ETH is in between the 2 outcomes, however momentum and provide motion will favor the bulls if it clears $3,069.

The publish Whales Add $1.2 Billion to Ethereum (ETH) as Worth Assessments Bearish Formation appeared first on BeInCrypto.