Gate Analysis, the analysis arm of cryptocurrency change Gate.io, has launched a weekly report on the Bitcoin and Ethereum markets.

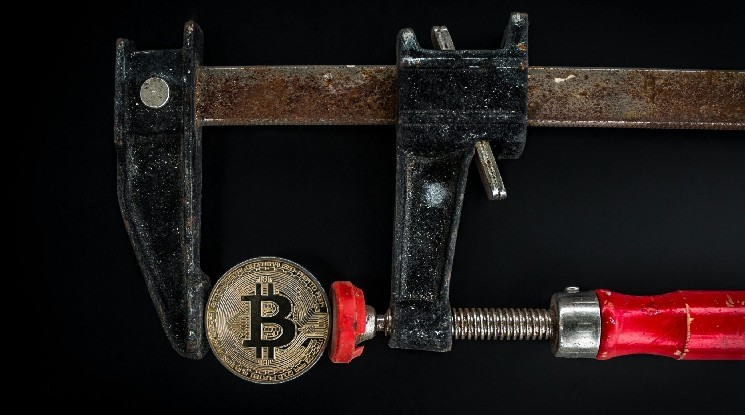

The report famous that whereas Bitcoin briefly dipped beneath $100,000 after which recovered to $106,000, this rise could be a technical correction.

With in the present day’s decline, BTC value is presently buying and selling at $101,180.

Analysts at Gate Analysis argued that easing considerations in regards to the danger of a U.S. authorities shutdown and a rebound in danger urge for food supported Bitcoin costs, however buying and selling volumes and capital inflows remained weak. In keeping with the report, “Whereas the MACD foremost indicator reveals a constructive crossover, this doesn’t point out a sustained uptrend.”

In the meantime, Ethereum reportedly fluctuated between $3,400 and $3,650 this week with restricted restoration momentum. It was famous that the current surge was a technical correction slightly than the beginning of a brand new bullish part, as total market sentiment stays cautious.

In keeping with information from Gate Analysis, Bitcoin’s implied volatility (IV) was 45%, whereas Ethereum’s was 74%. These excessive charges counsel that analysts count on market volatility to proceed.

Analysts famous that Bitcoin’s realized volatility (RV) has fallen to 39.7%, with the volatility danger premium getting into constructive territory. This means that market contributors are beginning to overestimate future volatility.

*This isn’t funding recommendation.