The U.S. Federal Reserve has had a big affect on crypto market momentum this yr, and that affect is more likely to proceed into 2026 as disagreements amongst policymakers stay.

The Fed has lower rates of interest thrice in 2025, most just lately on December tenth, when it lowered rates of interest to between 3.5% and three.75%.

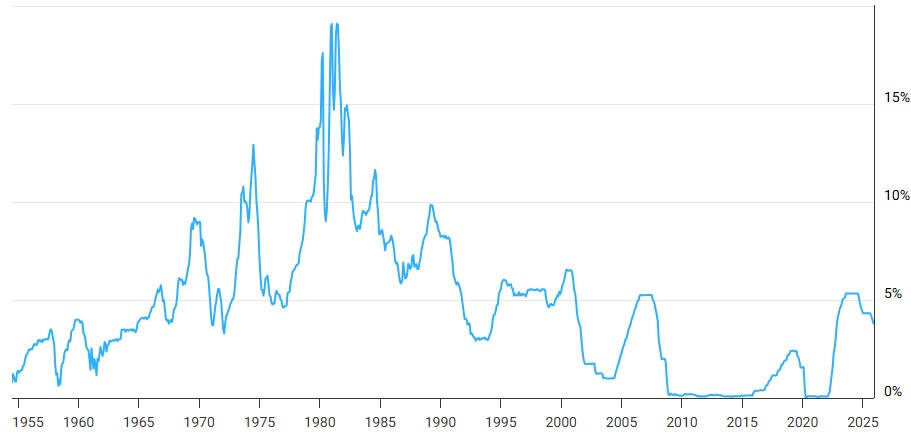

Nevertheless, although rates of interest are at their highest degree since 2008, some forecasts predict that there’ll solely be one additional price lower in 2026.

The primary elements influencing coverage makers’ choices are labor market knowledge, the trajectory of inflation, notably because of the affect of tariffs, and general financial progress.

The central financial institution will even select a brand new chair in Might, when Jerome Powell’s time period expires, and President Donald Trump has already shortlisted the most probably dovish candidates.

U.S. rates of interest are at an 18-year excessive regardless of three cuts this yr. sauce: macro traits

What’s going to the Fed do in early 2026?

The subsequent Fed board assembly on January twenty seventh and twenty eighth can be vital as it will likely be the primary alternative for Fed administrators to replace their steerage and will set the tone for the quarter.

CME Group predicts buyers solely have a 20% likelihood of one other 25 foundation level price lower in January, which might rise to 45% of the speed lower on the mid-March Fed assembly.

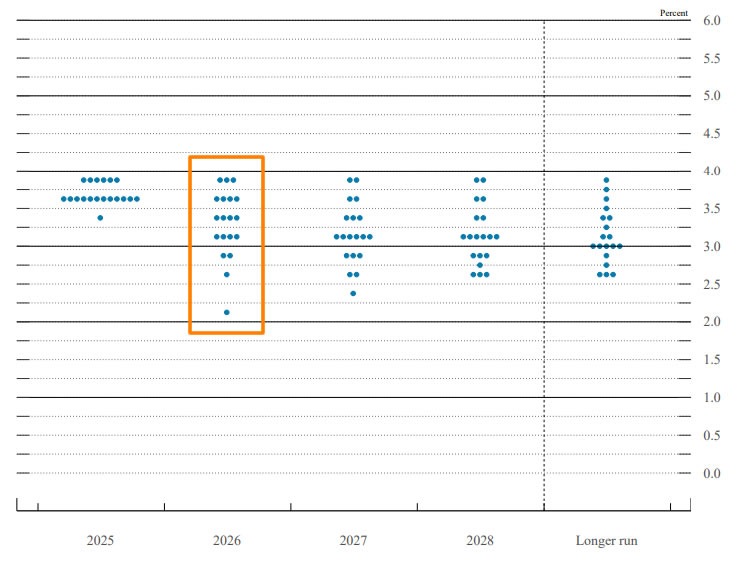

Dot plot exhibits splitting

The December 2025 dot plot exhibiting every policymaker’s rate of interest forecast exhibits a notable cut up, with equal numbers predicting zero, one or two price cuts, creating important uncertainty out there as 2026 begins.

This chart gives transparency into the Fed’s considering, however forecasts change steadily as new financial knowledge is launched.

The present median forecast for the top of 2025 is 3.6%, successfully the present price, however 3.4% by the top of 2026, indicating just one lower in 2026.

The December dotplot exhibits the cut up in opinion about what policymakers assume rates of interest can be on the finish of 2026. supply: federal reserve system

Analysts at Charles Schwab stated that after December’s Fed price lower, “the most recent forecasts weren’t notably hawkish,” with 12 of 19 policymakers anticipating no less than another price lower subsequent yr.

Analysts count on two price cuts in 2026

Jeff Koh, principal analyst at CoinEx Analysis, instructed Cointelegraph that the Fed “faces important inside divisions” and that the dot plot exhibits “a large divergence of views and no clear consensus on the trail for rates of interest in 2026.”

“In my opinion, the Fed is more likely to lower charges twice in 2026. The Fed will doubtless pause in January after which lower charges as soon as in March, however that may match inside the the rest of Powell’s time period, which runs via Might.”

“This timing could be justified if labor market circumstances stay weak although inflation may peak above 3% within the second quarter. After the management change, the brand new Fed management is more likely to proceed the gradual easing cycle via the remainder of the yr,” he stated.

Associated: Cryptocurrencies have all the things a bull market wants, so why is the market falling?

Jeff Might, chief working officer of the BTSE change, instructed Cointelegraph that there are a number of situations the Fed may play out within the first quarter.

“The bottom case is that the Fed cuts rates of interest as soon as within the first quarter and maintains the present Treasury invoice repurchase price, which might release liquidity out there and probably profit crypto inflows,” he stated.

“In a bullish state of affairs the place inflation falls and unemployment rises, the Fed would wish to behave extra aggressively, reminiscent of initiating two price cuts and rising Treasury invoice repurchases.The crypto market would profit as demand for risk-on belongings surges.”

However the worst-case state of affairs is that if inflation rears its ugly head once more, forcing the Fed to chop rates of interest and cease shopping for again Treasury payments altogether. He added that such issues may trigger inventory and cryptocurrency markets to plummet.

Hopes for 2026 waning

Justin Danesan, head of analysis at Arctic Digital, instructed Cointelegraph that most individuals have excessive hopes for the top of quantitative tightening and the ushering in of a brand new dovish period for the Fed.

“Nevertheless, most individuals really feel disillusioned as a result of the Fed seems to be accommodative however nonetheless very cautious,” he added.

“For an asset that basically hedges towards reckless central financial institution insurance policies, fiat forex depreciation, and in the end the quantity of liquidity in international markets, this extra cautious method tempers the euphoria part that almost all crypto merchants are (or had been) anticipating.”

However, a brand new chair may change the Fed’s general stance on rate of interest coverage and willingness to help dangerous belongings like cryptocurrencies.

As rates of interest fall, conventional investments reminiscent of bonds and time period deposits grow to be much less engaging, and buyers have a tendency to hunt higher-risk belongings reminiscent of cryptocurrencies. This will increase demand and shopping for stress, and costs normally observe.

journal: The large query: Can Bitcoin survive a 10-year blackout?