October has traditionally been considered one of Bitcoin’s strongest months, however because of its constant monitor file of income, it’s sometimes called “up-to-bar.” Over the previous decade, main digital property have closed October amid inexperienced in excellent years, reminiscent of 2017 and 2021, when cash spiked at 49% and 40% respectively.

Nonetheless, this yr might differ. With the crypto market displaying inactive efficiency in latest weeks, Fed fee cuts weigh the US greenback and curb systemic income, and BTC faces a extra unsure path because it enters October 2025.

Uptotober faces headwinds when btc maintain slips

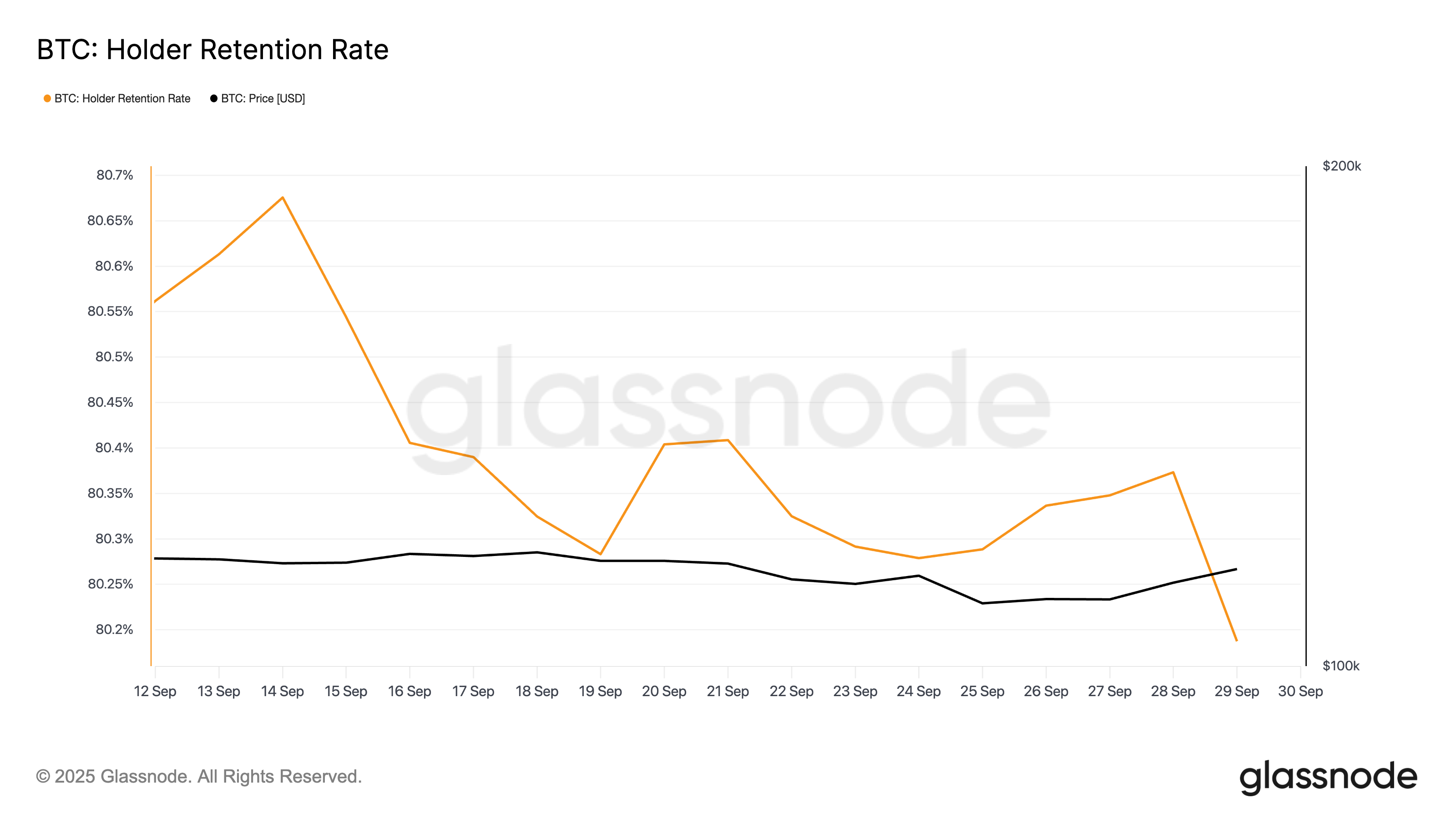

In line with GlassNode, Bitcoin holder retention fee has steadily declined since September 14th and continues to say no. It is down 80.17% at press, 1% over the previous 16 days.

For token TA and market updates: Need extra token insights like this? Join Editor Harsh Notariya’s each day crypto publication.

BTC holder retention fee. Supply: GlassNode

Holder Retention Price tracks the share of addresses that preserve the steadiness of BTC over a 30-day interval of consecutive days. It merely measures how lengthy a holder will preserve the coin.

The decline in retention fee displays the dearth of convictions amongst holders. It means that extra buyers are shifting cash for change or liquidation as a substitute of holding them for long run.

If this continues, it should cut back buy-side stability and make BTC extra susceptible to sharper worth fluctuations within the coming weeks.

The derivatives market is bearish

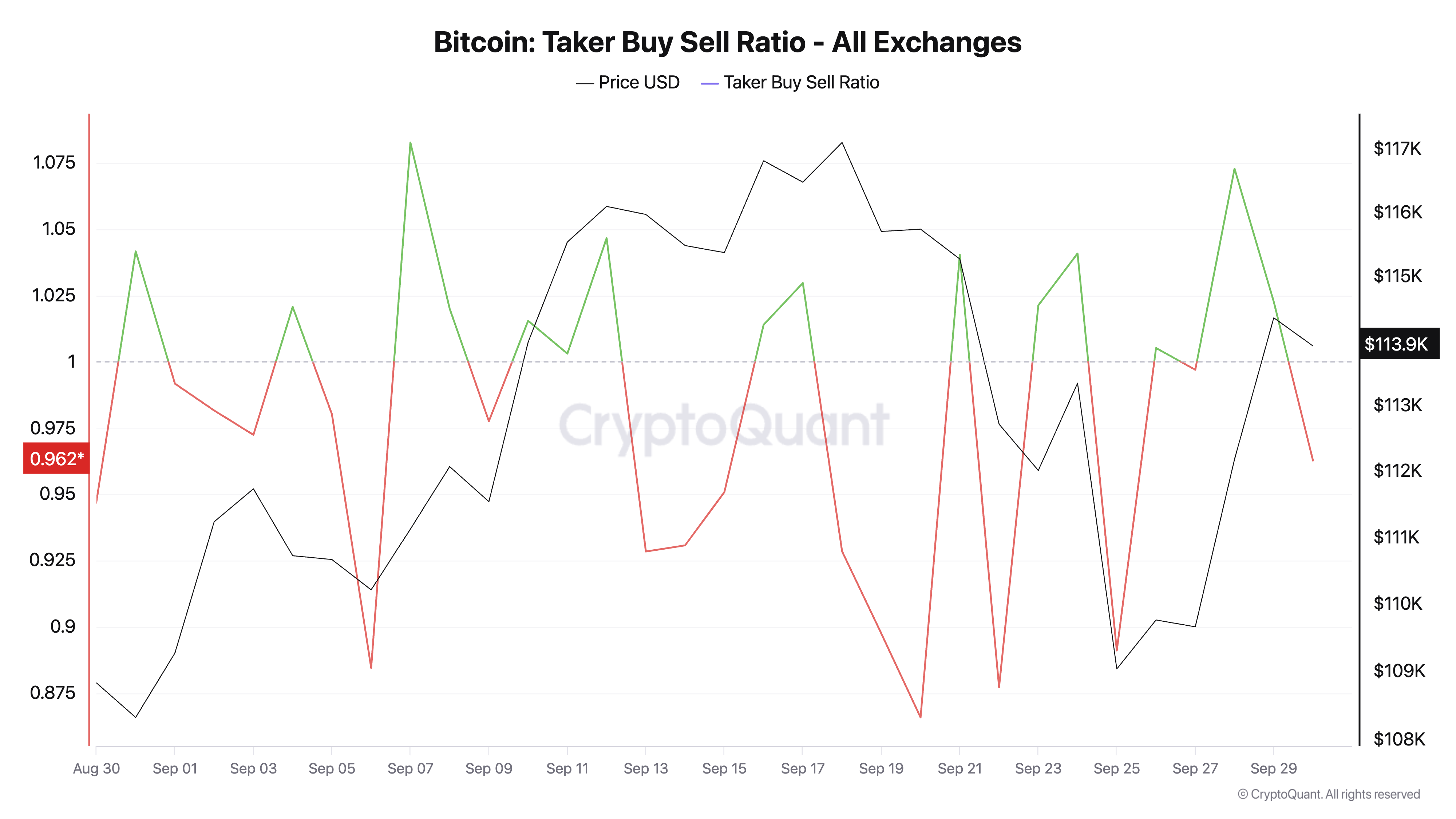

Coin’s Taker-Purchase Promote ratio has recorded most of its worth all through September, confirming bearish sentiment amongst spinoff merchants. In line with Cryptoquant knowledge, it’s 0.95 at press time.

Bitcoin Taker buy and gross sales ratio. Supply: Cryptoquant

This metric measures the ratio of asset buying and selling volumes within the futures market. Values above the worth point out extra shopping for than the promoting quantity, whereas values beneath the worth point out that extra futures merchants are distributing their holdings to forestall losses.

For BTC, the sustained bearish slope within the derivatives market means that brief sellers are more and more dominant and can strengthen the damaging bias.

Except this ratio returns one up and reveals new buy-side stress, October might stay difficult for main cash.

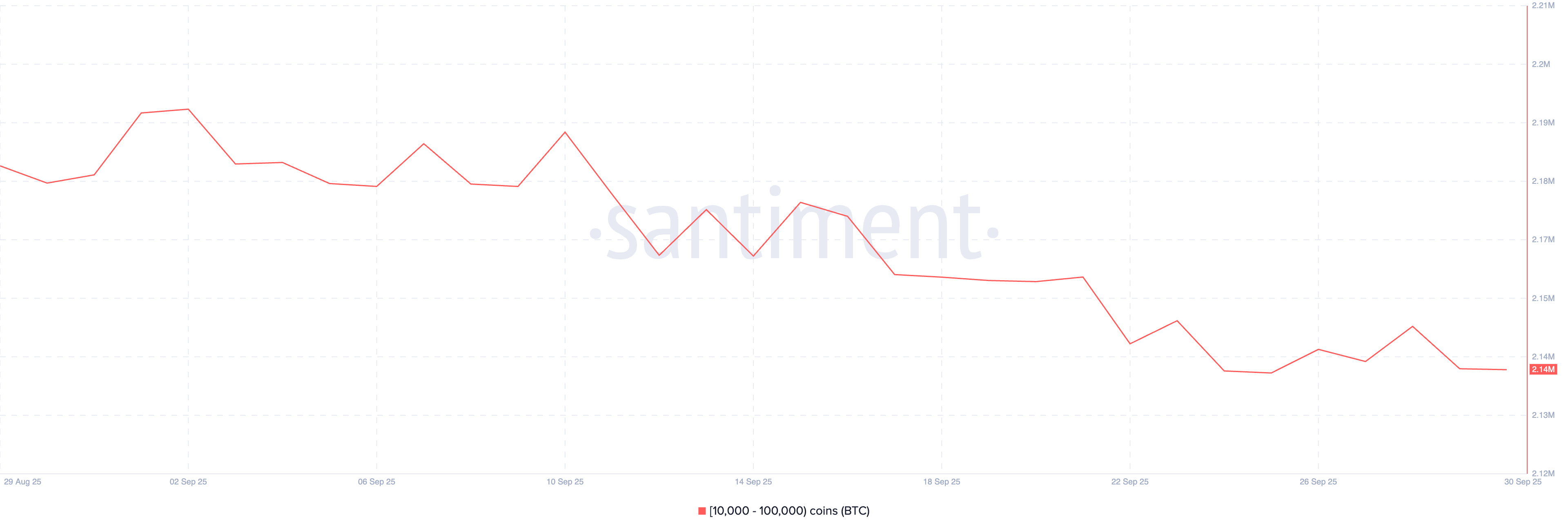

Whale exercise will lower and weaken market depth

The decline in whales’ curiosity additionally provides downward stress on BTC costs. In line with Santiment, giant buyers with between 10,000 and 100,000 BTC have diminished their holdings by 50,000 cash over the previous week.

BTC provide distribution. Supply: GlassNode

Traditionally, whale participation has been carefully linked to BTC rallies. These deep pocket gamers present the fluidity and momentum they should preserve upward motion.

Due to this fact, the absence of such exercise provides one other layer of threat. With out whales demand, retail move alone might not be sufficient to drive sturdy October rebounds.

Is your BTC steadiness subsequent to $107,000 or $119,000?

The BTC trades at $113,968 at press time. If this bearish momentum continues in October, the coin can take a look at rapid help round $111,961.

If gross sales proceed, the coin’s worth might drop to $107,557 as gross sales speed up.

BTC worth evaluation. Supply: TradingView

Conversely, if demand accelerated by enhancing macro situations and up to date demand recovers, BTC can get well resistance at $115,892 and push it as much as the $119,367 mark.

The put up hoping for Bitcoin costs in October first appeared on Beincrypto.