Crypto analyst Colin raised the next chance: bitcoin value It displays the parabolic motion of gold. The analyst additional revealed what influence this might have on BTC if it in the end occurs.

What would occur if the worth of Bitcoin mirrored that of gold?

in ×submitColin prompt that if Bitcoin costs observe the motion of gold, it may document an extra uptrend as early as subsequent week. He expressed the opinion that, contemplating the next circumstances, it’s unlikely that the principle digital forex will expertise a serious upward development once more. gold and shares In current months, there was a fast rise to the purpose the place the inventory value has reached a brand new all-time excessive (ATH).

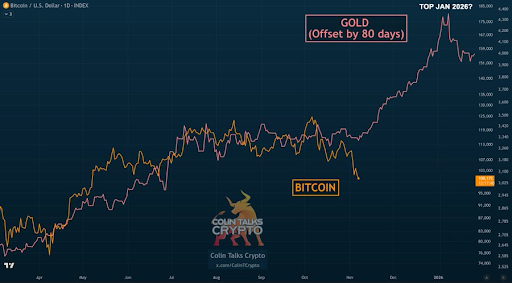

Koilin additional mentioned that funds will nonetheless go to cryptocurrencies, however there will probably be delays, as highlighted within the gold and Bitcoin charts. He added that he predicts a Bitcoin value peak in January 2026 if gold’s peak value is introduced ahead by 80 days. His hooked up chart confirmed that BTC may nonetheless rise to $175,000. that bull market Will probably be prolonged till January subsequent 12 months.

Colin admitted that this might be incorrect for Bitcoin value, however identified that many different indicators level to additional will increase in Bitcoin value. Nevertheless, he additionally emphasised the truth that market sentiment is changing into bearish. cryptocurrency market. The market is at present trending decrease, with BTC falling under $100,000 a number of occasions this week.

This has raised issues that Bitcoin costs are already in a state of collapse. bear market. Nevertheless, Colin prompt that BTC may attain new all-time highs earlier than this cycle ends. His predictions match these of individuals comparable to: normal charteredpredicts that BTC may attain $150,000 to $20,000 by the tip of the 12 months.

The reason why BTC high doesn’t enter

some other place ×submitColin additionally defined why the highest might not take part within the Bitcoin value on this bull market. He identified that the intersection of the 1150-day SMA and the earlier bull market peak is the time when the following peak crests. This occurred in each the 2017 and 2021 bull markets, BTC high at the moment.

Now, the analyst mentioned, this transferring common will not be fairly in keeping with the preliminary $65,000 excessive. earlier cycleindicating that BTC nonetheless has room to rise on this market cycle. Colin added that if this 1150-day SMA is predicted, it would mark the best value for Bitcoin round late December of this 12 months or January of subsequent 12 months. He reiterated that every one indicators collectively level to a peak round late December or January subsequent 12 months.

As of this writing, the worth of Bitcoin has risen over the previous 24 hours and is buying and selling at round $102,400. knowledge From CoinMarketCap.

Featured picture from Pixabay, chart from Tradingview.com