Bitcoin’s current selloff has worn out any extra leverage and pushed the value into a significant accumulation zone round $100,000 to $102,000.

Though momentum stays weak within the quick time period, on-chain and order circulate knowledge suggests sensible cash might re-enter to capitalize on retailer concern and compelled liquidations.

technical evaluation

Written by Shayan

each day chart

On the each day timeframe, BTC fell beneath each the 100-day transferring common and the 200-day transferring common, confirming a short-term breakdown from the earlier equilibrium vary. The rejection from the $114,000 resistance zone and subsequent cascade to $101,000 marks probably the most aggressive correction since August.

The asset at present sits on the high of the $100,000-$102,000 institutional demand block, a zone that has traditionally served as a key pivot level. This degree can also be according to earlier increased timeframe liquidity beneath the low of the vary, an space the place sensible cash typically absorbs retail give up orders.

If BTC kinds a consolidated base right here and regains the $106,000-$108,000 construction, the current decline may very well be a liquidity sweep, paving the best way for a rebound from $114,000 to $116,000. Conversely, failure to maintain above $100,000 will expose the macro demand zone of $93,000 to $95,000, which stays the subsequent necessary assist for potential accumulation.

4 hour chart

The 4-hour chart reveals the mechanism behind the current breakdown. After forming an ascending construction all through late October, Bitcoin broke away from the higher development line close to $116,000 and broke beneath rising wedge assist, triggering a speedy liquidation cascade.

After breaching the short-term demand zone of $108,000 to $109,000, the promoting accelerated, unwinding leveraged lengthy positions and capturing late consumers.

At the moment, the market has stabilized simply above the $100,000 demand space and is displaying indicators of uptake. If value is ready to set up increased lows on this timeframe, it might sign that the correction has reached a depletion level and main corporations are quietly elevating cash in a panic.

Nonetheless, we have to retest $106,000 as resistance earlier than confirming a sustainable restoration.

On-chain evaluation

Written by Shayan

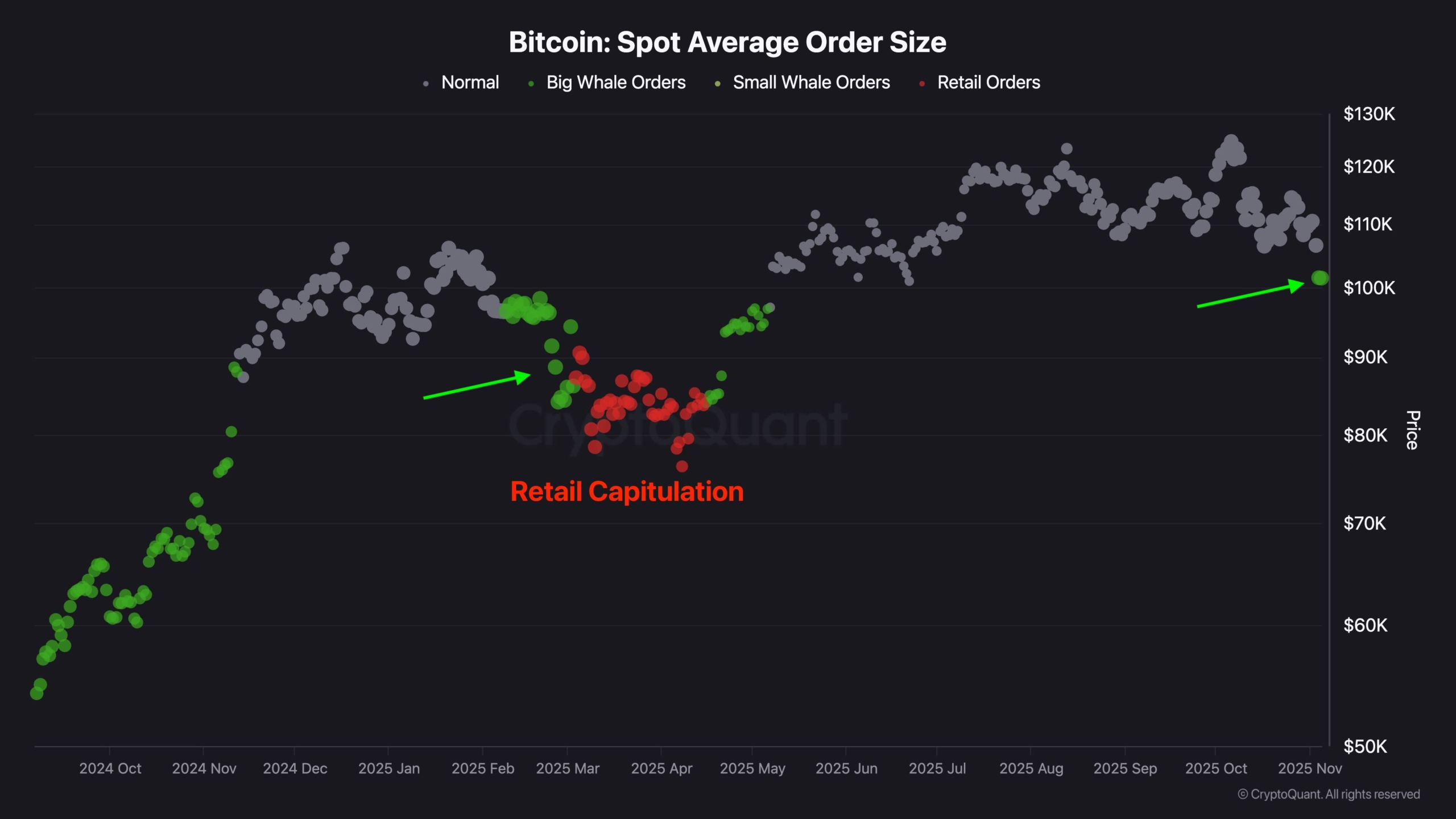

The Bitcoin Spot Common Order Measurement indicator offers precious perception into present market actions. After the massive drop firstly of 2025, this chart reveals a transparent order. A spike in whale-sized orders is adopted by an enlargement of small retail orders (pink cluster). This can be a sample that sometimes displays a decline in retail. This shift typically marks the purpose at which institutional buyers and high-net-worth members start to capitalize on emotional promoting by coming into the market at a reduction and accumulating positions.

Traditionally, the ultimate impulse rally of a broader bull cycle has been preceded by a part characterised by a retail capitulation adopted by a rise in whale order exercise. The identical construction is now reappearing. Following the current market selloff, giant order exercise (inexperienced cluster) has began to choose up once more round $100,000, indicating renewed engagement by deep-pocketed members.

Though affirmation remains to be wanted, this motion is according to what may very well be a “ultimate cull” stage earlier than a brand new wave of institutional accumulation gears up for the subsequent bullish enlargement.