Ethereum has returned to the important thing assist zone after seeing a pointy rejection from native highs. As Netflows demonstrates sustained runoff and momentum cooling, the market is presently testing whether or not the Bulls can defend their key ranges and whether or not there’s a deeper retracement forward.

Technical Evaluation

By Shayan

Day by day Charts

On the day by day charts, ETH was unable to carry greater than $4,400, falling under the lately shaped small ascent channel. This breakdown has modified momentum, with costs now reaching round $4,200. Additionally, RSI sits at round fortieth, reflecting bullish loss, however is just not but in excessive promoting situation.

The primary main assist was discovered at practically $4,000, then an space of $3,800, lined up on the decrease boundary of the 100-day transferring common and the bigger channel. When patrons adhere to this stage, the ETH can kind a better, decrease construction and maintain the broader uptrends intact.

For now, the medium-term development in ETH stays bullish so long as it holds $3,700, however the momentum change suggests extra unfavourable facet prolongation earlier than power returns.

4-hour chart

The 4H chart attracts a clearer image of current weaknesses. The ETH broke from the $4,400-4,800 built-in vary and rapidly fell to $4,100. The momentum is presently leaning closely in the direction of the draw back, with RSI practically 30, indicating short-term excesses. This might trigger a bouncing of aid, however the collapse undermined native traits till $4,400 was reclaimed.

The following sturdy liquidity cluster is round $3,800, and is according to each horizontal demand and ascending trendlines. This zone may result in patrons actively attempting to intervene. If ETH can maintain and rebound from this space, the preliminary upward aim is $4,200, adopted by a retest on the $4,400 key stage. In the meantime, failing to exceed $3,800 may speed up gross sales stress and drag the market into the general bearish stage.

On-Chain Evaluation

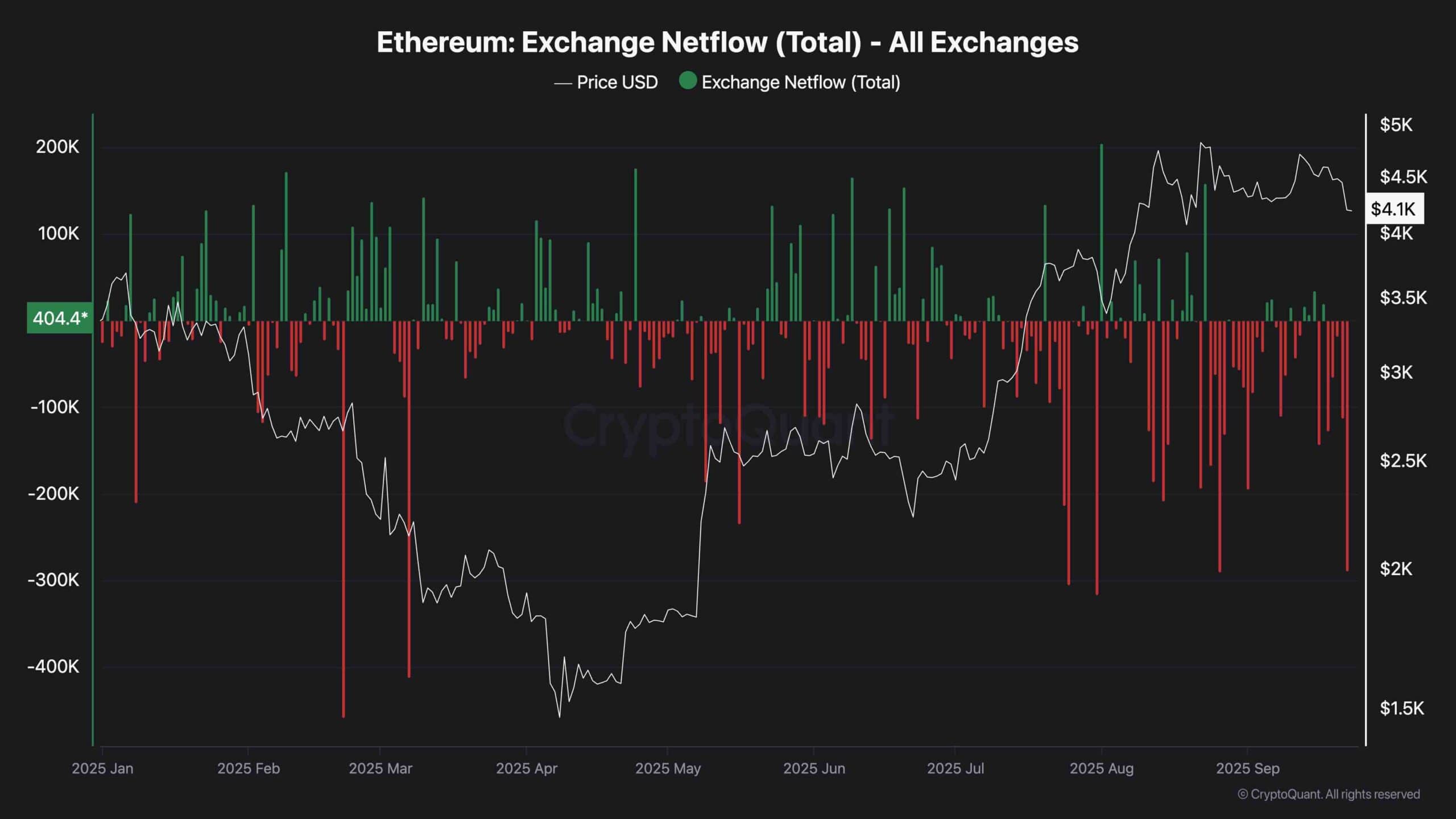

Exchange Netflows

Change Netflows proceed to indicate giant unfavourable spikes, indicating a constant ETH spiking from the trade. This means that buyers are transferring cash to self-supporting or staking, which reduces sell-side provide and usually bullish over the medium time period.

Nevertheless, within the quick time period, the market is affected by technical weaknesses and up to date income at highs. If accumulation continues throughout this dip, it could set a powerful restoration stage later, however for now, market sentiment is leaning in the direction of a decrease stage of assist check earlier than the brand new bullish leg begins.