As Bitcoin ($BTC) is buying and selling roughly 50% under its all-time excessive, traders are as soon as once more asking the frequent query: “How lengthy does a restoration usually take?” Market analyst Sam Daodu believes historical past supplies helpful clues.

Will Bitcoin as a complete not collapse this time?

Doto memo Sharp corrections aren’t unusual for Bitcoin. Since 2011, cryptocurrencies have endured greater than 20 declines of greater than 40%. Mid-cycle declines within the 35% to 50% vary usually defuse overheated bull markets with out completely derailing the long-term uptrend.

In conditions the place there was no systemic collapse within the broader market, Bitcoin usually regained its earlier highs in about 14 months. He contrasts the present setting with 2022, when a number of structural flaws shook the crypto business.

There may be at present no comparable system-wide collapse. Analysts emphasised that $BTCrealized valueAt present close to $55,000, long-term holders have traditionally gathered the coin round that degree, probably offering a psychological and technical decrease sure.

Whether or not the present recession develops into a chronic recession or a shorter-term reset will largely rely on international liquidity circumstances and investor sentiment, Daodu steered.

Wanting again on the historic inventory market decline

Through the 2021-2022 cycle, Bitcoin peaked at $69,000 in November 2021 and fell 77% to $15,500 a yr later. This financial downturn coincided with financial tightening by the US Federal Reserve, paralleling the collapse of the Terra (Luna) ecosystem. FTX chapter.

It finally took 28 months for Bitcoin to surpass its earlier excessive set in March 2024. On the backside of the market, long-term holders managed about 60% of the circulating provide and have been absorbing cash from compelled sellers.

The 2020 coronavirus illness (COVID-19) crash unfolded in a totally totally different means. In March of the identical yr, Bitcoin plummeted by about 58%, falling from about $9,100 to $3,800 as international lockdowns triggered a liquidity shock.

Bitcoin rebounded rapidly. Inside six weeks, it was again to the $10,000 degree, and by December 2020, about 9 months after the underside, it had regained its 2017 excessive of $20,000. It will definitely soared to $69,000 in November 2021, however that occurred about 21 months after the crash.

The 2018 bear market presents yet one more distinction. Bitcoin, which reached $20,000 in December 2017, had fallen 84% to $3,200 by December 2018. Preliminary coin providing The (ICO) increase, coupled with regulatory crackdowns and restricted institutional participation, has drained the market of speculative power.

Energetic addresses fell by 70%, and miners have been compelled to capitulate as revenues dwindled. With out vital new capital or a compelling progress story, it took Bitcoin almost three years to return to its earlier peak.

not but surrendered

The depth of the drawdown itself performs an essential position. Traditionally, corrections within the 40% to 50% vary took roughly 9 to 14 months to get better, whereas collapses of greater than 80% took greater than three years.

Bitcoin is at present down about 50% from its peak, and this decline falls into what Daodu calls the “average to extreme class”, which is important however not indicative. full give up.

He estimates, primarily based on previous occasions of comparable magnitude, that it may take greater than 12 months to return to historic highs, and that macroeconomic circumstances will finally decide the velocity of that restoration.

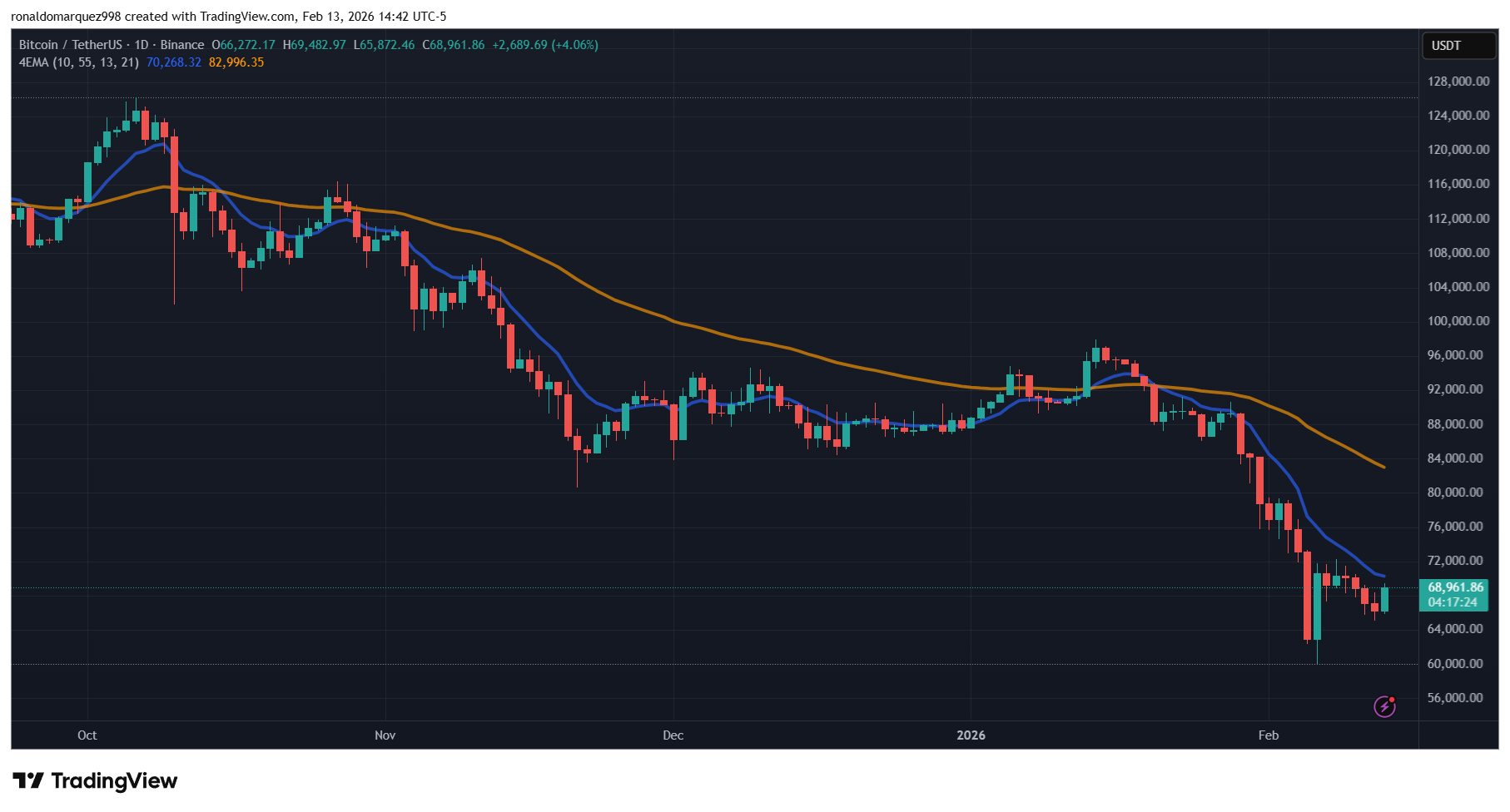

On the time of writing, $BTC is buying and selling at $68,960 and has rebounded barely on Friday, rising 5% to interrupt above the short-term resistance barrier at $70,000.

Featured picture from OpenArt, chart from TradingView.com