There’s at the moment a cut up in Ethereum. The large cash gamers have secretly began losing $350 million since Dec. 26 whereas the remainder of the market watches..

cash stream index

That is clearly seen whenever you take a look at the info. Cash stream indices, which observe cash coming in and going out, present that small traders aren’t truly placing actual money into these worth actions. In different phrases, if Ethereum rises, they will not rush to purchase.

From December 18th to twenty fourth, the worth of Ethereum elevated above, Nonetheless, the cash stream index has declined. That is the alternative of what you wish to see. it exhibitsReThe common individual simply would not imagine what’s occurring with costs proper now.

Consultants say retail traders are unlikely to begin shopping for till the cash stream index exceeds 37. It is nonetheless under that in the meanwhile. proper This raises the query of whether or not Ethereum can preserve its worth with out small companies coming into the market.

what the chart says

Chart customers imagine that the whales are conscious of what they’re seeing. An inverted head-and-shoulders sample could also be rising on the Ethereum chart. It might sound sophisticated, however it implies that costs can change from falling to rising if sure situations are met.

There’s one other clue value noting. What merchants name a bullish divergence is indicated by the Relative Power Index (RSI). Ethereum worth reached a low between November 4th and December twenty fifth, however the RSI truly reached an excellent decrease low throughout that interval. This often signifies that promoting strain is beginning to ease, even when the worth would not present it but.

however Ethereum has Some partitions to interrupt by means of first. The present most is $3,050. acquire After that, the subsequent cease is $3,390.

If Ethereum can break above $3,390, chart observers imagine it might rise to $4,400. That is what the sample suggests anyway. in fact, can do issuesI am going Different strategies too. drop Lower than $2,800 and This entire setup drop down Apart from that, the worth might drop to $2,620.

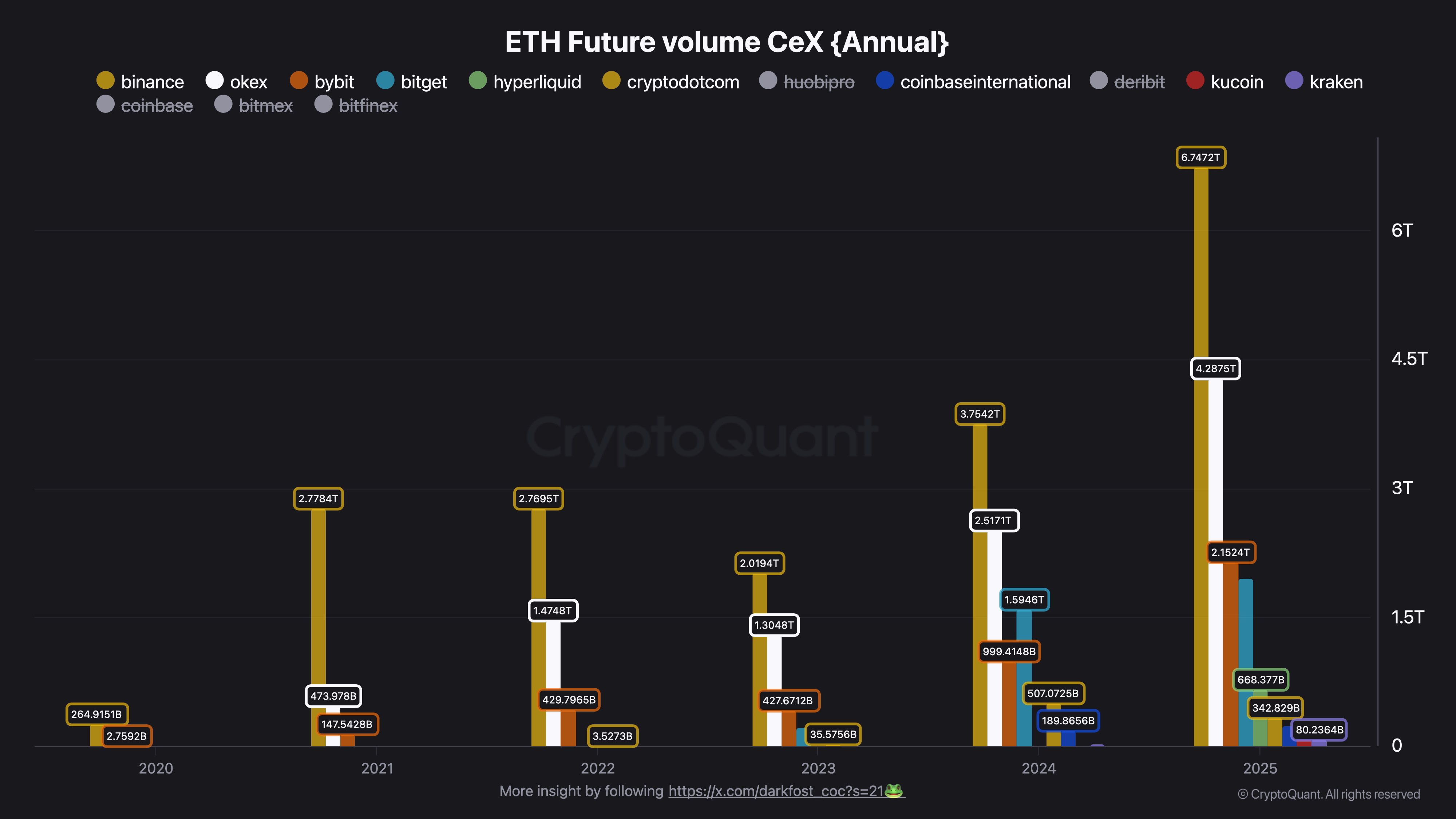

Futures buying and selling has been completely insane this 12 months. In line with CryptoQuant researcher Darkfost, Binance processed over $6.74 trillion in ETH futures in 2016. 2025. In different phrases About That is double the quantity noticed the earlier 12 months.

Comparability of worth and community efficiency

As 2025 attracts to an in depth, Ethereum is caught under $3,000. The second-largest cryptocurrency is buying and selling about 41% under its August excessive. That is fairly tough contemplating how a lot the community itself has improved.

Nonetheless, precise utilization numbers paint a special image. Ethereum had a file day on December twenty fourth, reaching a median of over 1.73 million transactions per week. It reached an all-time excessive. This enlargement is being pushed by stablecoin buying and selling, DeFi expertise, and layer 2 networks.

huge gamers take motion

However some main corporations are making huge strides. On December twenty eighth, BitMine Immersion Applied sciences bought roughly 103,000 ETH, rising its holdings to 257,600 cash, or roughly $750 million. This makes them one of many largest institutional holdings with a complete of over 4 million ETH.

Different celebrities are pursuing different techniques. Venice AI’s Erik Voorhees transferred round $5 million in ETH to Bitcoin Money, whereas Arthur Hayes is funneling Ethereum funds into different DeFi ventures.

Tokenization of real-world property is without doubt one of the components that may maintain bulls’ enthusiasm over time. In 2025, this market jumped from $5.6 billion to greater than $18.9 billion. With over $12 billion in tokenized property, Ethereum dominates this market, outpacing rivals similar to Solana and BNB Chain. Moreover, the community manages roughly $170 billion value of stablecoins.

Consultants on this subject imagine that this pattern will proceed for fairly a while. Tom Lee of Fundstrat predicts the worth of Ethereum will attain $7,000 to $9,000 by early 2026, citing the adoption of blockchain expertise by conventional finance. That is extra than simply crypto hype, as evidenced by DTCC’s announcement that it’ll tokenize US Treasury property on the Canton blockchain.

what occurs subsequent

Chart-wise, Ethereum is caught in a field between $2,900 and $3,000.

Market situations stay fairly risky. Greater than 40% of ETH holders are in losses, and the derivatives market is closely leveraged. Fusaka’s improve went easily in early December, proving that the expertise continues to advance, however whether or not it will probably translate into worth will increase will probably rely on institutional cash returning subsequent 12 months.

Whether or not Ethereum can get away of this vary will primarily rely on two issues. The query is whether or not huge institutional traders will begin shopping for once more, and whether or not on a regular basis merchants will regain the boldness to leap in once more. For now, the whales are betting YES, however they’re largely flying solo.