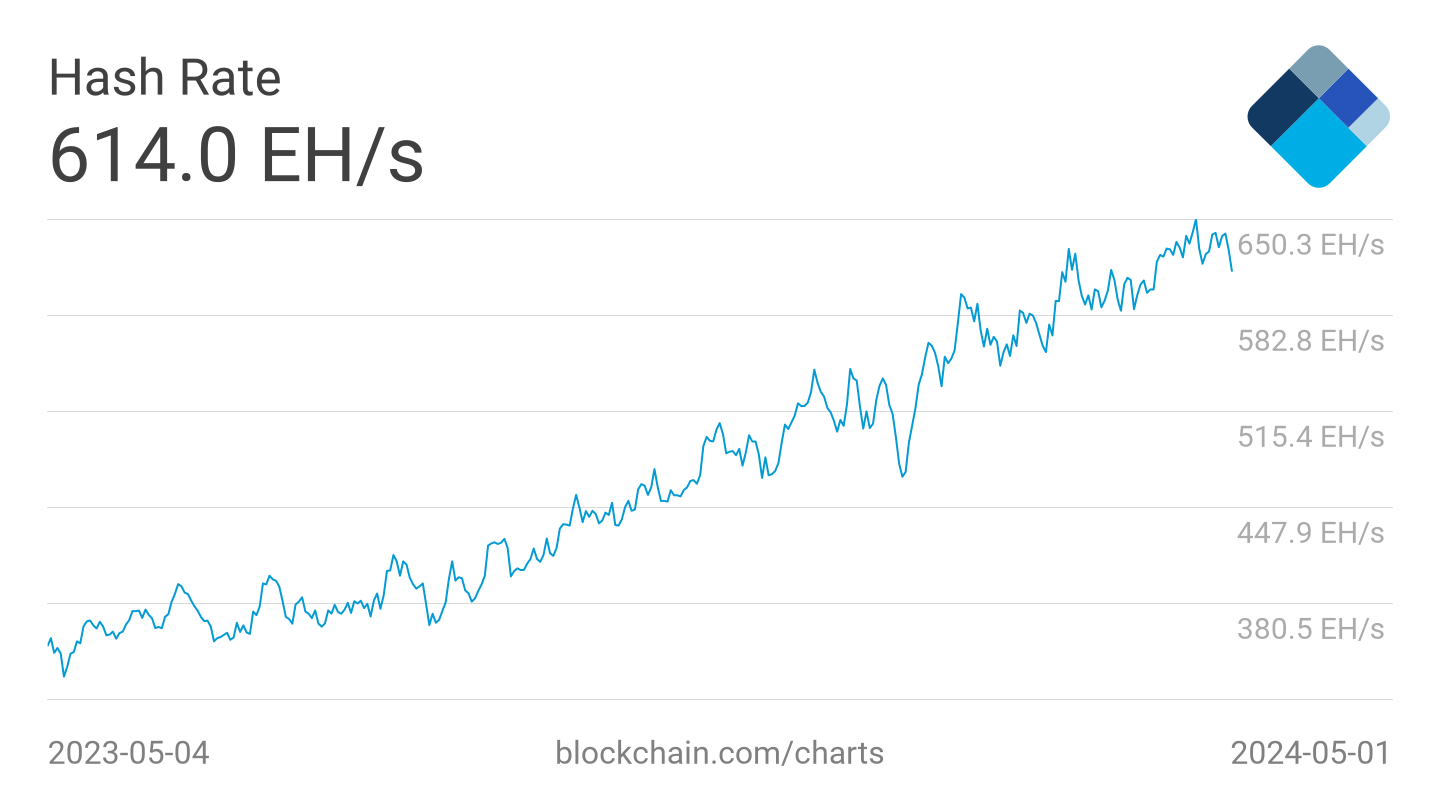

On September twenty third, Bitcoin hashrate set a brand new all-time excessive of 1,073 EH/s. Final month, Uncooked Compute rose by round 21%.

About 70% within the final quarter. Final yr, the curve has grow to be vertical, growing by about 675%.

Hashrates have been beforehand charts of miners and protocol geeks. It’s now learn like a capital expenditure scoreboard for tradeable industries.

Reply fundamental questions shortly. What’s a hashrate? Additionally, why do we’d like everybody exterior the mining warehouse?

Hashrate is an entire calculation work that factors out proof of Bitcoin’s work. That’s, how troublesome it’s to surrender on the community and rewrite the ledger. With extra hashrates, assaults are costlier and fewer sensible. Nevertheless, the extra attention-grabbing angle isn’t just “security.” That is what this says in regards to the measurement of the business behind it.

You will not get a Zetahash with out locking up an power contract large enough to arrange your facility, set up a transformer, carry container baggage, or energy the entire city. All of this rise within the line is cash and engineering that seems in the actual world.

Mechanically, the protocol stabilizes block cadence by growing or decreasing difficulties per block in 2016, like a treadmill that quickens when the runner will get stronger. If the hashrate jumps prefer it was in September, the treadmill kicks sooner on the subsequent epoch and the margins grow to be tighter.

That suggestions loop drives enterprise. The machine arrives on-line, blocks are too quick, problem is adjusted, and the unit’s economics is compressed till solely probably the most environment friendly operators have the benefit. The protocol is agnostic. We cannot negotiate. Miners both meet energy costs and fleet effectivity targets or are pushed behind the road.

The newest day by day print units a contemporary top of 1,073 eh/s. Over the previous 30 days, we added about 184 EH/s through the peak runup.

Yearly, hash charges enhance by round 36%. This collection surpassed every psychological marker with a predictable rhythm. 1 EH/s in early 2016, 10 EH/s by late 2017, 100 EH/s by late 2019, 500 EH/s in late 2023, and is now four-panel territory. These thresholds marked an industrial scale step-up: new technology ASIC waves, dense racks, higher firmware, cheaper electrical energy.

That is the place “Why hashrate issues past mining” turns into the incorrect lens, and so is the incorrect lens. Public miners are presently sitting on the coronary heart of the business, which is extraordinarily essential for the mining business. Mara, Riot, Clsk, Corz, Iren, CIFR and Friends are extra than simply buying and selling Bitcoin brokers. They’re enterprise firms linked to this treadmill.

When the hashrate accelerates sooner than the value, the issue follows it and the hashprice compresses. You may see that decision on income: the age and watts of the fleet per Terrahash are extra essential than the intelligent monetary line.

Sub $0.04-$0.05/kWh energy, environment friendly immersion or extremely activated air-cooled websites, and operators with strong energy hedges using changes with out coughing margins. Everybody else is seeing a break-even rise.

The inventory market aspect of that is straightforward to relate and troublesome to execute.

Scale is presently an actual infrastructure challenge. It’s a localized politics of the place substation lead instances, transmission constraints, interconnection cues, and masses will be positioned. That is why a hashrate chart is learn like a map of somebody who truly ran it.

The community that simply cleared one Zetahash is an business with laborious property all around the world, grouped into areas of low cost energy and assist native authorities. The inventory tape displays that kind.

Firms with contemporary fleets and ready-to-use megawatts are gaining shares upwards. The remaining can be diluted, consolidated or quietly sidelined when the subsequent problem Ratchet arrives.

The business is consistently tempted to show hashrate spikes into worth calls.

However the higher story right here is that worth displays temper, whereas hashrate displays dedication. The rig doesn’t magically seem as social feelings flip inexperienced. The motion we simply logged implies that months of Capex have already been spent and months in line for supply.

Within the case of spot stalls, problem nonetheless forces the business to do what they’re doing. When the value is run on it, you possibly can see that the general public identify is sprinting as a result of operational leverage is optimistic.

+20% for the previous month, +70% for the quarter is greater than only a magnitude. They’re quick. Absolutely the 30-day income on this run-hit in mid-September remind us that the rhythm of the deployment is clumpy because the container lands in bursts, energy is chunky and on-line, and the grid season is essential.

That rhythm determines the leaderboard within the subsequent few epochs.

You may forge the story. You can’t pretend the facility delivered.