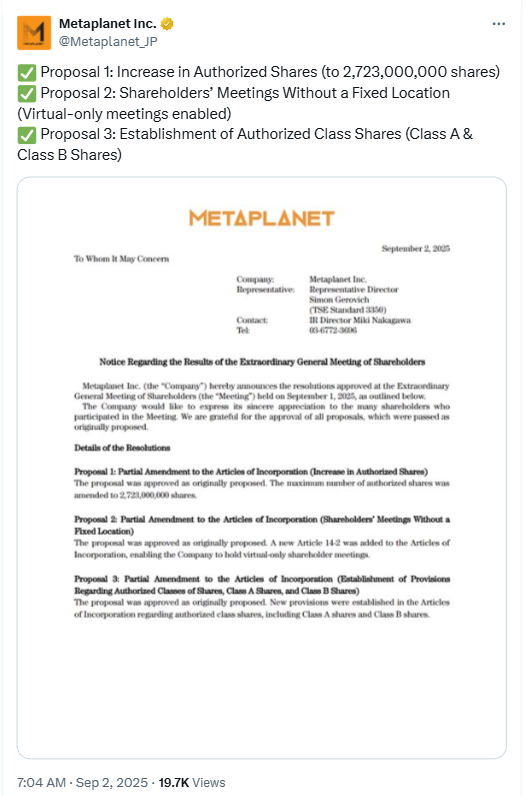

Bitcoin generates generational returns for buyers who joined digital property 10 years in the past, and Bitcoin miners appear like this:

The infrastructure Bitcoin mining firms used to minify Bitcoin are uniquely positioned to leverage synthetic intelligence.

Buyers are starting to see Bitcoin Miners as AI firms

Frank Holmes, government chairman and co-founder of Hive Digital Applied sciences, advised Beincrypto it could take three years to construct an information middle from scratch. It is because particulars comparable to permits, logistics, and information middle development should be thought-about.

Nevertheless, the trail to changing a Bitcoin mining information middle to an AI information middle doesn’t take time.

“If infrastructure is already constructed from Bitcoin mining, it is 9 months to enhance your information middle,” Holmes stated.

Hive’s market capitalization is over $600 million. Nevertheless, the corporate doesn’t think about itself a bitcoin miner. The corporate is a vertically built-in, renewable AI infrastructure firm, and Wall Road analysts agree.

Analysts’ aggressive worth targets vary from $6 to $12. Hive Inventory at the moment trades for round $3 per share. This implies a rise of over 300% from the present stage.

Hive Digital 6-month inventory chart. Supply: Google Finance

Some institutional buyers are starting to note as properly.

Citadel Securities just lately revealed a 5.4% stake in Hive. It has been one other 12 months since Hive just lately established its US headquarters.

Holmes stated retail buyers have pushed lots of Hivestock’s preliminary momentum.

These kind of shares are likely to make a giant revenue when institutional buyers take part, and investments in indexes just like the Russell 2000 entice extra capital from these buyers.

Investing in Bitcoin miners has turn into a preferred pattern amongst massive buyers. Great ‘Kevin O’Leary, a well known investor at Shark Tank, has additionally invested in Bitcoin Mining and Energy Infrastructure Firm Bitzero.

On an unique podcast with Beincrypto, O’Leary defined his technique.

“If I needed to begin investing in gold 300 years in the past, I might have invested in gold, gold miners, firms that made denims, picks and shovels, and I might have achieved a lot better than proudly owning gold.

Bitcoin Miner AI Alternatives

Most buyers learn about AI alternatives, however not many understand how large will probably be.

Massive tech firms are the main leaders, and a single contract with one among these firms can surge Bitcoin miners.

Terawulf shares, for instance, rose practically 60% a day after signing a $3.2 billion cope with Alphabet. Shortly after the settlement was introduced, Alphabet raised its shares in Terawulf.

Terawulf is constructing one of many largest information middle campuses in the USA, backed by a few of the most revered names in know-how.

@core42_ai @fluidstackio @google $ wulf

@paulbprager @sullycnbc @cnbc @powerlunch pic.twitter.com/99dyzngufth

-Terawulf (@terawulfinc) September 3, 2025

Restricted energy provide and information facilities place crypto miners to signal such transactions sooner or later.

Nevertheless, the most important alternative for Bitcoin miners sitting on AI infrastructure might not even be the big tech firms that dominate the headlines.

Holmes believes that innovation on the battlefield will make the navy and authorities a shopper of huge AI information facilities.

Drones, autonomous robots, and autonomous automobiles are a few of the superior applied sciences that use AI information facilities as their spine.

“Extra money goes to AI. In case you have all these drones, you may want an information middle and a satellite tv for pc. The intersection might be a sovereign information middle.”

Bitcoin Miners are undervalued in comparison with information middle stock

Bitcoin Miner is a serious participant within the AI information middle increase, however few buyers are conscious of this chance.

Specifically, when trying on the scores of Bitcoin Miners in comparison with conventional information middle shares, the chance remains to be within the early innings.

“In the event you have a look at the standard information middle ETFs there, you may see that they commerce at 20 instances the Ebitda, however Bitcoin miners like Hive are buying and selling at lower than twice the Ebitda,” Holmes advised Beincrypto. “I feel you may see this revaluation. I’ve seen Core Scientific Get 14 instances because it trades at CoreWeave at 40x EBITDA. You will see a revaluation, however in 5 years, I feel the information middle will turn into a useful asset.”

CoreWeave began in 2017 as a Crypto Mining Firm referred to as Atlantic Crypto. Now, it has been valued at round $50 billion because it absolutely embraced AI information facilities.

As a lot capital flows into the business, valuation and monetary development charges can transfer rapidly.

Not like the dot-com bubble, which was crammed with eyeballs however lacked money stream, AI is already producing concrete ends in report time.

CoreWeave Inventory Value Chart. Supply: Google Finance

Holmes stated Openai has made between $0 and $1 billion in month-to-month income inside two years.

Hivestock is greater than doubled from its 2025 low, however it’s not the one crypto mining inventory that may carry out. Aylen has greater than doubled because the begin of the 12 months, however crypto mining has greater than tripled its 2025 low.

All three shares loved a robust rally within the second half of August. If Bitcoin mining specialists like Holmes are proper about how they may unfold over the subsequent few years, these large earnings might be only the start.

The rationale why Bitcoin Miner sits within the era of AI Goldmine was first launched in Beincrypto.