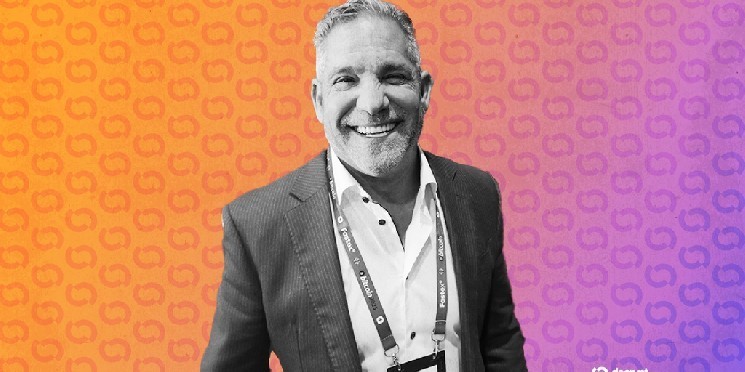

Buyers may even see alternative in gold’s historic rally, however they should not promote Bitcoin In keeping with actual property investor and entrepreneur Grant Cardone, that is to get a agency grip on treasured metals.

Though the worth of gold has risen greater than 50% this 12 months, outpacing Wall Road favorites like Nvidia, the most important cryptocurrency by market capitalization stays an excellent retailer of worth and has a greater long-term outlook, he mentioned. decryption In an interview.

“Do not say something silly,” Cardone mentioned Wednesday. “I am not going to chase this proper now. Each time I promote a Bitcoin, I’ll lose $1 million.”

Cardon’s evaluation comes as traders start piling into various property as a approach to defend in opposition to a possible downturn within the U.S. financial system and the ensuing decline within the U.S. greenback. derogatory commerce.

On Wednesday, gold costs crossed the $4,000 per ounce degree for the primary time. Bitcoin value determined the day earlier than greatest ever $126,000, in accordance with crypto information supplier Colling gecko.

Myriad Markets discovered that 60% of respondents assume Bitcoin is extra prone to rise to $140,000 than fall to $110,000. Myriad is a part of Dastan, the editorially impartial firm’s guardian firm. decryption.

Bitcoin’s value could also be extra risky than gold proper now, however Cardone believes technological innovation will boring the dear metallic’s shine within the coming years. He mentioned automation might have a adverse affect on gold shortage, pointing to the lowered labor prices inherent in robots.

“If Elon’s Optimus works, he’ll be capable of drill 24/7 with out being paid,” he mentioned, referring to the billionaire tech CEO’s push to develop robots at electrical automotive maker Tesla. “The quantity of gold we mine is restricted by the quantity of people that can mine it.”

That is clearly totally different in comparison with Bitcoin, which has a complete provide of 21 million cash, or actual property, which faces geographic constraints, he added. prediction counsel Primarily based on the community’s present guidelines, 2093 would be the 12 months by which the penultimate Bitcoin will likely be mined.

Buyers might hunt down exchange-traded funds backed by gold, however they’re successfully investing in paper, Cardon argued. For them to actually personal gold. Mr Cardone mentioned he needed to handle the administration of his property whereas working the chance of them being stolen.

The identical precept applies to traders who maintain Bitcoin in self-custodial wallets. However Cardon identified that Bitcoin doesn’t require bodily storage and is simple to make use of.

Whereas Cardone might favor Bitcoin over gold, different entrepreneurs, together with star hedge fund investor Ray Dalio, advocate a mix of each. He mentioned this in late July, when gold costs had been buying and selling round $3,300 an oz.. prompted Buyers allocate 15% of their portfolio to them.

He mentioned on the time that rising authorities debt was not priced into world markets and that he had a “robust desire” for gold. Final month he echoed He mentioned if the federal government would not curb its spending habits, the USA dangers struggling a “debt-induced coronary heart assault.”

The Bridgewater Associates founder argued that central banks are unlikely to undertake Bitcoin as a reserve foreign money due to its lack of privateness. He additionally raised questions on whether or not modifications to Bitcoin’s codebase might make Bitcoin’s retailer of worth “much less efficient.”

This week, funding firm VanEck Estimation Bitcoin has the potential to seize half of gold’s $26 trillion market cap, however that would take years. Bitcoin is presently price $2.4 trillion, in comparison with $1.2 trillion a 12 months in the past.

This 12 months, Cardon It began It mixes actual property and Bitcoin in funds supplied to accredited traders via Cardone Capital, which manages a $5 billion portfolio. When a tenant dwelling in a business property pays lease, the funds are allotted to Bitcoin over time.

Nonetheless, Cardone mentioned he has inspired some curious Bitcoiners to sit down again and watch.

“Some individuals got here as much as me and mentioned, ‘I would like to speculate Bitcoin in your venture,’ and I assumed, ‘Why would you do this?'” he mentioned. “Why not simply preserve the Bitcoin and redeem a number of the money? I do not see why somebody would do away with that asset.”