1. The rise of DAT: Signs of shallow understanding

As public corporations speed up adoption of Bitcoin, copycats are inevitable. Newest developments? Information – “Digital Property Treasury” – seeks to copy the success of Bitcoin finance corporations by assigning reservations to altcoins corresponding to Ethereum and Dogecoin.

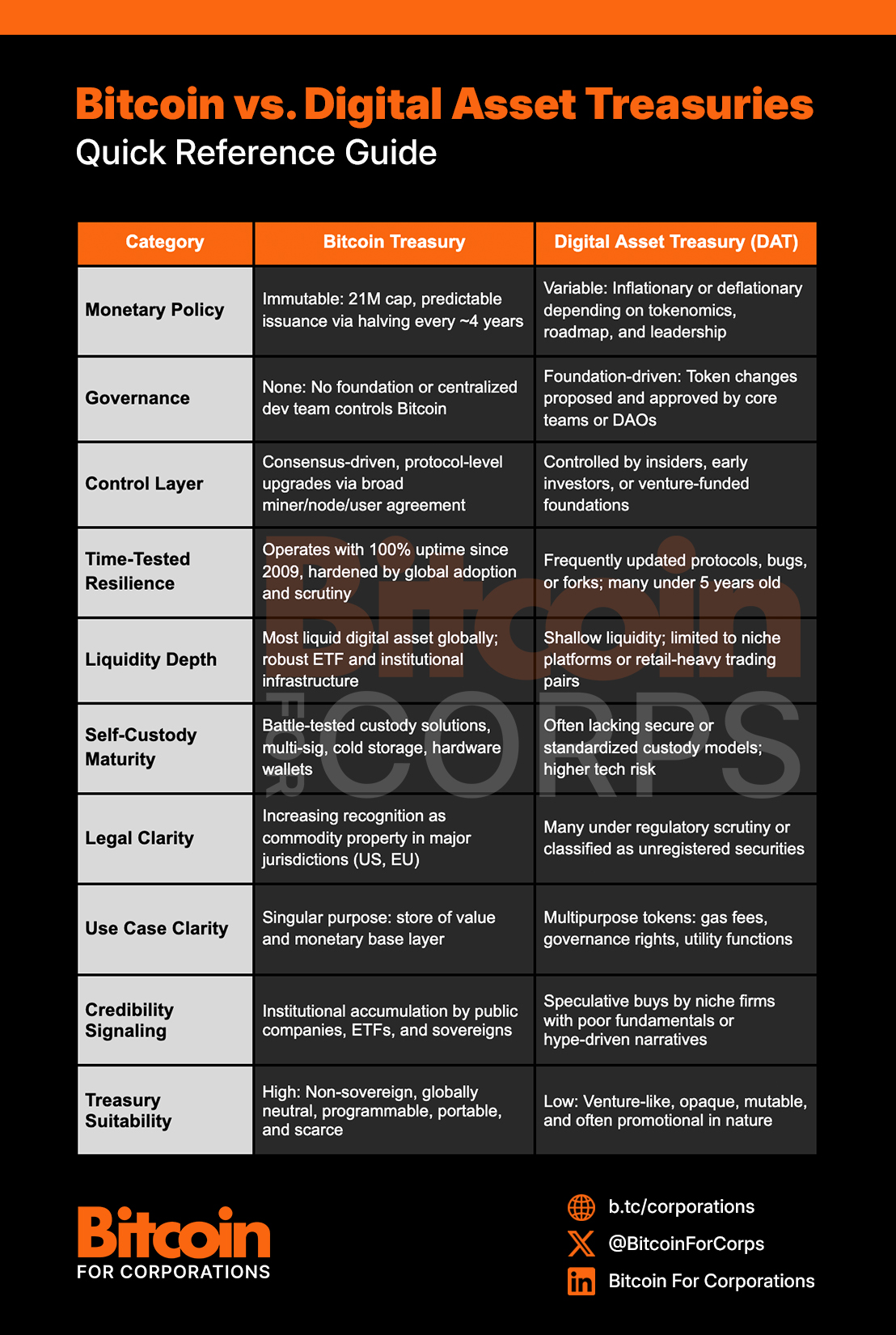

From the surface, the floor stage pitch could seem related: to amass digital belongings, transfer early and construct monetary methods, attempt to problem in the long run with shares or dehttps://bitcoin-for-corporations/how-bitcoin-counterparty-in-corporate-corporate-strategybt. However beneath the floor, the comparability collapses.

Over the previous few months, a number of corporations have created headlines to pivot into the DAT mannequin.

- CleanCore Options It slashed 60% after saying its $175 million Dogecoin Treasury plan.

- Bit Digital (BTBT) Defeating Bitcoin Mining Operations, it grew to become an Ethereum-only staking and finance firm.

- Spirit Blockchain Capital and Dogecoin Money Inc. We launched a Doge-centric monetary technique and misplaced over 70% of YTD.

These actions will not be simply harmful. It uncovers basic misconceptions of what Bitcoin is uniquely suited to function a reserve asset for the Ministry of Finance.

2. Bitcoin is cash. The token is a enterprise guess.

Bitcoin is neither a tech platform nor a product roadmap. It is cash – devoted, impartial, leaderless and maximally conservative in its evolution. That rule is ready on stone, problem schedules are improperly locked, and designs are extremely resistant to alter.

In distinction, Altcoins like Ethereum and Dogecoin are higher understood as enterprise stage software program initiatives pose as cash. they’re:

- Managed by a core developer basis or small group

- Steadily, typically conditional on basic protocol adjustments

- We have been in a position to actively optimize for adoption of latest options slightly than monetary stability.

- It’s intently linked to the charismatic founder and basis’s capital construction

From a capital administration perspective, that is the next distinction:

- Assigning spares to sovereign, non-political financial tools

- Guessing the long-term success of a VC-style expertise platform

One is devoted to preserving worth. The opposite is proxy for early stage threat.

3. Time Horizon Inversion: Bitcoin Align, Altcoin Mism

The position of the Ministry of Company Finance is to not chase yields, however to take care of and develop shareholder worth over the long run. Public corporations are rewarded with the resilience, self-discipline and a transparent capital framework that’s held all through the cycle.

The Bitcoin design matches this. The property rewards convictions over time:

- Provide is mounted: 21 million folks, issuance is halved each 4 years

- Market entry is fixed globally: no alternate occasions or gatekeepers

- As adoption grows, fluidity deepens over time

- Volatility is compressed over an extended subject of view

Altcoins inverts this logic. They’re:

- Inflate provide by means of unlock schedules and protocol adjustments

- On a regular basis shifting consensus fashions (e.g., transitioning to proof of ETH)

- Depend on speculative development tales to take care of curiosity

- No predictable issuance and improve path

This discrepancy creates tensions for the Ministry of Finance. The longer you maintain the token, the extra governance, enforcement, and regulatory dangers. It turns into tough to stick to assignments – not simple.

Bitcoin, in contrast, turns into simpler to justify over time. It’s the solely digital asset that deeper retention is diminished, and it doesn’t enhance – the chance of the tail.

4. What’s not working: dangers to construct in Altcoin’s Treasury

For public corporations, capital methods ought to prioritize sturdiness, auditability and market belief. Assigning them to Altcoins introduces dangers which can be in battle with these objectives.

- Protocol uncertainty: Tokens like Ethereum endure frequent technical upgrades that may introduce bugs, change the economic system, and expose the Validator to new types of thrashing or MEV threat. Company finance requires stability, not ongoing protocol experiments.

- Governance and Seize Dangers: Many altcoins are managed by foundations or small groups. The selections on key protocols could replicate the advantages of insiders or early traders slightly than long-term holders. Firms are prone to being uncovered to governance forks, roadmap pivots and consensus drama.

- Regulation uncertainty: Bitcoin is widely known as a product by US regulators. Most Altcoins occupy extra intense authorized territory. Many are actively investigating or pending lawsuits. A sudden classification as safety may cause pressured gross sales, authorized penalties, or reputational harm.

- Responsibility and infrastructure restrictions: Bitcoin advantages from mature facility custody options, however many altcoins don’t. Contracts, wrapped tokens, and definition-based administration layers add sensible contract threat and scale back auditability. This weakens the steadiness sheet slightly than strengthening it.

- The vulnerability of the story: When value viewing is gradual or reversed, the underlying papers of the Altcoin Ministry of Finance typically collapse. With out the monetary fundamentals set again, the “strategic” story is left to the speculative narrative, and boards, auditors and shareholders start to ask harsh questions.

Constructing a Company Treasury on tokens with versatile guidelines, weak settlement ensures and governance opacity will not be daring. That is reckless. Bitcoin is an exception not solely as a result of it got here first, however as a result of it’s the just one that lasts for a very long time.

5. Bitcoin is rock

Public corporations using Bitcoin don’t guess on crypto. They improve the foundations of their capital construction with belongings.

- Non-sovereign: Immunity of political interference or monetary decline

- Restricted: 21 million gained with out centralized authority to inflate provide

- Verification attainable: All auditable items, all transactions are immutable

- Accessible: Liquid and tradeable in all main jurisdictions

- Battle Check: Function completely for over 15 years with none aid or downtime

Bitcoin’s uniqueness will not be ideological, it’s structural. And its construction permits it to behave as an anchor for contemporary steadiness sheets in an age of forex volatility, debt saturation, and institutional distrust.

Disclaimer: This content material was written on behalf of Bitcoin for companies. This text is for informational functions solely and shouldn’t be construed as an invite or solicitation to amass, buy, or subscribe to a safety.

This put up Dat Delusion: Why Bitcoin solely belongs to the company steadiness sheet first appeared in Bitcoin Journal and is written by Nick Ward.