Ethereum lowers 4k to underneath 4k amid whale liquidation, ETF spills and weak institutional demand, with the subsequent assist being round $3,800.

The ETH market has proven a decline in management, a decline in on-chain exercise and RSI in gross sales, indicating additional declines however long-term accumulation alternatives.

Ethereum ($ETH) has lately fallen beneath its important assist stage of $4,000, sparking concern amongst buyers about how low Ethereum costs can be within the brief time period. A number of elements have contributed to current declines, together with macroeconomic uncertainty, slower ETF inflows, and low alternate liquidity.

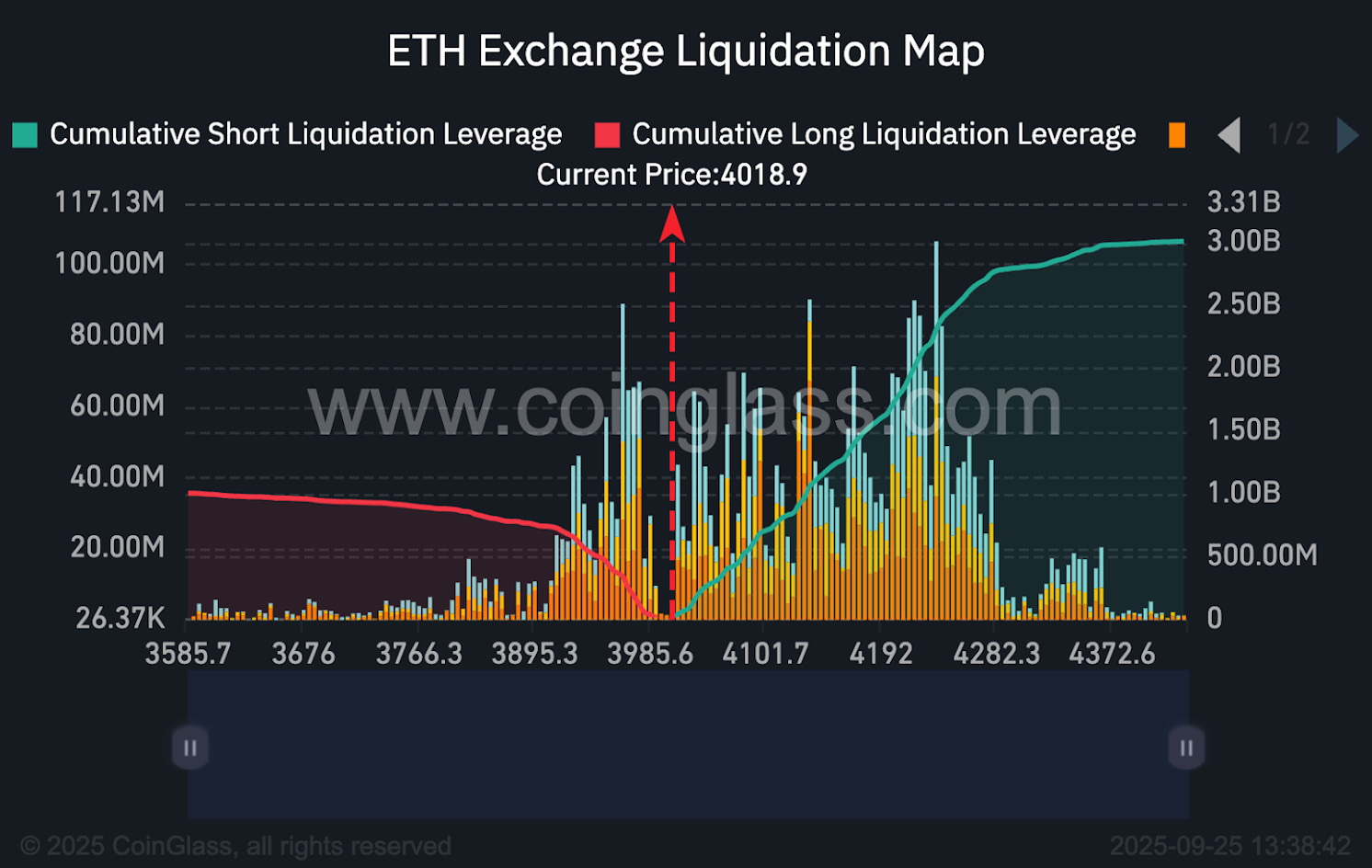

Ethereum liquidation warmth map

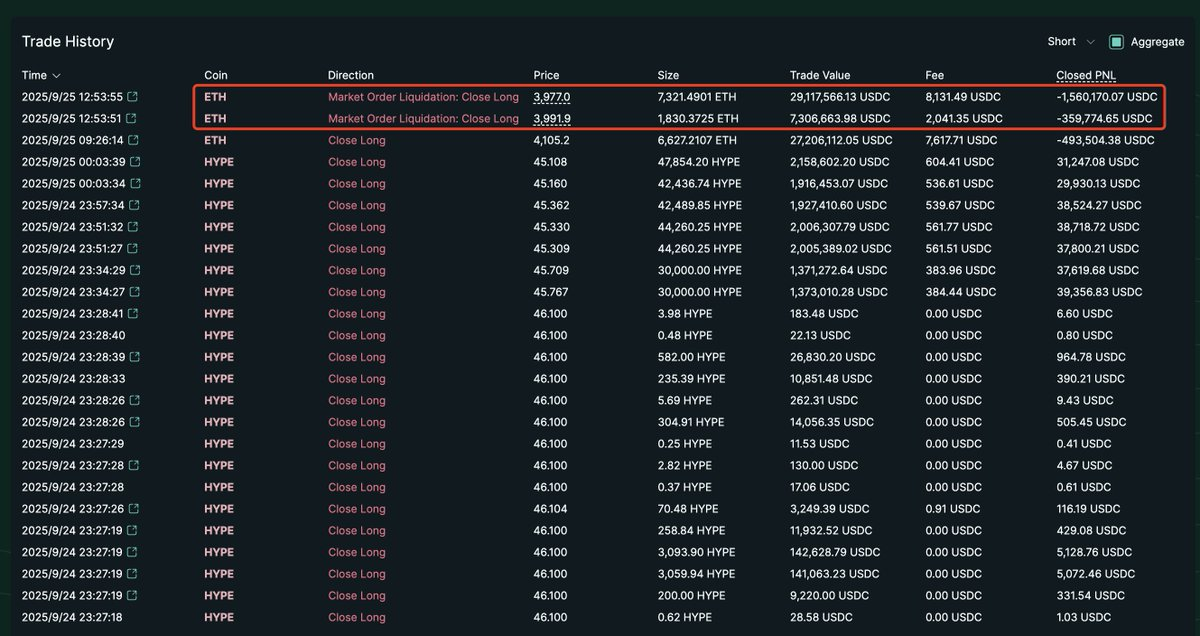

In keeping with Coinglas, the $100 million Ethereum lengthy place has been liquidated up to now hour. One whale dealer, 0xA523, misplaced $36.4 million at $9,152 ETH and presently has a lack of greater than $45.3 million, leaving his account underneath $500,000.

This reveals how buying and selling exploited in unstable markets might be in danger. Excessive leverage drives higher value fluctuations in Ethereum and impacts different cryptocurrencies like Bitcoin. Each day ETH Lengthy Lengthy liquidation has lately exceeded $500 million, placing much more strain in the marketplace.

Deceleration of ETH ETF influx

Over the previous few weeks, Ethereum’s momentum has pale after preliminary pleasure from the power buy and ETF inflow. Public firms like Tomlin’s Bitmine had been initially optimistic, however current information reveals that the inflow of Ethereum ETFs has been considerably slower.

On September twenty fourth, ETH-related ETFs skilled $79.4 million in web outflow in comparison with BTC ETFs that noticed a web influx of $241 million. This reveals that institutional buyers are presently cautious about Ethereum and are placing downward strain on costs.

Weak institutional demand

Giant buyers are retreating from Ethereum. Grayscale lately offered $53,810,000 Ethereum at Coinbase, indicating that enormous sums of cash haven’t been shopping for $ETH presently.

On the identical time, Ethereum provide on the alternate fell to simply 14.8 million tokens. That is the bottom value for 9 years, which has not been seen since 2015.

Ethereum’s on-chain exercise can be decreased by 10%, with decrease fuel costs as buying and selling volumes lower, weaker market participation and fewer person reliability.

- Learn once more:

- Why crypto costs are falling immediately: The important thing elements behind the sale

- ,

Ethereum’s management is declining

Ethereum’s market benefit fell from 14.6% to 12.8%, indicating a lack of relative affiliation. Analysts warn that if this development continues, Ethereum may fall by as much as 45% beneath Altcoins.

The decline displays each a slower institutional demand and a shift within the circulation of the broader crypto market, highlighting the shortage of momentum at Ethereum earlier this yr.

How low is the ETH value?

In keeping with analyst TED, Eth/USD examined a assist stage of $4,060 twice in simply three days, indicating sturdy gross sales strain. Analysts are presently wanting on the subsequent assist zone at round $3,800. This might function a possible accumulation level for long-term buyers.

The each day relative power index (RSI) is 35, suggesting that Ethereum is oversold however doesn’t have a rebound momentum anytime quickly. These technical alerts are mixed with the liquidation of heavy derivatives, indicating additional declines earlier than restoration.

For long-term buyers, this pullback can be a possible alternative to build up $ETH earlier than a market restoration.