The adoption of company Bitcoin continues to unfold as extra corporations pursue the Ministry of Finance’s accumulation technique. Corporations can profit from recapitalization, diversification and inflation hedge if executed correctly.

Nevertheless, not all Bitcoin acquisition methods are created equally. If the only real goal of an organization is to retain BTC with out adequate assets or dimension, it might danger an entire collapse throughout the prolonged naked market interval. The chain response might additional amplify downward pressures that would show catastrophic.

Numerous approaches to company Bitcoin Holdings

Establishments’ adoption of Bitcoin is on the rise worldwide, with Bitcoin’s Treasury knowledge exhibiting that their holdings have doubled since 2024.

Apparently, this quantity improve additionally represents the extent to which the explanations for doing so.

High public Bitcoin finance firm. Supply: Bitcoin Treasuries.

Some corporations, particularly Technique (previously MicroStrategy), have intentionally pursued such playbooks to turn into Bitcoin monetary holding corporations. The transfer labored effectively with a method that provides 53% of whole company holdings with over 580,000 BTC.

Different corporations, equivalent to GameStop and Publicsquare, have taken a unique method, prioritizing publicity over aggressive accumulation. This situation is ideal for companies that simply wish to add BTC to their steadiness sheets whereas persevering with to concentrate on their core enterprise.

Such initiatives have far much less danger than corporations whose core companies personal solely Bitcoin.

Nevertheless, the rising pattern of corporations including Bitcoin to their monetary reserves, simply to focus on holding Bitcoin, may have a serious influence on the enterprise and the way forward for Bitcoin.

How do Bitcoin-focused corporations entice traders?

Constructing a profitable Bitcoin Treasury holding firm is not only about actively buying Bitcoin. When the only real goal of a enterprise is Bitcoin retention, it’s only evaluated primarily based on the bitcoin it holds.

To make sure that traders purchase shares relatively than straight retain Bitcoin, these corporations must surpass Bitcoin itself and attain a premium known as a number of in internet asset worth (MNAV).

In different phrases, they have to persuade the market that their shares are value greater than their whole holdings of Bitcoin.

The technique implements this by convincing traders, for instance, that by buying MSTR shares, it’s not simply a specific amount of Bitcoin. As an alternative, they put money into methods that executives work aggressively to extend the quantity of Bitcoin attributable to every share.

If traders consider that micro methods can constantly develop Bitcoin per share, they pay a premium for that twin capability.

Nevertheless, that’s solely a part of the equation. If traders win that promise, a method have to be offered by elevating capital to purchase extra Bitcoin.

MNAV Premium: How it’s constructed and the way it breaks

An organization can solely provide MNAV Premium if it will increase the overall quantity of Bitcoin it holds. The technique does this by issuing convertible obligations that assist you to borrow funds at low rates of interest.

It additionally leverages market (ATM) fairness choices by promoting new shares when the inventory trades at its underlying Bitcoin worth and premium. With this transfer, the technique will purchase extra Bitcoin per greenback raised than present shares, rising Bitcoin per share for present homeowners.

This self-enhancement cycle permits premiums to lift extra capital, fund extra bitcoin and strengthen the narrative, however it goes past the direct bitcoin holding of technique to take care of inventory valuations.

Nevertheless, such processes contain a number of dangers. For a lot of corporations, this mannequin is straight unsustainable. Even pioneers like Technique endured the heightened stress when Bitcoin costs fell.

However, over 60 corporations have already adopted a Bitcoin accumulation playbook within the first half of 2025. As that quantity will increase, new finance corporations face extra keenly the related dangers.

Aggressive BTC accumulation is in danger for small gamers

In contrast to technique, most corporations haven’t got the size, established popularity, or the “chief standing” of leaders like Michael Saylor. These traits are necessary to draw and preserve the belief of traders wanted for premiums.

In addition they usually should not have the identical creditworthiness or market energy. Understanding this, small gamers usually tend to expertise increased rates of interest on their money owed and face extra restrictive contracts, making their money owed costlier and troublesome to handle.

If their money owed are secured by Bitcoin within the bear market, a value drop might instantly trigger a margin name. During times of lengthy downward strain, refinancing obligations for refinancing might be extraordinarily troublesome and costly for companies which are already below burden.

Worse, if these corporations shift their core operations to focus solely on Bitcoin acquisition, there isn’t a different enterprise cushion that generates steady, separate money flows. They may turn into totally depending on capital raises and Bitcoin costs.

If a number of corporations make such strikes on the similar time, the outcomes to the bigger market might dramatically transfer south.

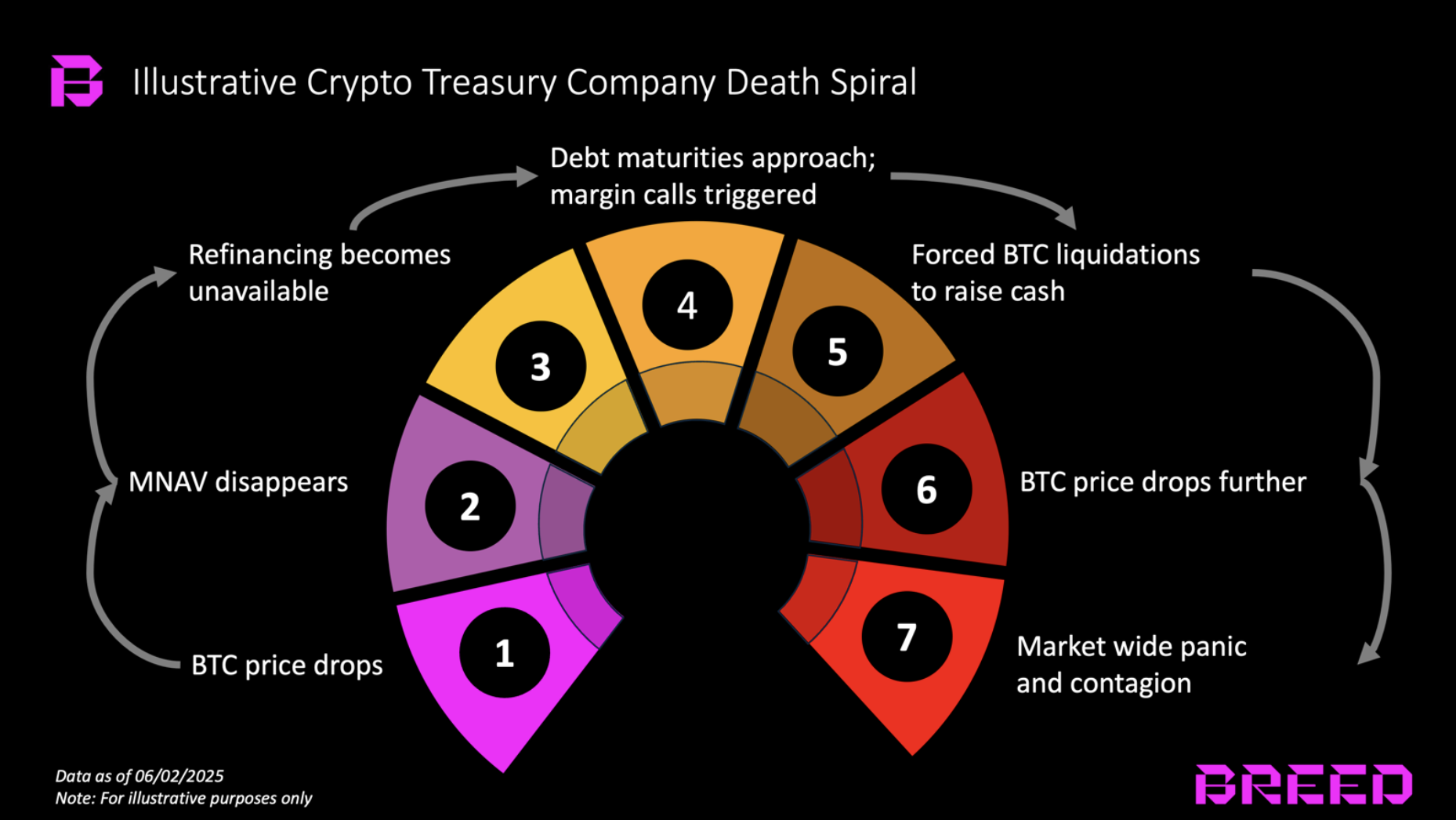

Is the adoption of company Bitcoin prone to a “loss of life spiral”?

If many small companies are pursuing a Bitcoin accumulation technique, the market influence throughout a recession might be extreme. If Bitcoin costs fall, these corporations might run out of choices and be compelled to carry them.

This widespread distressed gross sales inject enormous provide into the market, tremendously amplifying downward strain. As seen within the 2022 Code Winter, such occasions could cause a “reflexive loss of life spiral.”

Completely different phases of the Bitcoin Dying Spiral. Supply: Breed VC.

Pressured gross sales by one distressed firm can additional cut back the worth of Bitcoin, inflicting compelled liquidation of different corporations to related positions. Such a destructive suggestions loop can drive a market decline.

Second, extremely publicized failures can undermine the belief of a wider vary of traders. This “risk-off” sentiment can result in widespread gross sales throughout different cryptocurrencies as a consequence of market correlation and normal flights to security.

Such a transfer will inevitably put regulators on excessive alert and can shock traders who might have thought of investing in Bitcoin in some unspecified time in the future.

Past Technique: Danger of changing into “all-in” with Bitcoin

Bitcoin’s strategic place as a monetary holding firm is exclusive because it was the primary mover. Solely a handful of corporations match Saylor’s assets, market influence and aggressive benefit.

The dangers related to such playbooks range and, if grown, might be dangerous to the bigger market. As extra public corporations transfer so as to add bitcoin to their steadiness sheets, they should make a cautious determination whether or not to get publicity or all-in.

In the event you select the latter, you will have to rigorously and totally measure the outcomes. Bitcoin is the best ever right this moment, however the bear market by no means utterly escapes the issue.