Bitcoin (BTC) April 2024 reduce block reward can be halved from 6.25 BTC to three.125 BTC, compressing hash costs and forcing Bitcoin miners to rethink their enterprise fashions.

As an alternative of ready for the charge market to rescue margins, the biggest operators have begun signing offers to lease infrastructure to AI tenants.

Core Scientific has dedicated to produce 500 megawatts of energy to CoreWeave for $8.7 billion over 12 years. Cipher locked in 168 MW with Fluidstack for $3 billion over 10 years with Google’s backstop obligations.

These offers are based mostly on the calculation that the identical inputs that energy SHA-256 ASICs can generate extra income per megawatt-hour if they’re directed towards high-performance computing.

The query is how a lot non-Bitcoin income miners might want to relieve promoting strain on authorities bonds, what is going to occur to the community’s hashrate as capability shifts, and which operators have the steadiness sheets to carry out.

Bitcoin miners management all the pieces wanted for AI computing, together with low cost electrical energy, industrial land, cooling infrastructure, and operational experience.

The income curves are completely different. Mining ties income to hash worth and coin worth. AI colocation delivers contracted greenback income per kilowatt month. What issues is the margin comparability in {dollars} per megawatt hour, and when the hash worth is compressed, the unit economics favor internet hosting.

Safety budgets below strain

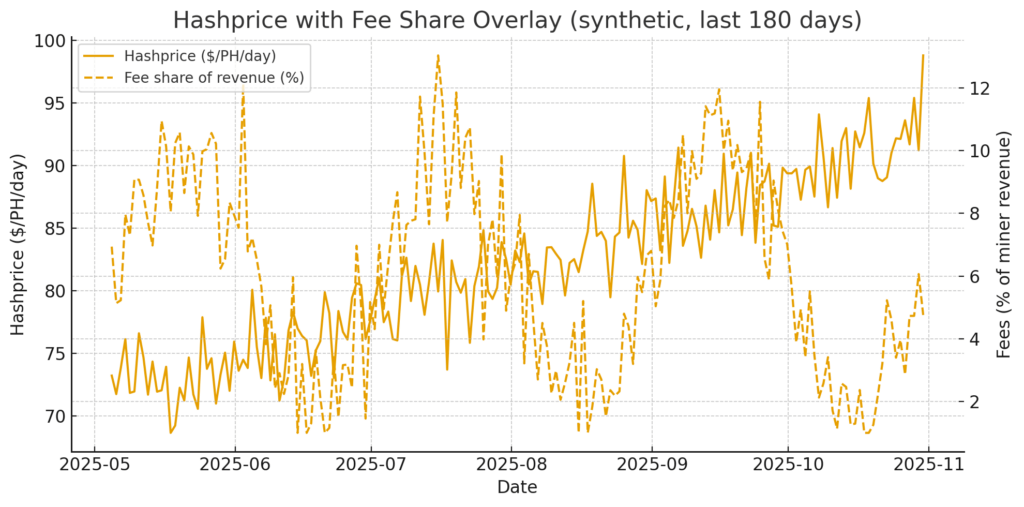

Hashprice measures a miner’s income per petahash per day. When it falls, miners shut down their machines or promote their Bitcoins to cowl authorized prices.

The community’s safety finances is equal to dam subsidies plus charges in Bitcoin phrases, however its greenback worth has turn into extra unstable because the halving.

A brief spike in charges when Runes launched through the halving block confirmed how on-chain demand can affect hash costs, however exterior of these spikes, charges have been modest.

Electrical energy costs are fastened in {dollars} and earnings are earned in Bitcoin. If hash costs stay at $50 per petahash per day, a contemporary fleet of Antminer S21 class machines working at 17.5 joules per terahash will generate roughly $119 per megawatt hour.

Subtracting the $50 per MWh electrical energy worth, the money margin is $69 per MWh. The mannequin is operational, however simply barely.

For those who improve the hash worth to $75 per petahash per day, the income will increase to $179 per MWh, supplying you with a money revenue of $129 per MWh.

The distinction between survival and profitability is slender and is dependent upon elements exterior the miner’s management, equivalent to BTC worth, community issue, and charge velocity.

AI internet hosting makes use of the identical infrastructure that runs ASICs and gives an answer with dollar-denominated contracts that don’t fluctuate with hash costs and are locked in over a number of years.

The place Bitcoin miners meet AI

Bitcoin miners and AI operators require the identical infrastructure, together with inexpensive energy, proximity to substations, industrial cooling, fiber optic interconnects, and experience to take care of uptime.

Core Scientific’s CoreWeave contract prices about $121 per kilowatt for internet hosting. Cipher’s Fluidstack contract prices roughly $149 per kW monthly.

These are contracts signed with creditworthy counterparties and are usually not formidable projections. The income construction usually separates internet hosting charges and energy prices, because the tenant reimburses the facility consumed and the operator earns a set charge per kilowatt.

This transfers commodity threat to tenants and transforms miners’ income into infrastructure-as-a-service.

Assuming an influence utilization effectivity of 1.2, a rack fee of $120 to $180 per kW monthly corresponds to a facility income depth of roughly $139 to $208 per megawatt hour.

Since electrical energy is handed via, a lot of its income is allotted to money movement excluding non-electricity working bills.

Evaluate this to SHA-256 mining at $75 per petahash per day. Income depth is $179 per MWh, however each greenback of electrical energy prices are paid upfront.

The internet hosting mannequin eliminates Bitcoin worth volatility and charge volatility, and as an alternative offers you multi-year visibility. For debt-ridden miners, their money movement profile favors financing.

Unit economics and monetary coverage

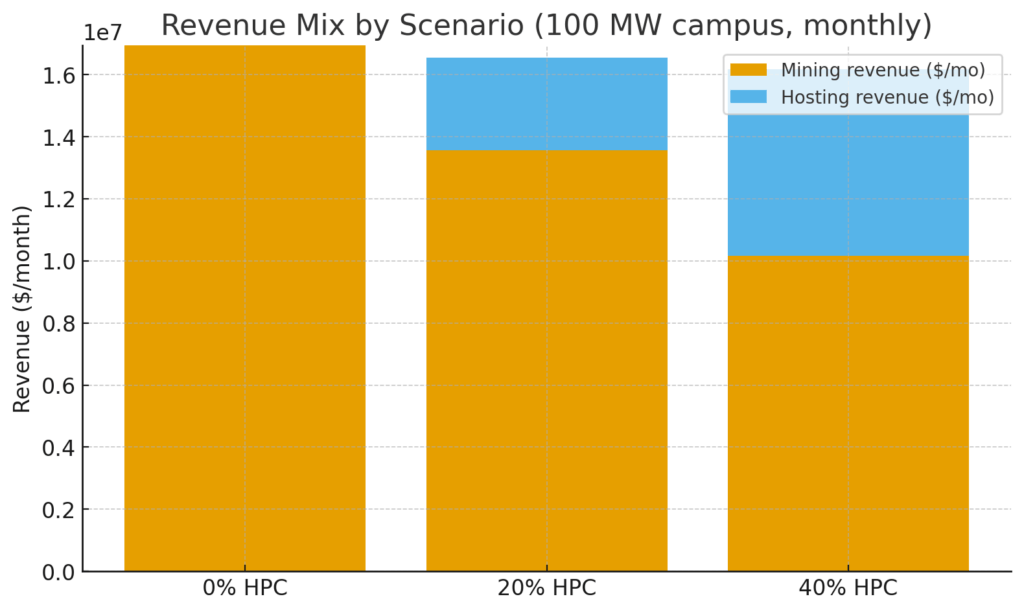

A 100 MW web site working SHA-256 at an electrical energy fee of $75 per petahash per day and $50 per MWh would generate a money margin of roughly $129 per megawatt hour, which works out to roughly $11.3 million per 12 months.

For those who lease the identical 100 MW to an AI tenant for $150 per kW monthly, your facility income depth can be roughly $174 per MWh.

If the tenant pays for the electrical energy, the operator retains most of it as margin. The internet hosting construction supplies considerably extra cash movement per megawatt when hash costs fall or electrical energy costs rise.

Monetary coverage is essential. MARA Holdings held as a lot as 52,000 BTC of Bitcoin, however typically didn’t promote it in any respect. Riot Platforms offered 465 BTC for roughly $52.6 million in September 2025 to fund growth. CleanSpark continues to ramp up, growing its funding to over 13,000 BTC.

Everybody faces the identical statutory expense base, together with electrical energy payments, debt repayments and salaries. Internet hosting income modifications the equation. If a miner generates $15 million per 12 months from 100 MW of AI colocation, that is $15 million with out having to promote any Bitcoin.

The Treasury can keep coin denominations with out working out of money. When hash costs are compressed, that buffer permits miners to climate weak environments with out being compelled to promote, thereby weakening the promoting strain that usually happens after a halving.

Much less BTC despatched from miner wallets to exchanges means much less marginal provide.

Hashrate migration and community affect

If a big share of the hashrate is migrated to AI internet hosting and never backfilled, the community hashrate will decline till retargeting turns into troublesome and equilibrium is restored.

The safety finances in BTC stays unchanged and blocks will proceed to generate 3.125 BTC plus charges, however decrease hashrates could improve assault prices.

The again aspect is mechanical. Assuming Bitcoin costs and charges stay fixed, a decrease community hash fee means the next hash worth for the remaining miners.

In a state of affairs the place 10% of the world’s hashrate migrates to AI internet hosting over 18 months and the community hashrate drops by roughly 10%, issue can be adjusted downward and hash costs for the remaining miners will improve proportionately.

Miners who stick with SHA-256 will seize the upside, whereas miners who pivot to AI will safe their contracted greenback income.

There’s a trade-off between Bitcoin publicity and money movement certainty. Charges complicate evaluation. If the charge market turns into lively via runes, layer 2 cost visitors, or cost quantity, hash costs can rise quickly.

Miners who migrate from SHA-256 to AI internet hosting miss out on its advantages. AI contracts present draw back safety however restrict participation in charge income surges.

The optimum technique will depend upon every miner’s price construction, steadiness sheet, and look at of Bitcoin’s charge trajectory.

Who wins and what breaks?

Carriers with very low energy prices, scalable interconnections, and capital flexibility are the only option. Core Scientific’s post-bankruptcy reorganization pivot to HPC internet hosting illustrates how a steadiness sheet reset can allow strategic repositioning.

Google-backed Cipher buying and selling demonstrates the significance of reliable counterparties. Bitdeer, Iris Vitality, TeraWulf, and CleanSpark have all introduced their intention to leverage HPC, reflecting the business’s rising recognition that AI demand can monetize pent-up energy capability.

The dangers are actual. GPU cycles change, miners spend capital expenditures on infrastructure, and worth might be misplaced. Counterparty threat is a priority for smaller AI startups with out robust steadiness sheets.

In Texas, grid coverage over heavy hundreds is intensifying. In Texas, ERCOT’s interconnection queues are lengthy, and capability additions are lagging behind demand progress.

Miners that lease interconnection capability to AI tenants could wrestle to cut back as soon as Bitcoin economics enhance.

Interconnection queues are extra essential than fashionable dialogue acknowledges. Miners with 200 MW of contracted energy and grid interconnection approvals can change between SHA-256 and HPC based mostly on economics.

Miners ready in ERCOT’s queue can not earn cash from the location till they’re accredited, which might take years. Miners who moved early gained choices that late movers didn’t have.

What to observe in 2026

Over the following 12 months, it could be clever to trace energy buy settlement bulletins, ERCOT interconnection milestones, miner steering on non-BTC income combine, and Bitcoin charge velocity.

ERCOT’s capability report supplies context for the shortfall in Texas, the place giant load actions are concentrated. Interconnect capability is turning into a binding constraint.

Pricing tendencies will decide whether or not persevering with to make use of SHA-256 supplies the identical advantages as AI internet hosting. If rune or layer 2 visitors drives continued worth will increase, hash costs may stabilize above $100 per petahash per day, permitting mining to compete with internet hosting on a risk-adjusted foundation.

If costs stay below management, the hosted mannequin wins for money movement certainty. Miners are hedging. Convert your share to AI internet hosting whereas retaining some capability for SHA-256, preserving your choices till the market reveals which mannequin is dominant.

The strategic query just isn’t whether or not miners will turn into AI firms, however how they’ll allocate finite interconnection capability, energy contracts, and steadiness sheet assets between competing makes use of.

Profitable miners can each keep SHA-256 operations when the hash worth warrants, scale AI internet hosting as contracts finish, and keep the pliability emigrate between fashions because the financial system evolves.

The query is whether or not the Bitcoin mining business will keep a disposable identification or turn into a multi-tenant energy monetization layer that occurs to guard the blockchain.