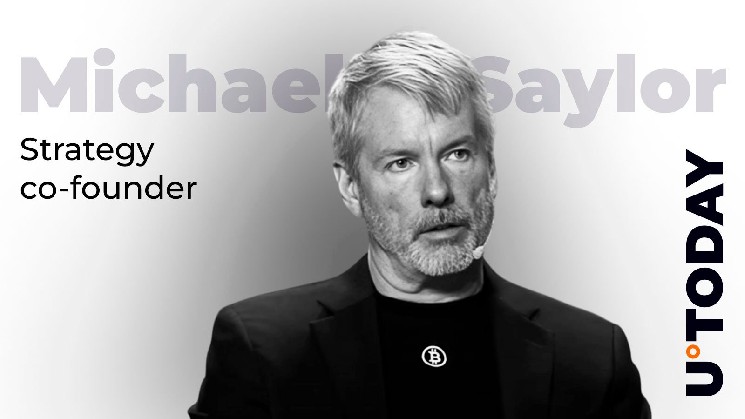

Michael Saylor, the person whose Company Treasury Division has turn out to be roughly synonymous with Bitcoin itself, says as soon as 2025 reaches its last quarter, “Will BTC shut a yr past $150,000?”

His polls have already exceeded 42,000 votes, and three out of three in 4 consider that the world’s largest cryptocurrency can obtain that purpose.

For Saylor, that is greater than only a random thought. Technique, an organization registered with NASDAQ, which he’s chargeable for, has 640,031 BTC bought since August 2020 for a mean of $73,981. Valued at greater than $77 billion at a worth of $120,700 in the present day, this stash has grown by greater than 63%.

Will $BTC finish the yr above $150,000?

– Michael Saylor (@saylor) October 3, 2025

Nevertheless, the significance of the $150,000 mark exceeds the earnings of paper.

As soon as Bitcoin strikes into that zone, the worth of the technique’s holdings will improve by greater than $18 billion. This brings BTC’s place nearer to the $96 billion line and transforms the corporate into an asset base corresponding to among the world’s largest banks.

A $100 Billion Technique

The market has already proven approval. Strategic shares are price round $100 billion, and their firm worth is round $115 billion.

The Bitcoin chart additionally exhibits why this query is so vital. Its market capitalization is simply $120,000, and BTC is rising from its low level in September, approaching its summer season excessive.

The ultimate three months of 2025 present whether or not Saylor’s bets have changed into one of many largest company victories of the last decade or whether or not it has turn out to be probably the most troublesome bubble burst of this century.