Bitcoin traded at $116,393 on September 19, 2025, with a market capitalization of $2.31 trillion and a 24-hour buying and selling quantity of $366.7 billion. The cryptocurrency’s intraday vary ranges from $116,349 to $117,888, reflecting integration that’s near main resistance.

Bitcoin

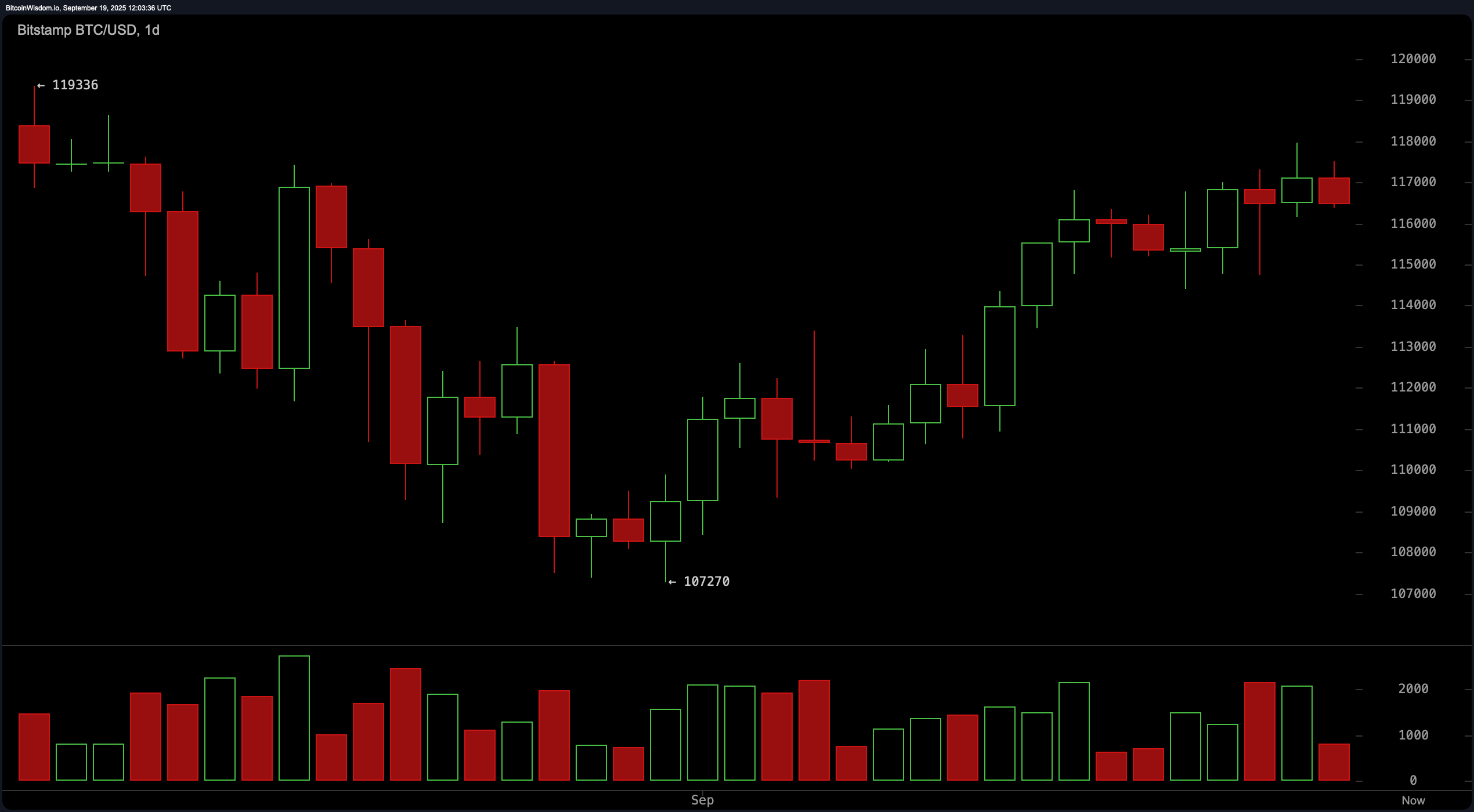

On the day by day charts, Bitcoin has been on an uptrend confirmed since early September, bouncing again strongly from its $107,270 help degree, which fashioned a double backside construction. Value motion has since risen steadily, however is now stagnant slightly below the important thing resistance zone at $119,336.

The uptrend stays intact, however present consolidation, near the $117,000-118,000 vary, exhibits indecisiveness. The amount elevated barely throughout the upward thrust, however the newest candles recommend warning as costs strategy fictional resistance. The important thing buy zone is between $113,500 and $114,500, with optimum take professional bit ranges of $118,000 to $119,500 and cease losses of lower than $111,000.

BTC/USD 1-Day Chart by way of BitStamp on September 19, 2025.

On the four-hour chart, Bitcoin lately peaked at $117,968, forming a number of bearish candles which have declined and have misplaced momentum. This shift is accompanied by a distinguished spike in crimson quantity, suggesting the potential for short-term distribution. However, the broader construction stays supportive, with sturdy advance help noticed at round $114,421. The property may probably retest an space of between $115,000 and $115,500 earlier than resuming a broader pattern. Merchants this zone for bullish flip candles could discover favorable danger response eventualities.

BTC/USD 4-hour chart by way of BitStamp on September 19, 2025.

The one-hour Bitcoin chart exhibits a transparent short-term downtrend, that includes a collection of low highs and lows following the highest of the $117,968. The current value motion reached $116,369, and he challenged minor help. This motion seems to be corrected throughout the broader bullish construction context seen within the greater time-frame. Quantity has been rising steadily on the vendor facet, and we’re additionally seeing a retracement section. Until a robust bullish candle comes true close to the $116,000 degree, an extended entry is shortly discouraged. If the upward momentum returns, you’ll be able to think about robust entries from $116,000 to $116,300.

BTC/USD 1-hour chart by way of BitStamp on September 19, 2025.

Among the many key technical indicators, the oscillator attracts advanced footage. The relative power index (RSI) is 58, reflecting impartial momentum. Chance idea is within the territory acquired at 87, indicating a possible sale. In the meantime, the 95 commodity channel index (CCI) and the 19 imply directional index (ADX) each present uncommitted stances, with Superior Oscillator studying 3,185 with impartial bias. Particularly, Momentum (10) is flashing bear sign at 4,930, however the 961’s shifting common convergence divergence (MACD) stays bullish.

Transferring averages (MAS) present extra vital directional steerage, with all main short- and long-term averages suggesting bullish momentum. The exponential shifting averages (EMA) and easy shifting averages (SMA) for the intervals 10, 20, 30, 50, 100, and 200 all fall beneath present costs and present sturdy underlying pattern help. The EMA (10) is $115,575 and the SMA (10) is $115,924, each exhibiting bullishness. Lengthy-term shifting averages such because the $105,738 EMA (200) and SMA (200) strengthen the optimistic outlook.

General, Bitcoin stays technically sturdy in its day by day time-frame, however merchants want to stay cautious amidst indicators of short-term fatigue. The best entry depends on checking help for decrease time frames, significantly near the $115,000-116,000 vary. A breakout over $118,000 backed by quantity will disable the consolidation paper, reintroducing momentum and testing new highs.

Bull Verdict:

Bitcoin maintains a structurally bullish perspective, sustaining constant help from all main shifting averages and uptrends established on the day by day charts. If costs exceed the help zone between $115,000 and $116,000 and quantity checks exceed $118,000, you may even see a continuation of $120,000 or extra within the close to future.

Bear Verdict:

Regardless of sturdy day by day developments, Bitcoin faces fast resistance strain and weakening momentum within the low time-frame. Failure to gather $117,500 may probably begin a deeper retrace in direction of the $113,000 vary, coupled with a breakdown beneath $115,000, which may undermine current rally.